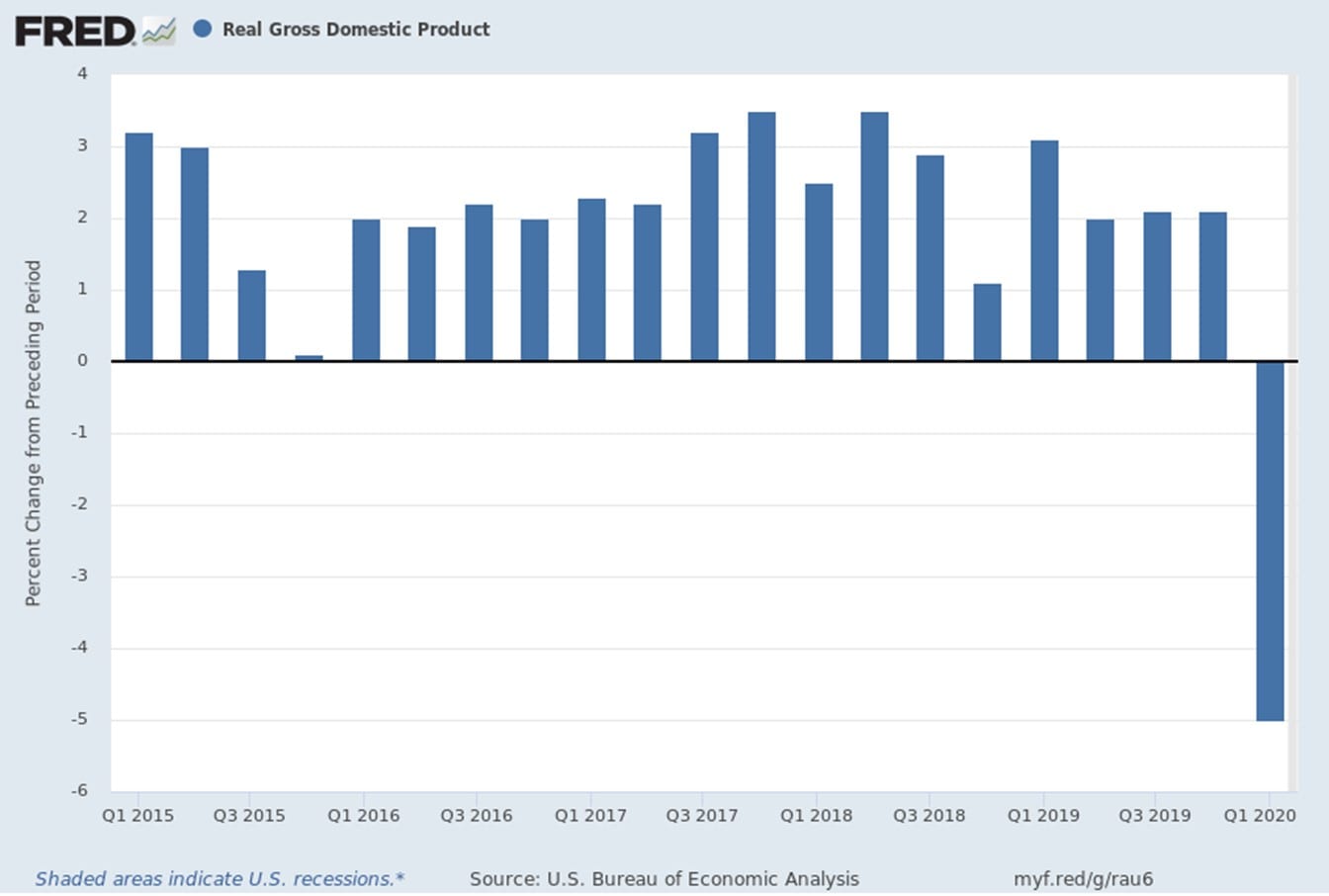

The Federal Reserve System’s Board of Governors released the Monetary Policy Report on June 12th, which is a report delivered to Congress twice a year to update policymakers on the basic state of the U.S. economy. The report looks at past policy decisions and their impacts along with an assessment of the current financial condition of the U.S. economy. Unsurprisingly, it focuses heavily on the impacts of COVID-19, including some of the early pandemic-related problems such as the soaring unemployment rate (which has since dropped), the disrupted flow of credit to households and sudden drop in economic activity. For example, real personal consumption (measured by the Personal Consumption Expenditure index) dropped 6.7% and 13.2% in March and April, respectively. These numbers, along with a collapse in housing sales and construction, have contributed to first quarter real gross domestic product (GDP) contracting by 5%.

