Federal Reserve Chairman, Jerome Powell, last week warned the national economy is still far from pre-pandemic levels. In a speech delivered to the National Association for Business Economics, Powell emphasized too little federal government support may lead to a weaker recovery and create unnecessary economic hardship. He stated, “By contrast, the risks of overdoing it seem, for now, to be smaller. Even if policy actions ultimately prove to be greater than needed, they will not go to waste. The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side to provide support to the economy until it is clearly out of the woods.”

These comments come on the heels of the September jobs report indicating employers added 661,000 jobs in September, slower than previous months. Approximately 11.4 million of the 22 million jobs lost in March and April have been replaced, but job growth overall has slowed with September marking the first time since April net hiring was less than 1 million jobs for the month.

However, the lowering of the unemployment rate from the beginning of the pandemic-induced economic shutdowns has been swift. Unemployment fell to 7.9% in September compared to 8.4% in August and the 80-year high of 14.7% in April 2020. The 6.8 percentage point drop from April to September is significant when compared to the Great Recession. For example, it took 35 months from October 2009 (when unemployment peaked at 10.0%) to September 2012 for unemployment to reach 7.9%.

Bloomberg reports in their article, “Next Big Shift in Economics Takes Shape under Covid Shadow” (October 11, 2020) the use of fiscal stimulus will be a major consideration at the International Monetary Fund meetings this week, the purpose of which is to try and answer the question, “how long should central banks keep public spending as a primary tool to fight the negative economic effects of the pandemic?” Bloomberg economists forecast a 4.5% contraction in global economic growth for 2020 followed by 4.8% expansion in 2021, assuming rising cases in Europe and the U.S. continue to “dent” the recovery, the U.S. passes additional fiscal stimulus in the first quarter of 2021, and a vaccine is widely distributed by mid-2021.

Following the recession in 2008, government spending increased significantly. The present debate centers on whether this spending ended too quickly at that time and if history may repeat itself now. With central bankers using many of the monetary policy tools available to them (keeping borrowing costs low for an extended period), expect the debate over fiscal policy and direct stimulus tools to remain at the forefront of the response to the pandemic both domestically and abroad.

Prospects for a quick end to the stalemate in the U.S. over a new stimulus faded Monday. Members of the House were advised not to expect any action this week and many Senate Republicans are rejecting calls from the White House for a deal.

The equity markets continue to monitor talks about additional support to households and businesses experiencing disruption from the pandemic.

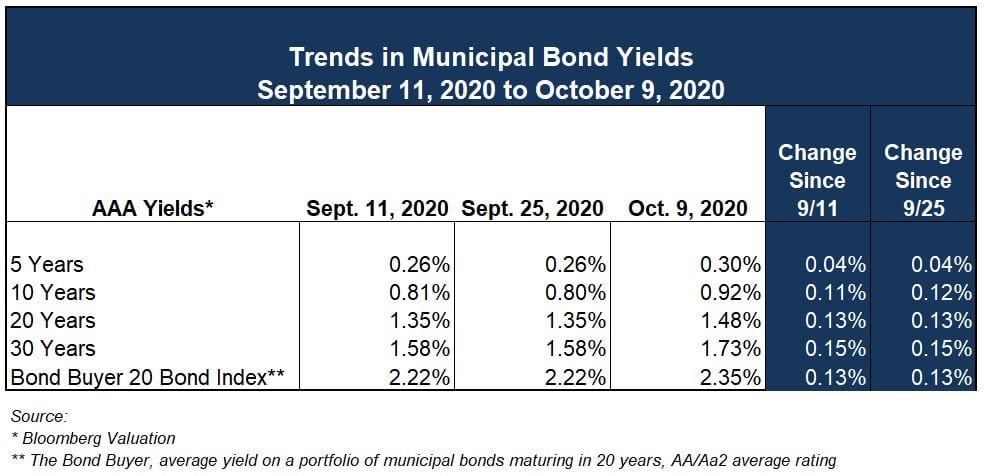

Municipal Bond Yields

The Bond Buyer reports the week of October 12 has the largest supply of new municipal bonds this year, with more than $14 billion of issuance. Municipal bond yields have continued to trend upward, slightly, over the past two weeks.

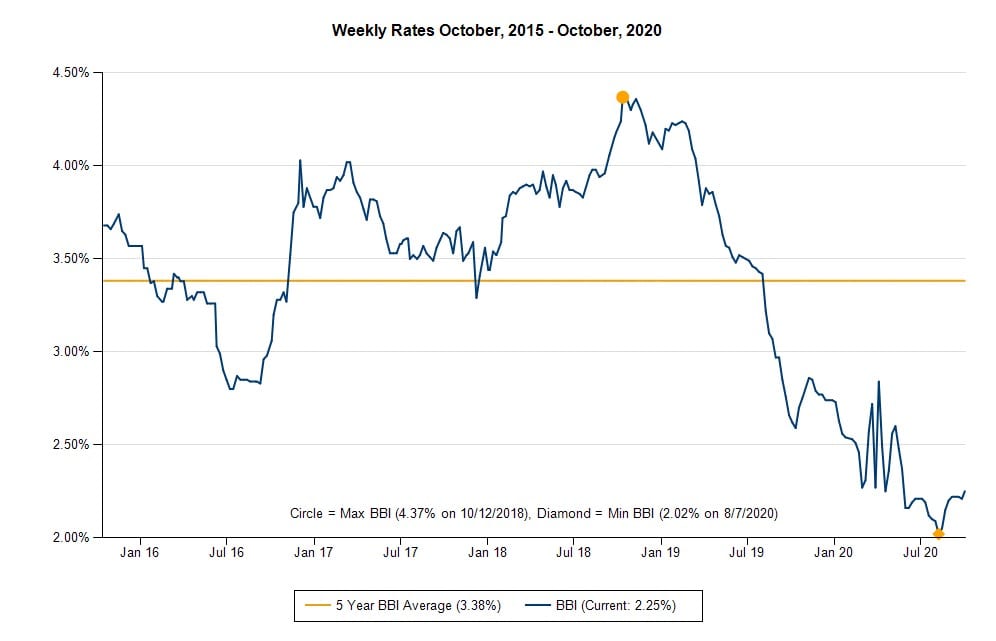

When yields show some movement upward, it is beneficial to look at yields over a longer time horizon. The Bond Buyer “20 Bond Index” (BBI) shows average yields on a group of municipal bonds that mature in 20 years and have an average rating equivalent to Moody’s Aa2 and S&P’s AA. The graph below depicts trends over the past 5 years, which as one can see, the BBI reached its lowest level in recent years in August 2020.

5 Year Trend in Municipal Bond Indices

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.