Update on Federal Economic Stimulus/Pandemic Relief

The Senate prepared to move ahead this week with debate of President Biden’s $1.9 trillion economic stimulus/coronavirus relief proposal, which includes $350 billion of direct aid to state and local governments, $170 billion for schools, and $20 billion for mass transit. Not included was a provision to increase the federal minimum hourly wage from $7.25 to $15.00 after a backup plan to raise the federal minimum wage through tax penalties and incentives failed over the weekend. To recap, last week the Senate parliamentarian said an across the board federal minimum wage increase did not comply with the chamber’s rules, so Senate Democrats had proposed late last week to penalize large companies through the tax code if they did not increase the minimum wage. But the plan fizzled after it became clear some Senate Democrats were skeptical of the provision and likely to vote no.

If the Senate passes the bill later this week without the minimum-wage increase, it may return to the House, where it could fail if liberal Democrats refuse to vote for any aid package without the minimum wage provision (as some have previously indicated).

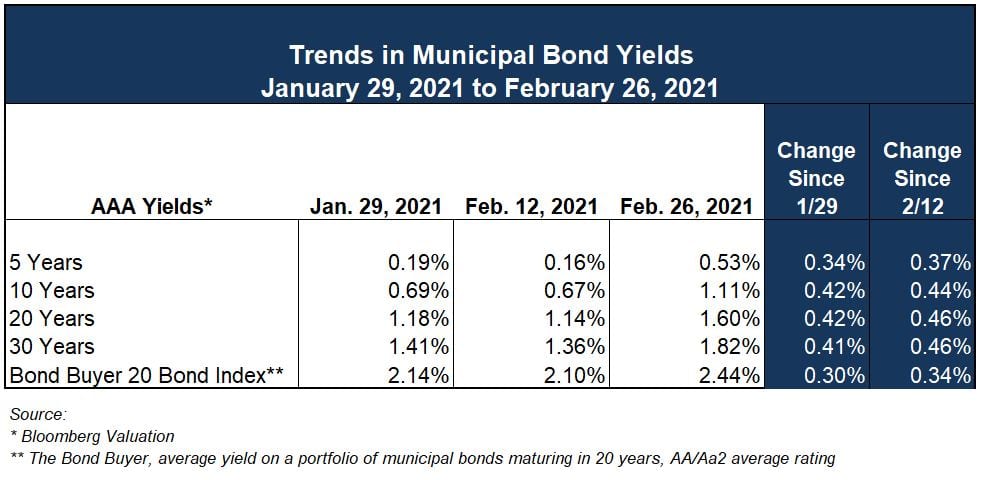

Trends in Municipal Bond Yields

Despite rising Treasury yields, municipal bond yields have remained relatively flat for much of 2021. This dynamic was primarily driven by a supply/demand imbalance caused by strong inflows into municipal bond mutual funds and low supply of bonds coming to market. Last week represented the fourth consecutive week-over-week increase in U.S. Treasury yields (also the longest streak since 2018); the benchmark 10-year note ended the week at a 10-month high of over 1.40% after reaching a midweek peak of 1.60%. The advance in intermediate and long-term yields paused on Monday of this week, easing investors’ inflationary concerns, though it seems municipal bond yields are back up to where they were about a year ago. However, unlike the sell off last March (when yields rose due to fear of COVID-19 unknowns), this sell off suggests investors believe munis are too expensive and do not adequately reflect where the market is headed.

Is Higher Inflation on the Horizon?

For the past 25 years, inflation has been below the Federal Reserve’s current 2.0% target and the usual conditions for inflationary concerns – tight job markets and public expectations of rising prices – are absent, so why is there so much anxiety about rising inflation?

Couple of reasons – markets are optimistic about the economy “getting back to normal,” and Congress is close to pumping another $1.9 trillion into the U.S. economy, which could further boost growth and inflation. Meaning, with additional stimulus, investors believe the U.S. economy will grow in 2021 and probably by more than what the Fed is projecting. In short, many market pundits believe annual inflation will jump up in the coming months, if only because prices were depressed a year ago when the pandemic induced lockdowns. To illustrate the point, last year’s economic growth was 3% to 4% below the Congressional Budget Office’s estimate of GDP “potential” – the level of economic output without increasing inflation. Similarly, the U.S. unemployment rate was 6.3% in January, well above the Fed’s median estimate of the “natural” rate of 4.1%. If these market pundits are right, maybe lockdowns have created some pent-up demand and consumer spending (which powers much of the U.S. economy) may rebound and further push up inflation.

Indeed, much of what has happened should have been expected. In normal times, the 10-year Treasury is generally considered a good barometer of risk appetite in markets and of economic confidence more broadly. Since bond prices tend to move in the opposite direction to market confidence, prices should fall (and yields increase) as the economy recovers.

To be fair, mild inflation is not to be feared but hopes for a reflation of the economy can quickly spill over into fear of sustained increases in inflation, particularly given the Fed’s previous indications that it will focus less on inflation and more on full employment.

While the Fed continues to signal its plans to keep short-term rates near zero for the foreseeable future, the market is starting to price in the likelihood that a rate hike will be coming sooner than previously expected due to greater than anticipated economic growth in 2021 and 2022. Looking at the New York Fed’s Nowcast, Q1 GDP growth is expected to be 8.6%.[1] Should that level be sustained through Q4, the U.S. economy will be right back to pre-pandemic 2019 trendlines by Q1 2022, prompting projections the Fed will increase the fed funds rate well ahead of its current guidance of December 2023.

In sum, it appears the combination of very easy monetary policy, expansive fiscal policy, and the Federal Reserve willing to let the economy “run hot” for a period of time, is prompting markets to reassess both economic prospects and Fed policy responses to it. And investors pricing in odds of better-than-forecasted growth and higher inflation could force the Fed’s hand, pulling forward both guidance on bond buying/tapering and rate hikes. As such, they [investors] have started to demand higher yields to compensate them for the likelihood of higher rates. Even so, at 1.5% or even last week’s peak of 1.6%, the 10-year Treasury yield is still well below the 2.6% it was at two years ago or the 5.0% twenty years ago. However, it seems the days of low market volatility may be over and we may again see jitters play out in the financial markets.

[1] https://www.newyorkfed.org/research/policy/nowcast

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.