Federal Reserve Chair, Jerome Powell, stated late last week at the Fed’s annual Jackson Hole symposium the economy has made “substantial further progress” towards the Fed’s inflation target of 2% and “clear progress” toward its goal of full employment. Since spring of 2020, the Fed has been buying U.S. Treasury and agency mortgage-backed securities to provide monetary policy accommodation in order to achieve those inflation and employment goals. The Fed’s current monthly open market securities purchases total $120 billion, comprised of $80 billion of U.S. Treasuries and $40 billion of agency mortgage-backed securities.

The minutes of the Federal Open Market Committee (FOMC) meeting that concluded on July 28 were released last week and indicated most Fed officials expect tapering of bond purchases to begin by the end of the year. Chair Powell’s comments revealed he shares that viewpoint, acknowledging that if the economy evolves as broadly as anticipated, reducing the magnitude of asset purchases is appropriate.

In anticipation of the August jobs report, which will be released on September 3rd, economists polled by Dow Jones expect 750,000 jobs were created in August with the unemployment rate falling to 5.2%. Full employment is generally defined as the lowest level unemployment can fall to, understanding that there will always be friction in the labor market. While this number cannot be known with precision, it is estimated to be just under 4%.

Annual inflation is presently at 4.2% (Consumer Price Index, less food and energy). Chair Powell reiterated comments he made earlier this summer that prices have increased primarily for reasons related to the pandemic, such as supply chain issues and the surge in travel related expenses, but those increases have not spread more broadly into various products and services – largely echoing a continued belief by the Federal Reserve the inflation spike is temporary in nature. History has generally proven that price levels remain sticky, even as inflation abates.

CME Group’s FedWatch tool presently shows probabilities of 100% that there will be no change to the federal funds target range of zero to 0.25% until mid-March of 2022. The FOMC has clearly indicated its intent to adjust asset purchases well in advance of any changes to the fed funds target range.

Consumer Sentiment Drops

The University of Michigan’s Index of Consumer Sentiment saw a decline of 13.4% from July. This marked the index’s least favorable economic prospects in more than a decade, per chief economist Richard Curtin. The Sentiment Index has only recorded larger losses in six other monthly surveys since 1978.

The decline is attributed to an emotional response from hopes that the economic effects of the pandemic would soon end, amid Delta variant cases increasing. Personal financial prospects continued to worsen among smaller income gains amid higher inflation trends.

The survey notes this recent decline in consumer confidence does not imply an imminent downturn in the economy. The post-pandemic sentiment could be repeating patterns seen following 9/11 where the emotional impact on spending patterns lasted for a much longer time. It is also hard to separate the logistical and supply-chain issues that underly the current economic environment – you can’t sell what you don’t have even if someone is willing to buy it.

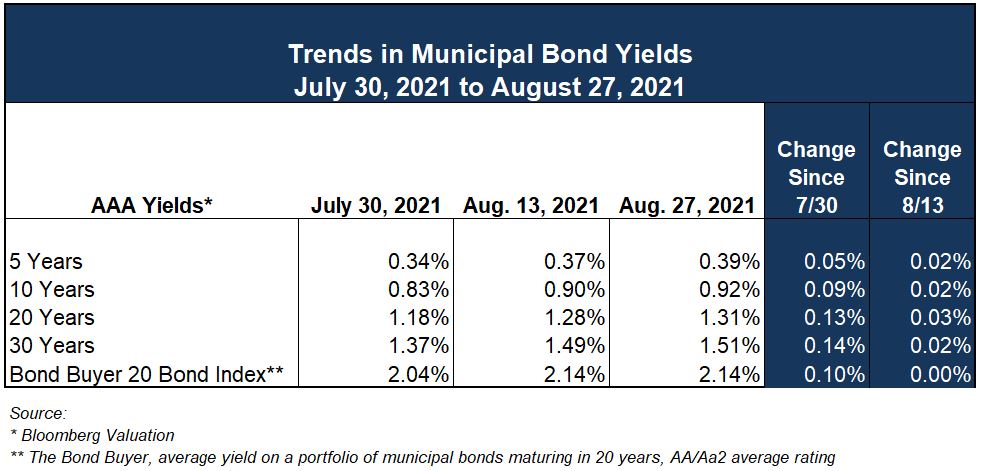

There has been minimal change in municipal bond yields over the past two weeks. The Bond Buyer and commentaries from municipal market analysts report supply-demand imbalances will likely persist into the fall. The imbalance seems to be diminished from the summer months, when large maturities and redemptions were taking bonds out of the market. Measures of demand, such as net inflows to municipal bond mutual funds remain robust, with no indication investor appetite is waning.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.