March was a volatile month for some sectors of the bond market, with rates moving higher early in the month, then retreating to some degree, and recently stabilizing in a tight range. Municipals were one exception, as tax-exempt bonds largely outperformed most other sectors (more on that later).

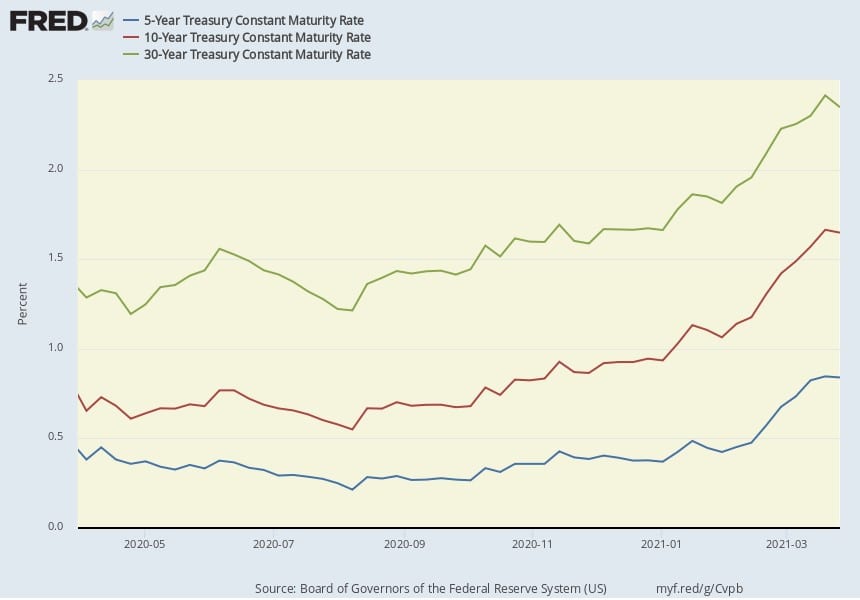

Intermediate and long-term U.S. Treasury yields increased roughly 20 – 25 basis points (1 basis point = 0.01%) from five years and beyond. Rates have steadily moved higher over the past year, albeit in an orderly fashion. Recall that the end of the first quarter last year was at the height of pandemic-induced shutdowns – not just here, but globally.

