Consumer Confidence is Up

The Consumer Confidence Index for the month of October was released Tuesday by the Conference Board with a reading of 113.8. This is up from 109.8 in September and the first increase in three months. According to the economists polled by the Wall Street Journal, expectations for the October release were estimated at 108.0. Respondents indicated that vacations were among the big-ticket expenditures that they planned to make in the near future. In addition, the number of people reporting they planned to take a vacation in the next six months marked the highest level since the beginning of the pandemic in March 2020.

The Consumer Confidence Index combines consumers’ assessment of the present situation and their short-term outlook. Though the nominal number is difficult to put into context (1985 = 100), the trends tell the story. This month’s increase comes just a couple months after a sharp drop in the index in August, following a resurgence in COVID cases and the delta variant.

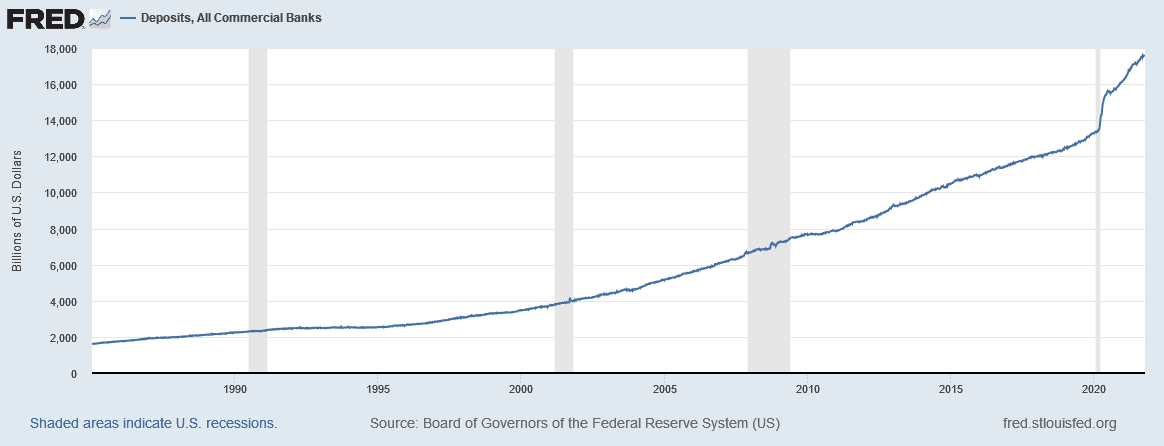

The data indicate there’s sufficient savings to take on the additional spending by consumers. Bank deposits continue to increase, recently reaching nearly $18 trillion. The recent pace at which deposits have increased since the spring of 2020 far outpaces growth over past decades, which is attributable to increased savings rates, direct federal stimulus, and the monetary policy actions of the Federal Reserve.

Updates from Washington D.C.

Having initially proposed a $3.5 trillion legislative plan, the Democrats have pulled back and set their sights on a spending package of approximately $1.75 trillion. The social spending and climate package deal has a somewhat artificial deadline of October 31, in the hopes that it can be tied together with the $1 trillion infrastructure package, which includes reauthorization of certain transportation programs currently set to expire on that date. As for the municipal bond tax law changes included in the original $3.5 trillion plan, no one can say for certain if these proposals will make the cut.

Additionally, some in Washington have begun to speculate on the upcoming February 2022 term expiration of the top Federal Reserve post currently held by Chair Powell. Originally appointed by President Trump, the top job has not typically swayed according to the political winds of the White House. Most recently, President Obama reappointed a Republican appointee (Ben Bernanke) and President Clinton did the same (Allen Greenspan). President Reagan, a Republican, similarly reappointed a Chair from a prior Democrat administration (Paul Volker). The appointment by the President requires Senate confirmation.

Municipal Markets Trending Slightly Upward

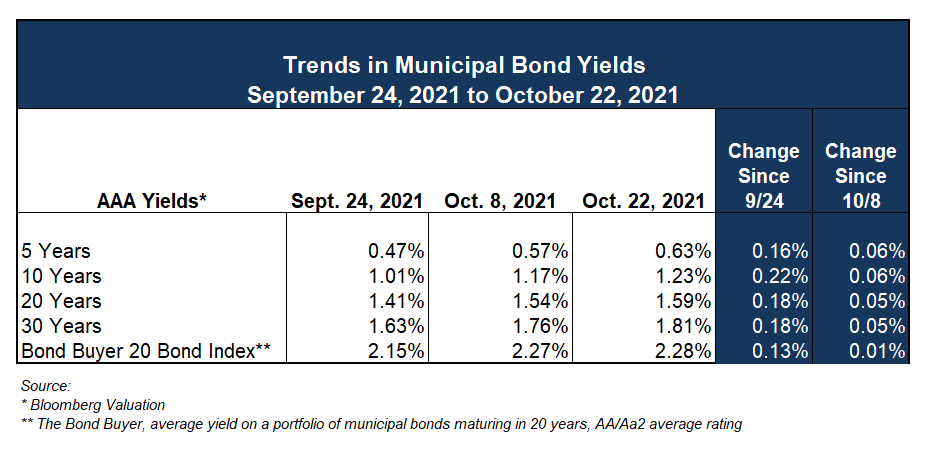

After months of very little change, the municipal bond market experienced increases in yields at all points on the yield curve, relative to the beginning of September. Change over the past two weeks has subsided somewhat with a slight 6 bps (1 basis point – 0.01%) increase over the week ending October 8. The municipal market has generally moved in concert with increases to U.S. Treasury yields, although with slightly less volatility.