Some positives from the report:

- The Federal Open Market Committee (FOMC) reacted quickly during the pandemic to reduce the federal funds target range to near zero (0.00-0.25%). All indications from the report are that the FOMC expects to keep that rate near zero for at least the next several quarters, depending on the pace of the recovery.

- Inflation has been mostly held in check or even lowered due, in part, to very low energy prices.

- The Fed, along with the Secretary of the Treasury, reacted quickly by creating new credit and liquidity facilities.

All these actions had the impact of helping the equities markets recover from their March lows and the fixed income markets to stabilize (as we discuss in the next section).

Trends in Municipal Bond Yields

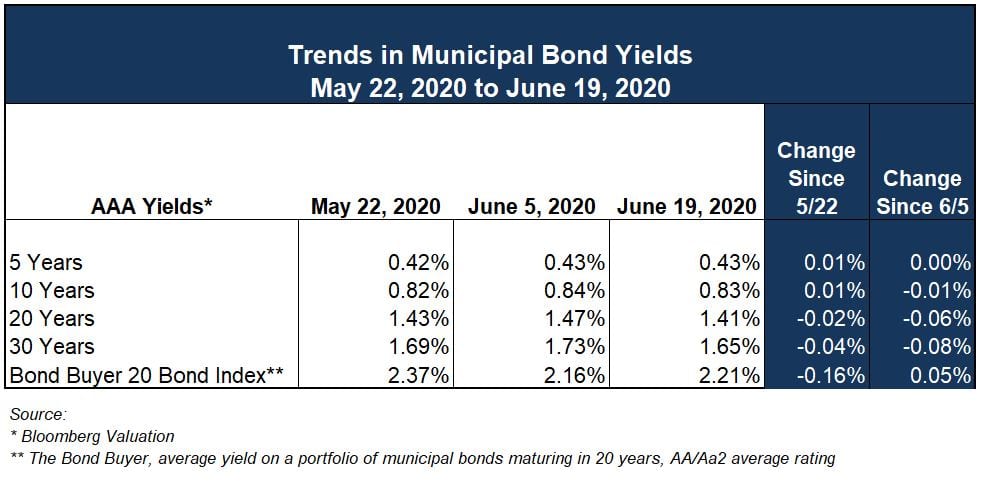

Since our last market commentary, there have been more than $18 billion in municipal securities sold, both competitively and negotiated. Bank of America says that “[t]he primary market looks fully recovered from the COVID-19 induced crises. The calendar and visible supply index suggest that June’s new issuance volume should match or exceed our estimate…” (The Bond Buyer). Issuers accessing the capital markets in the near future will likely benefit from a high demand and low yield environment. Yields have recently remained mostly flat after some volatility in May. Bloomberg Valuation (BVAL) shows that AAA-rated yields are unchanged between 6/5 and 6/19.

One reason for such robust demand is increased redemptions that occur this time of year (for the many issues with 6/1 or 7/1 call and maturity dates) coupled with several months of lower new issue supply. June will see around $32 billion in new issue volume, the highest monthly total in 2020.

Coupled with the strong primary market is an actively traded secondary market. Municipal investors seem to be sitting on a net $52 billion of funds to invest in the municipal market, says John Miller of Nuveen. This will ensure that the market can absorb the anticipated higher levels of supply in the coming months.

Ongoing COVID-19 Impacts

RBC Wealth Management’s Adam Boardman recently stated that credit exposure will be the biggest ongoing impact from COVID-19. Those issuers at greatest risk for potential downgrades or negative outlooks will be sector-specific: airport, transportation, convention centers, hospitality, parking and credits backed by sales taxes or user charges/fees are more exposed than general obligation and essential purpose revenue credits.

Survey data recently released by the National League of Cities (NLC), a local government advocacy organization, found nearly 700 out of 1,100 respondents are likely to defer or cancel capital investments currently planned for the near future. These investments include equipment purchases, economic development spending or major infrastructure. This is a departure from the optimistic outlook on capital spending that existed previously.

Much of the impact on governmental entities will present itself with a lag, due to the nature of property tax collections and any associated declines in real and personal property values as a result of declining economic activity associated with the pandemic. However, already 1.5 million public sector jobs have been lost since March, a sign of the squeeze being felt. Keep an eye on whether the Federal government provides some sort of infrastructure package as part of any new stimulus legislation. Absent that, it appears many municipal budgets will start to reflect great caution moving forward. 80% of the NLC survey respondents were from cities with populations less than 50,000.

https://www.federalreserve.gov/monetarypolicy/files/20200612_mprfullreport.pdf

Cities are Making Unavoidable Cuts in Response to COVID-19 Fiscal Pressures

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.