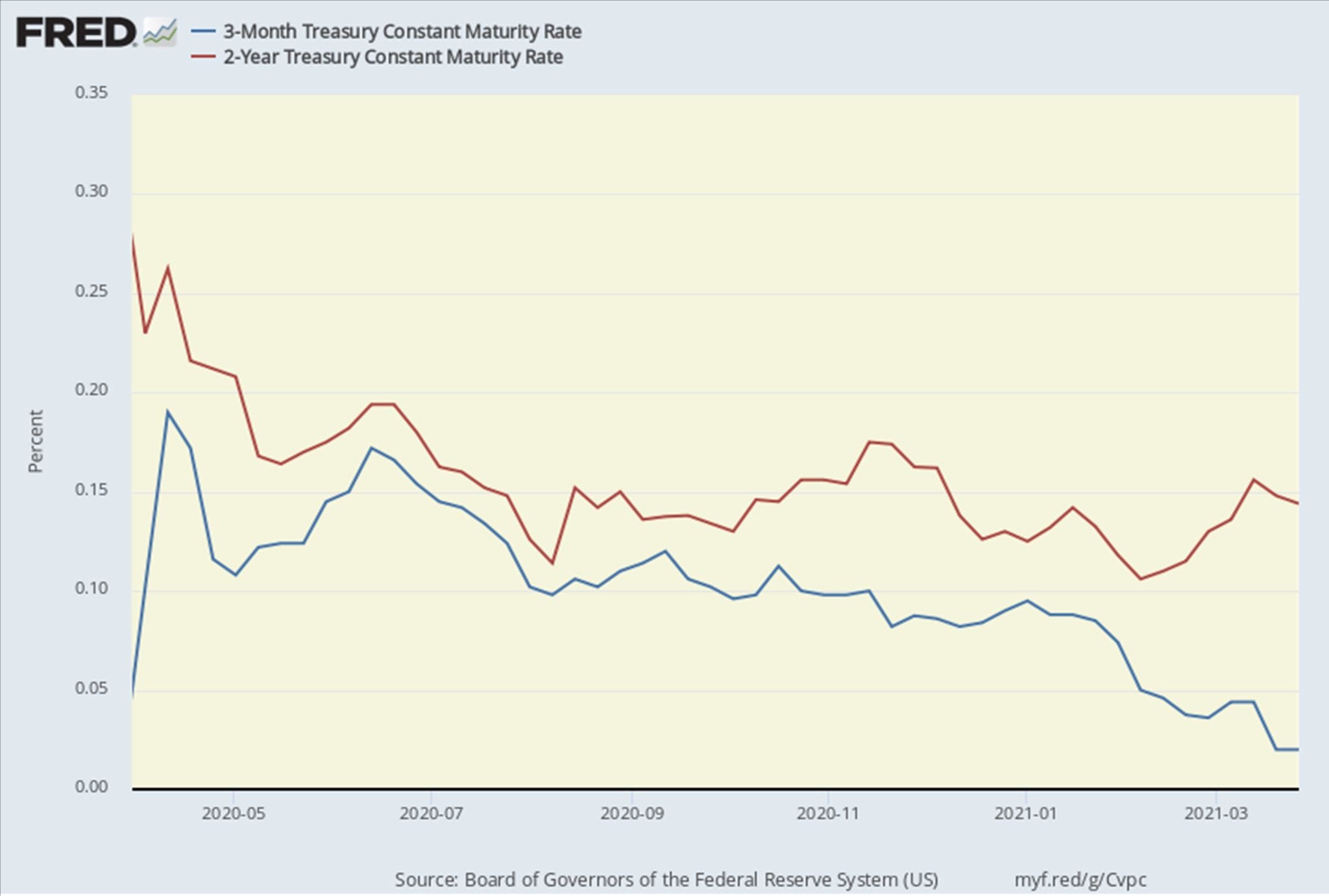

There are several factors market observers pointed to as reasons for recent increases to intermediate and longer-term Treasury yields: growth expectations, $2 trillion of deficit spending by the federal government (i.e. more Treasury issuance), inflation expectations, uncertainty around Federal Reserve monetary policy, to name a few. With over twenty speeches by Fed officials following the recent meeting of its Federal Open Market Committee (FOMC) and testimony by Fed Chair Powell to both chambers of Congress, the Fed largely extracted itself from the mosaic of uncertainty. It’s clear the Fed does not intend to relinquish its pressure on the pedal of U.S. monetary policy for the foreseeable future, using its tools of the fed funds rate and outright bond purchases. We can see this manifest on the short end of the interest rate curve where the Fed exerts the most influence over rates.

The 90-day T-bill has declined in yield throughout this entire year and fell a few basis points upon conclusion of the last FOMC meeting. It now stands at approximately 0.025%. Similarly, the 2-year yield was creeping up through mid-March, reaching a recent high of about 0.16%, then declining a few basis points through the end of the month.

Certainly, the nearly $2 trillion of federal spending associated with the American Recovery Plan will be entirely financed with debt, albeit over a number of fiscal years. However, large federal deficits have generally produced a yawn on the part of fixed-income investors. Persistent increases in federal debt held by the public have not led to the emergence of what used to be called the “bond market vigilantes.”[1]