As reported in The Bond Buyer and according to Refinitiv MMD, municipal-to-UST ratios are 53%, 74% and 83% at the 5-, 10-, and 30-year marks, respectively. Generally speaking, lower muni-to-UST ratios indicate greater investor demand for tax-exempt income. Current ratios are consistent with the past few months.

The Fed’s Plan to Curtail Asset Purchases Before Employing More Traditional Monetary Policy Tools

The Federal Reserve has a number of tools available to effect monetary policy across the banking system and more broadly in the financial markets. Those tools include:

- Reserve Requirement

- If you weren’t already aware, should every depositor show up at the bank tomorrow and demand their funds, the bank would have to close its doors (remember It’s a Wonderful Life). Ours is a fractional reserve banking system, where banks must hold reserves at the Fed against some percentage of “reserve liabilities.” For most of the Fed’s history, that amount has been very low and is generally based on a tiered structure. During the financial crisis of 2008, the Fed increased the reserve requirement significantly to protect the banking system as a whole. This more stringent reserve requirement was later eased as the economic conditions improved. In 2020, the Fed reduced the reserve requirement percentages for all depositary institutions to zero. Lower reserve requirements tend to increase the amount of bank lending and the money supply, all else equal.

- Discount Rate

- The rate the Fed charges financial institutions to borrow funds on a short-term basis against posted collateral (i.e. loans). Banks borrow at this rate from the fed at the “discount window” which serves as a back-up source of funding. The Federal Reserve Board sets the discount rate.

- Open Market Operations

- The buying and selling of securities in the open market by the Fed. When the Fed buys securities, the proceeds of those purchases are added to reserves in the system, generally increasing the money supply. Traditionally, the Fed has used this as the primary tool to achieve its target range for the federal funds rate, or the rate at which banks lend excess reserves to each other. The Federal Open Market Committee is the body that established the range for the fed funds rate, with the New York Federal Reserve Bank carrying out open market operations to achieve the target. In the last fifteen, or so years, the Fed has used open market operations in a more non-traditional fashion through purchases of longer-dated securities in order to exert influence over interest rates more broadly across the interest rate spectrum. The stated purpose of open market operations is to ease the flow of credit throughout the financial system, although the efficacy of these operations cannot be known since there is no control group to measure against.

- Interest on Reserves

- With the passage of the Emergency Economic Stabilization Act of 2008, Congress allowed the Fed to pay interest to members with excess reserves held at the Fed. This interest paid on reserves incented banks to hold more funds at the Fed, which is generally an attempt by the Fed to mitigate potential inflationary impacts of its open market operations

- Overnight Reverse Repurchase Agreements

- Transactions in which the trading arm of the Fed sells a security with the agreement to repurchase that same security for a stated price in the future (this is really imputed interest on the transaction). Again, the Fed’s reverse repo operations are meant to “immunize” potential for inflation across the broader economy through the mobilization (bank lending) of excess reserves in the economy as a result of open market operations.

Following the 2008 Financial Crisis, and in addition to the traditional tools outlined above, the Fed offered additional support to the economy by purchasing unlimited amounts of Treasuries and agency mortgage-backed securities (MBS). Then in 2013, the Fed signaled that it would begin backing off on the volume of purchases. The 10-year U.S. Treasury, and longer rates generally, rose approximately 100 basis points (bps) in a matter of months in what is now commonly referred to as the “taper tantrum.”

In 2020, in response to the economic disruptions caused by COVID-19, the Fed again began purchasing large amounts of Treasuries and agency MBS. In the effort not to make the same mistake that sent markets abruptly higher in May of 2013, the Fed has provided ample communication about the future direction of asset purchases and the target for the fed funds rate. Since July of 2021 the Fed has indicated that it would begin scaling back its purchases, though official action will need to be approved by the Federal Open Market Committee (FOMC) at a future meeting.

The FOMC, which holds eight regularly scheduled meetings each year, will meet twice more in 2021, with the next meeting concluding on November 3rd. At that time, they’ll release a statement and press release. The full minutes of the meeting are released three weeks later.

Prior to the FOMC meeting, speculation ensues and markets, for the most part, settle into expectations. Assuming the Fed doesn’t diverge from their previously proposed plan for tapering asset purchases that was largely disclosed in the minutes to the last meeting, the markets are expecting a decision on tapering at either the November or December meeting. In survey results reported in the September minutes, “around half of the respondents viewed December as the most likely timing of the first reduction…although respondents also attached significant probability to the first reduction coming in November.” An abrupt increase in U.S. Treasury yields like that seen in 2013 is viewed as less likely in large part due to the communication and expectation of the tapering plan.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.