S&P 500 Sets New Record

The S&P 500 closed Tuesday at its highest level in history. The stock index, which plunged over 34% in February and March, has fully recovered and surpassed its previous record high on February 19th. The entire recovery took place over 126 trading days which makes it the fastest recovery in history (or perhaps shortest bear market in history). The S&P 500 is now up 5% for 2020, and it will be interesting to see how the election and continued pandemic-related turmoil impact equities over the rest of the calendar year. The stock surge has occurred despite historic unemployment numbers and uncertainty about the economy; however, investors seem willing to buy-in on a post-Covid-19 economy. The other reality is that with bond yields so low, keeping money in the equity market has been the only place for investors to seek out any returns.

Federal Reserve Lowers Emergency Lending Rates

The Federal Reserve Board of Governors voted last week to reduce the interest rates charged under its Municipal Liquidity Facility (MLF) by 50 basis points (1 basis point = 0.01%). The program had struggled to find any issuers interested in using it since it was created in March. The MLF was authorized as part of the Coronavirus Aid, Relief, and Economic Security Act and was intended to ensure governmental issuers would have no trouble securing capital during the economic downturn in the wake of the Covid-19 pandemic. However, until this week, only the State of Illinois had borrowed from the MLF, with a $1.2 billion note in June. The MLF was authorized to purchase up to $500 billion in municipal debt.

Municipal bond yields have been so low recently that issuers were still able to find better rates in the market than through the MLF, so the Fed’s response has now been to decrease the rates hoping for more participation. Tuesday, according to The Bond Buyer, the New York Metropolitan Transportation Authority took bids on a $1.3 billion tax-exempt note and decided to reject the bids (with a winning True Interest Cost (TIC) of 2.79%) in favor of borrowing through the MLF for a TIC of 1.92%.

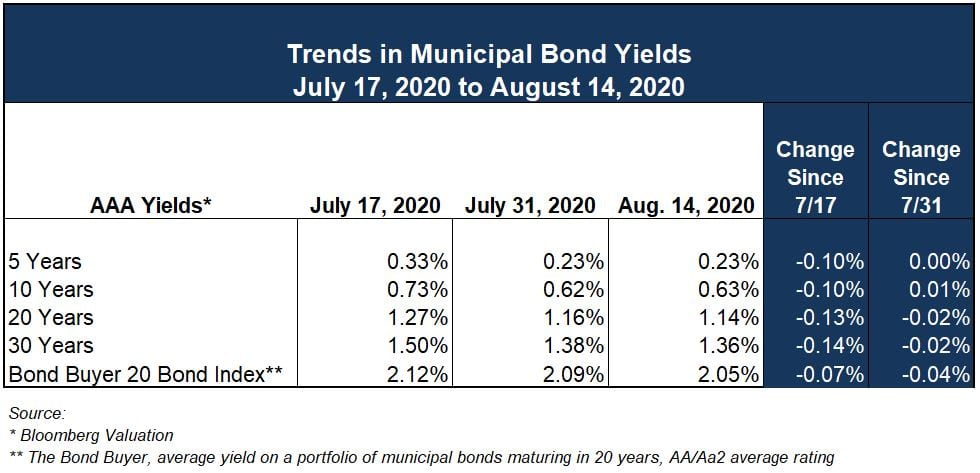

Trends in Municipal Bond Yields

Tax-exempt municipal bond yields have been historically stable this summer, but have now seen an increase last week and again this week. The Refinitiv MMD 10-year, AAA scale increased 3 basis points late last week and another basis point on Tuesday up to 0.67%. And the 30-year, AAA scale increased 3 basis points last week and another 3 basis points Tuesday up to 1.39%. This movement ends just over a month of almost completely unchanged muni yields.

According to Bloomberg Valuation, the AAA curve showed yields to maturity of 0.10% in 2021, 0.12% in 2022, 0.63% at 10-years and a 30-year yield of 1.36%. The 10-year muni-to-Treasury ratio stood at 99%.

Covid-19 Impact on Municipal Revenues Will Be Severe

A study released by the National Tax Journal entitled “The Fiscal Effects of The Covid-19 Pandemic on Cities: An Initial Assessment“ is just the latest analysis meant to sound the alarm on future financial difficulties for municipal governments. Despite the bullish stock market and some recovery in labor numbers, the fiscal impact on municipalities likely won’t be fully felt until fiscal year 2021. With the lag in reporting tax collections and the impact of state budgets on local government units, there will be a lot more analysis coming the in the months ahead but the theme seems to be to prepare for the worst.

Cities that rely on sales tax revenues, tourism revenues, gambling or large state aids from states which rely on those revenues will be the first to feel the full effect. Meals at restaurants are typically subject to taxation, but groceries are often not, and as the pandemic moved people from restaurants to cooking more at home those tax revenues will surely have been impacted.

The National Tax Journal analysis specifically looks at Rochester, NY, with a prediction of over 20% in lost revenue next year. As municipalities wait and hope that the Federal government will provide additional aid, this is the time to take a look at cash reserves, capital improvement plans and what revenues will be most impacted in the next year.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.