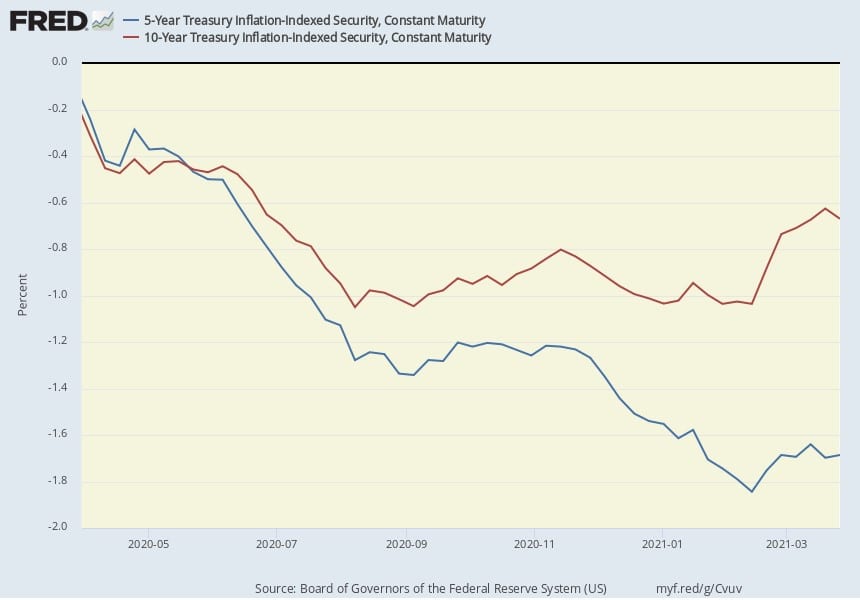

Many observers have pointed to inflation expectations as being a proximate cause of increases in yields, especially in light of the fiscal stimulus. While inflation expectations have certainly gone up recently, it may not be as much as some think. There are a number of ways to infer investor expectations for inflation. One is to observe yields for Treasury Inflation Protected Securities (TIPS), which provide investors compensation for inflation through indexing the face amount of the bond. We can see that long-term inflation expectations have increased but are still rather muted looking forward five and ten years out.

[1] https://www.ft.com/content/542d6127-11e7-47ff-86cb-dd7bd974cda3

Yes, yields on TIPS with five- and ten-year maturities are negative, but are less so than just two months ago, indicating increased inflation expectations on the part of investors. However, the increase likely wouldn’t be described as dramatic. When we contrast the 5-year TIPS yield with that of the 5-year Treasury we arrive at what is described as the “break-even” inflation rate of roughly 2.55%, meaning one would be indifferent between the two investment options at that rate of inflation over the five-year term. This break-even rate has, indeed, been increasing, up about 0.50% since the beginning of the year. Meaningful in today’s low rate environment, but arguably modest by historical standards.

