The most common interpretations by various market observers of the meeting minutes from the Federal Open Market Committee’s (FOMC) October 30th meeting seem to indicate any additional action this year on the target range for the federal funds rate is unlikely. CIBC’s head of fixed income, Gary Pzegeo, says markets expect the Fed to be “in a holding pattern for the near term,” as reported by The Bond Buyer. There would seem to be a general consensus amongst economists that the Fed has positioned monetary policy to a place that sufficiently recognizes global economic weakness and ongoing trade tensions (The Bond Buyer, 11/20/2019). Indeed, this sentiment is verified by the stated probabilities of changes to the target rate implied in fed funds futures pricing. The CME’s FedWatch Tool implies a 93.4% probability of no change to the target range at the FOMC’s December 11 meeting.

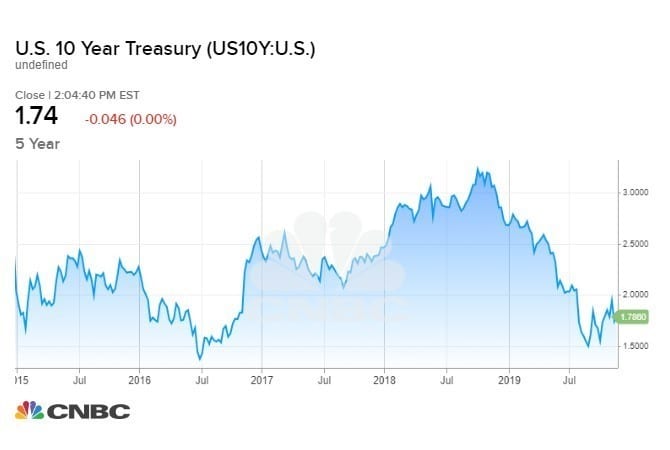

The U.S. stock market has reacted favorably while digesting the latest Fed guidance. The major U.S. stock indexes have increased in 16 of the last 20 sessions, and the S&P 500 is up 8% over the past seven weeks. While the equity market continues reaching historic highs, intermediate and long-term bond yields linger around their historic lows. The benchmark 10-year U.S. Treasury note yield has fallen over 125 basis points since the recent high in September 2018, but has risen slightly since early September, albeit down about 20 basis points from earlier this month.

Perhaps more importantly to the health of the current macroeconomic landscape is the fact that the U.S. Treasury yield curve has abated its recent “inversion” and returned to what is generally considered to be a more “normalized” state. Previously, yields from overnight out to three months were higher than nearly all points on the interest rate curve out to nearly ten years. Yields are now generally flat out to five years.

See the chart below: the light blue line is the yield curve 30–days ago, and the dark blue line is the yield curve today.

Source: CNBC

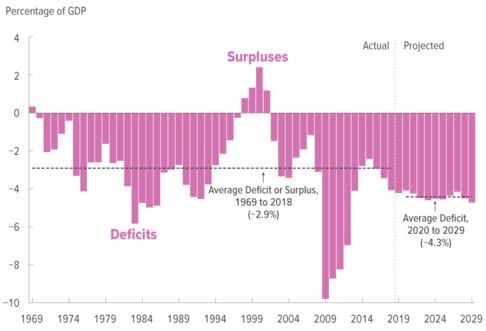

How do we evaluate the current level of deficit spending?

The Nonpartisan CBO projects the U.S. deficit will average 4.3% of GDP between 2020 and 2029. This level of sustained deficit is nearly double the average from 1969 to 2018 and begs the question about how the market will react? As mentioned above, the equities market continues to reach historical heights on a weekly basis. Additionally, the U.S. treasury is still able to borrow money at historical lows. Does this environment challenge conventional wisdom which would imply that a substantially larger supply of U.S. Treasuries would demand higher yields from investors? Given the current state of affairs across the globe, it’s hard to make the argument we are in a “conventional” environment. Only time will tell, in this case.

Source: Congressional Budget Office (CBO)

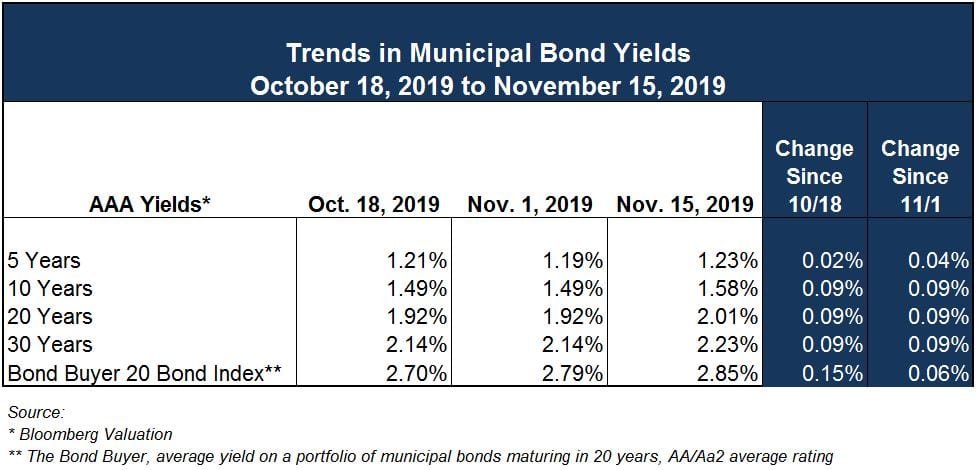

Trends in Municipal Bond Yields

New issue volume the prior two weeks has been higher than average at right around $10 billion. As would be expected, volume for this holiday week will be light at roughly $1.5 billion. Investors have happily absorbed the increased supply with commentators speaking to high levels of oversubscription on many issues in both the competitive and negotiated markets.

The Bond Buyer’s 30-day visible supply was $13.325 billion on 11/20/19, down from $16.961 billion on 11/13/2019. Interestingly, a large amount of the new issues being sold are taxable advance refundings of tax-exempt bonds. There seems to be increasing appetite for taxable munis – even investors outside the U.S. are seeking diversification through participation in the taxable municipal market, given the low and negative yields prevalent in their local markets. There is some general debate on the efficacy of executing a taxable advance refunding vs. waiting for issues to be subject to current refunding on a tax-exempt basis. Current reinvestment rates certainly have diminished the economics of taxable advance refundings.

As of 11/15 The Bond Buyer “20 Bond Index“ (BBI) was at 2.85%. This index tracks the average yield on a group of municipal bonds maturing in 20 years with an average rating of Aa2 on the Moody’s scale and AA on the S&P scale. Two weeks prior on 11/1 the BBI was at 2.79% and one month ago the BBI was at 2.75%. Generally speaking, the BBI has seemed to lag improved pricing for the competitive issues sold by Ehlers‘ clients in the last few weeks.

Your Ehlers Municipal Advisor is happy to keep you up to date on the most recent trends in interest rates to ensure you are well-informed about your capital borrowing needs.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.