Happy New Year! In our first Market Commentary for 2020, we will look back at 2019 and look ahead to the new year and what to expect in the municipal bond market.

2019 Review

2019 saw a healthy increase in municipal bond volume and an increase in taxable issuance. According to The Bond Buyer¹:

- Municipal bond volume issuance in 2019 was $421.49 billion compared to $346.06 billion in 2018. From 2010-2019, municipal bond volume exceeded $400 billion four times – in 2010, 2016, 2017, and 2019.

- Taxable bond issuance in 2019 rose to $67.27 billion from $29.95 billion in 2018. This was the highest annual taxable municipal bond issuance since 2010, the last year of the Build America Bond and other direct-pay programs, when $151.88 billion of taxable debt was issued. The increase in taxable bond issuance is largely attributable to issuers executing taxable advance refundings.

Municipal bond volume was strong at the end of the year and that trend is expected to continue into 2020. Fourth quarter volume in 2019 was 54.1% higher than the previous year. December bond volume in 2019 was 57.1% higher than 2018. Demand for municipal bonds remains robust; the week ended January 1 marked the 52nd consecutive week of positive inflows into tax-exempt bond funds according to data released by Lipper.

Entering 2019, it was generally anticipated there would be multiple interest rate increases during the year. At the conclusion of the final policy meeting of the Federal Reserve’s Federal Open Market Committee (FOMC) in mid-December, the FOMC kept the federal funds target range at 1.50% to 1.75%, following respective quarter-point cuts at each of their last three meetings. Notably, all voting members agreed with this direction, lending a definitive stance to the decision. An inverted yield curve and weakening economic indicators that surfaced during the summer and into early fall caused concerns about a recession, but those concerns were ultimately short lived.

Moody’s Outlook for 2020

Moody’s Investors Service has published its US Local Government Outlook for 2020². Moody’s 2020 outlook remains stable for cities, counties, and school districts over the next 12 to 18 months. Highlights include:

- Property tax revenue is projected to grow by 4.5% in 2020. Moody’s projects this revenue stream will reach its highest point in over a decade in 2020. This revenue source is shielded from any immediate economic slowdowns as declines generally lag immediate weakening of the broader economy.

- Moody’s projects Gross Domestic Product (GDP) growth will fall to 1.7% in 2020 compared to 2.3% in 2019.

- Liquidity, as measured by median cash and investments as a percentage of operating revenues, is at a five–year high and a sign of increasing financial flexibility.

- Many local governments have challenges posed by pension burdens. Moody’s adjusted net pension liabilities (ANPLs) relative to revenue will continue to rise, noting recent market interest rate declines indicate that trend will continue through 2020. Moody’s calculates the percentage of cities, counties, and school districts, with ANPL over 100% between 2010 and 2018 has increased by 31%, 39%, and 34% respectively.

Moody’s writes continued property tax growth in line with recent trends combined with improved economic growth, improved national economic conditions that are materially stronger than current projections, and moderation of pension liabilities could drive a positive outlook.

There are five trends that could drive a negative economic outlook according to Moody’s:

- Materially weaker national economic conditions, particularly those affecting property values, or changes in GDP that increase unemployment;

- Property tax revenue growth of less than 2%;

- Property tax revenue growth of less than 2% that is outpaced by rising fixed costs or growth in leverage from debt and pensions;

- Materially increased challenges from factors such as pension cost increases, environmental risks, increasing healthcare costs, and changing demographics that impact sector stability.

- Reduced willingness of local governments to pay debt service, or willingness of states to support distressed local governments.

Primary global credit themes affecting the US local government sector in 2020 include recession risks, trade tensions, disruptive technologies, and climate risks.

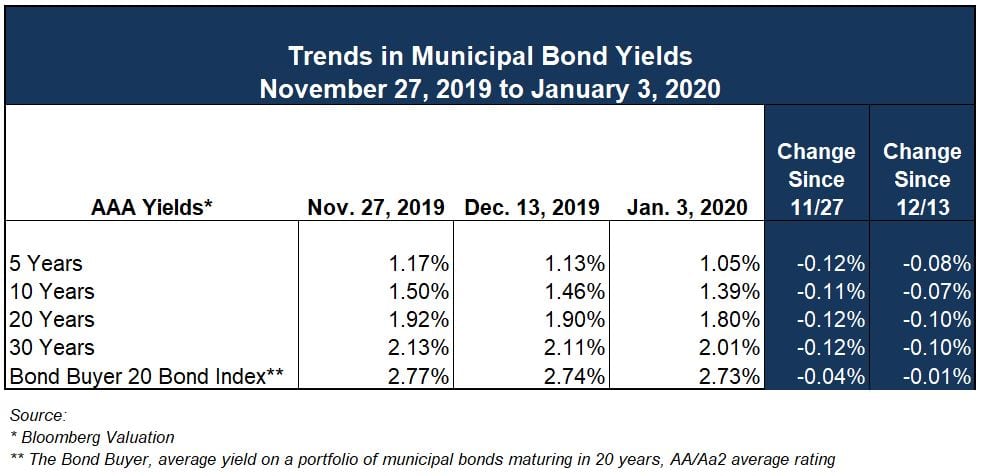

Current Municipal Bond Yields

Pent up demand for municipal bonds and declines in yields are a favorable combination for issuers entering 2020. Sale activity the last few weeks of the prior year was minimal. In the first full business week of 2020 (week of January 6th), competitive sales conducted by Ehlers on behalf of our clients have generated on average 7 bidders per issue. Typically, issuers this time of year are beginning to engineer and bid construction projects and evaluate capital needs for the coming year. Please consult your Ehlers Municipal Advisor to begin preliminary planning and determining the fiscal impact of proposed capital improvements.

¹ The Bond Buyer, December 31, 2019 “Munis finish 2019 with a robust $421B, including $67B of taxables”

² Moody’s Investors Service, December 4, 2019 “2020 outlook stable with revenue set to grow despite slowing economic growth”

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.