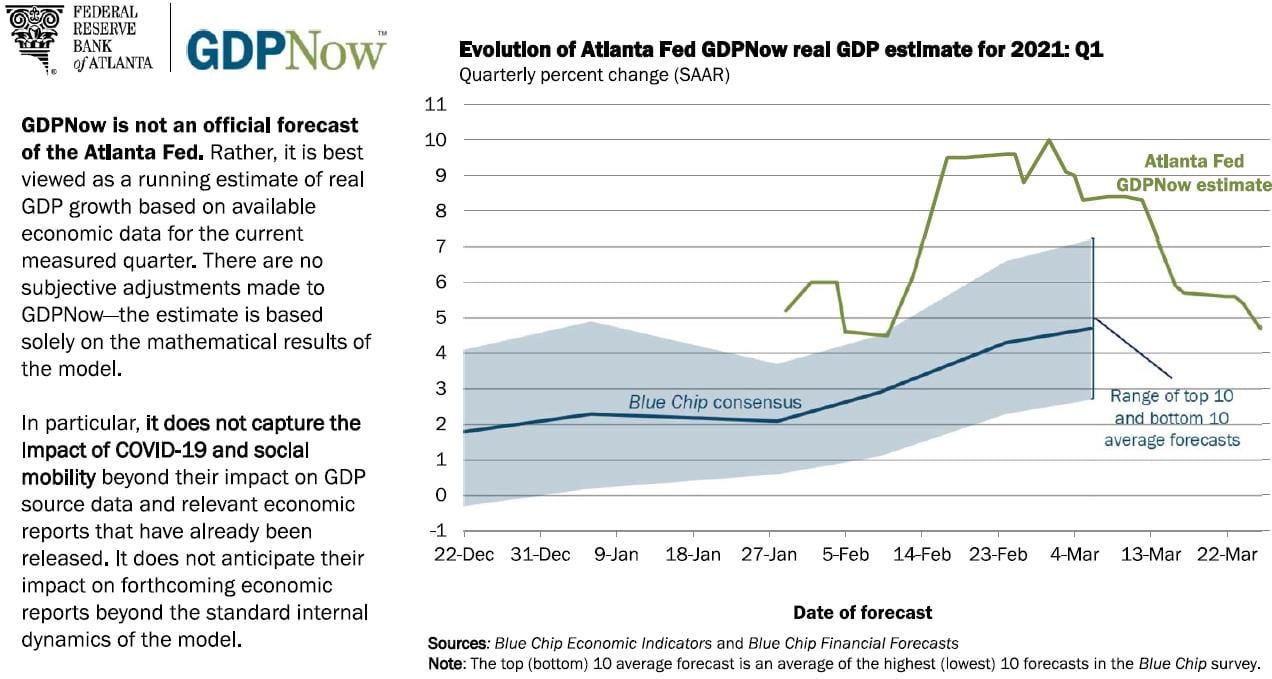

Growth expectations have been strong for the first quarter of this year. However, they have recently waned. Still, current expectations based on the Atlanta Federal Reserve Banks, GDPNow forecast tool present a picture of greater than 5% GDP growth (down from 10% earlier this year).

Part of the recent decline in expectations is the result of the impact of changes in business inventories. There’s undoubtedly a COVID-induced backlog in certain sectors in relation to manufacturing and transportation. Have you tried to purchase a major appliance lately: windows, furniture…? Backorders are prevalent on both finished goods and materials. After inventories are drawn down, we will likely see a reversal, and positive contribution to GDP as businesses rebuild their raw materials caches.

It would seem the market’s points of view on growth and inflation can be looked upon as the primary drivers of recent increases in rates. We would be remiss if we don’t point to the fact that rates are still quite low by historical standards. Additionally, when compared against the rest of the world, U.S. rates are clearly held down by the gravity of even lower sovereign yields among the world’s major economies.

President Biden unveiled his proposed $2+ trillion infrastructure plan and Made in America Tax Plan on Wednesday. We’re confident he avoided April 1, so people knew he was serious about the respective proposals. While light on granular details, the infrastructure plan set forth some broad brushstrokes on allocation of the funds: $621 billion for transportation infrastructure; $400 billion in the area of care for elderly and disabled Americans; $300 billion for drinking-water projects, broadband access and electrical grid; $300 billion building and retrofitting affordable housing, and constructing and upgrading schools; and, $580 billion for manufacturing, research and development, and job training. The money is intended to be spent over a total of eight years. This spending plan was proposed to largely be funded by changes to tax law that would prospectively increase tax revenue under the Made in America Tax Plan. The proposal includes an increase to the corporate income tax rate to 28% from the current 21% (lowered to 21% from 35% in the Tax Cuts and Jobs Act of 2017), as well negotiation of a global corporate minimum tax of 21% to mitigate the attractiveness of tax havens. Additionally, the plan calls for an increase in individual marginal income tax rates for incomes greater than $400,000 and potential changes to itemized deductions.

These would be important changes in the sphere of tax-exempt, municipal debt. Changes in tax law result in demonstrable impacts to the borrowing costs and market dynamics for municipal issuers. On their own, these changes in tax law would likely increase the value of tax-exempt income. However, these changes are not being undertaken in a vacuum. A number of representatives and senators have recently spoken positively about introducing legislation to reform the municipal market by reinstating tax-exempt advance refundings, increasing the annual bank qualification limitations, and bringing back direct-pay tax credit bonds not subject to sequestration. There’s also discussion of eliminating the cap on the state and local tax deduction, which would generally result in a reduction to taxable income. When so many dials are proposed to be turned simultaneously, it’s quite difficult to assess what the results would be beyond just stating the potential for volatility. When the Tax Cuts and Jobs Act was made law in 2017, there was a period of adjustment in the municipal market, but stability emerged once the initial effects made their way through the economy.

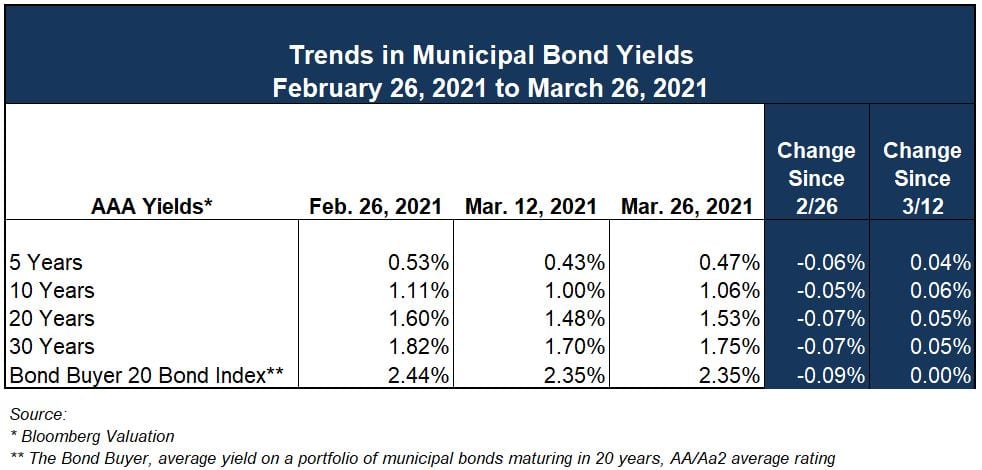

Speaking of the municipal market, it has been one of the only areas of relative strength in fixed-income of late. “AAA” yields reported by Bloomberg Valuation are up roughly 4 – 6 basis points from 5- to 30-years in maturity and are actually down around 5 basis points across the maturity spectrum from late February. This has resulted in some of the lowest ratios of tax-exempt to taxable yields since the early 1990s. Tax-exempt yields versus taxable equivalents are roughly 60% at 5 years, 70% at 10 years and 75% at 30 years, making municipals rather expensive based on recent norms. However, tax-exempt yields on the shorter end of the interest rate curve are still higher than U.S. Treasuries and agencies.

The present situation remains largely a result of supply and demand – there aren’t enough tax-exempt bonds to meet investor appetite, as well as investors believing there will be increases in tax rates. Refinitiv Lipper reports three straight weeks of net inflows into municipal bond mutual funds an ETFs. ICI (Investment Company Institute) data shows positive inflows in all but one week of this calendar year.

This holiday-shortened week has rather light new issue-volume of nearly $3 billion as a kick-off to the second quarter. The Bond Buyer reports that municipal issuance is up 7.1% for the first quarter year-over-year, at $102 billion. That shouldn’t be a surprise given the basis of comparison, as the first quarter of 2020 saw significant major uncertainty and economic and market disruptions resulting in very low new issue volume in the months of March and April. In fact, March volume, at $41.6 billion was up 105% from 2020. New money issuance has been the primary volume driver with refunding activity down.

Given this backdrop and the strong credit quality of municipal issuers, market access remains robust. We anticipate new issue activity to pick up even more with much of the country emerging from its thaw and entering construction season. Investors seem to be ready and willing to put money to work, although certain parts of the interest rate curve can be more challenging. We have similarly seen fairly vigorous interest and competitive pricing from bank purchasers for certain structures. We look forward to discussing capital plans with clients, evaluating sources of capital, and market timing. This is especially important given the ever-changing situation at the federal level and the possibility of evolving and even new financing options.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.