Treasury Secretary Janet Yellen spoke at a meeting of the Senate Finance Committee this week and noted that the White House will be revising its outlook for inflation through the rest of the calendar year – which had previously been estimated at 4.7%. Secretary Yellen noted that administration officials now believe inflation will persist through the end of the year and that year-end numbers will be tracking toward 8% annually. This coincided with a report from the World Bank that seemed to echo the Treasury Secretary’s concerns over a prolonged period of pronounced inflation pressures. At the same time, the World Bank also reduced its outlook for global growth, now expected to drop to 2.9% from 5.7%. The combination of sluggish growth and high inflation resembles a similar economic environment from the 1970’s, including wild swings in energy prices.

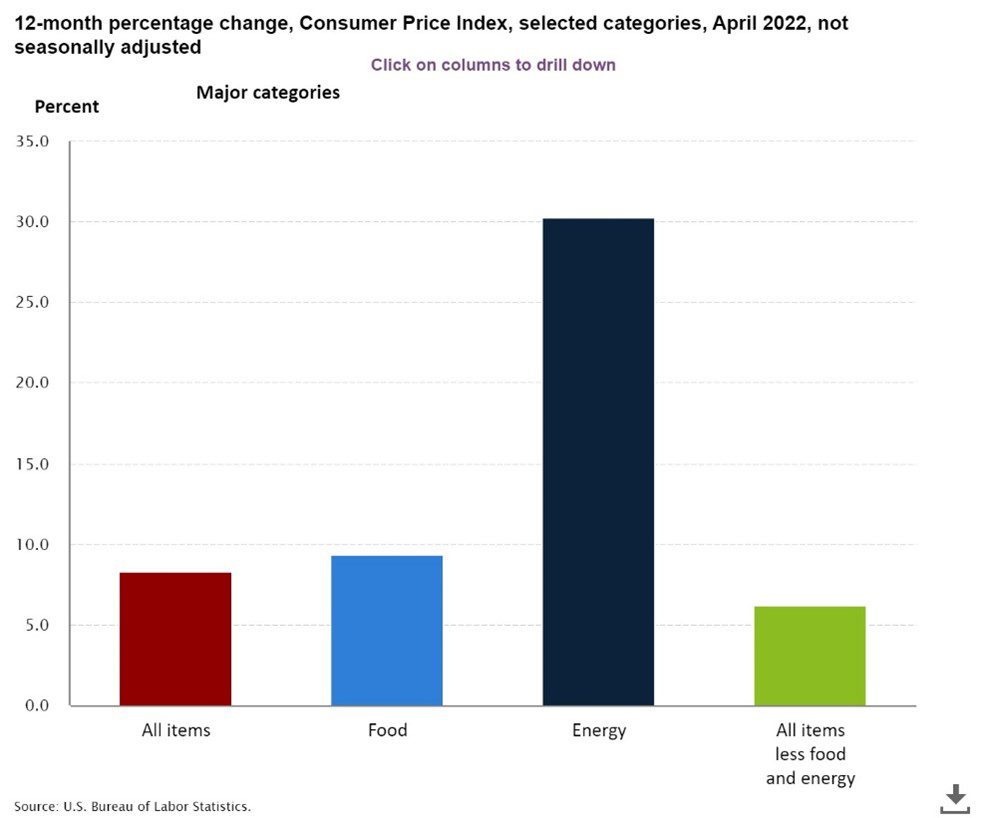

The table below shows the unadjusted 12-month percentage increase in the Consumer Price Index (CPI) split out by certain categories. The difference between the red and green bars represents food and energy prices, which are typically considered the more volatile CPI categories. In other words, the majority of the most recent inflationary pressures are in the food and energy sectors. The latest monthly data from April showed a 12-month increase of 8.3%. May data will be released on Friday, June 10.

Trends in Municipal Bond Yields

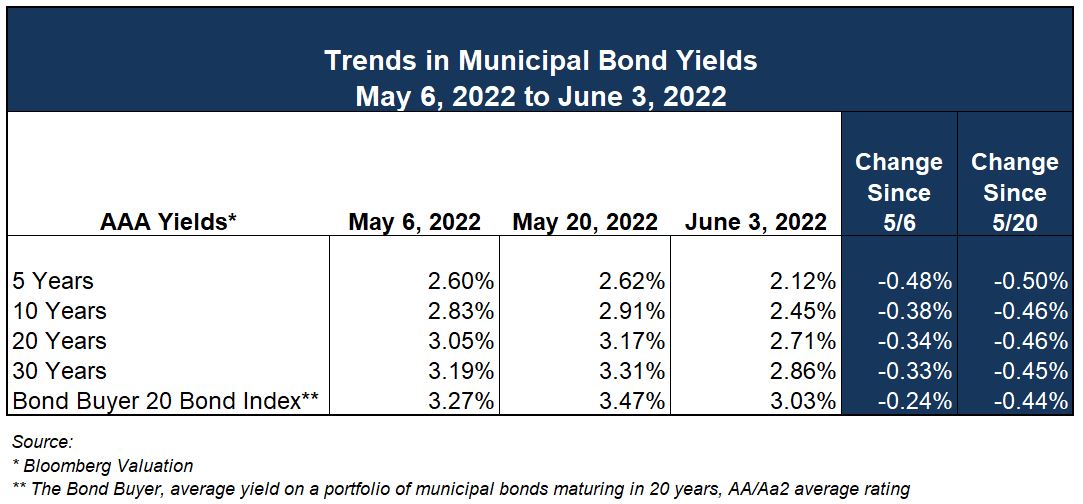

The muni-to-UST ratios as of close of business on June 7 were 67%, 84% and 90% for the 5-, 10-, and 30-year benchmarks, respectively, according to Refinitiv MMD. On April 28, 2022, our Commentary noted that the same benchmarks were at 80%, 91% and 103% – proof of the astounding rally and turnaround in the municipal bond market over the past few weeks. Munis have significantly outperformed treasuries across the curve, but it is especially evident on the short end. The chart below shows the change in Bloomberg Valuation (BVAL), an index of AAA-rated municipal bond yields, since May 20th was a drop of 50 basis points (1 basis point = 0.01%) at 5 years, and a drop of 45 basis points at 30 years. It should be stated yields are up a bit this week from last.

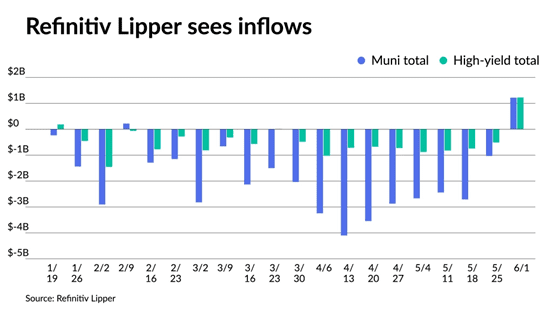

Other proof of the improving municipal market is that investors have begun to pour cash back into municipal bond mutual fund. Refinitiv Lipper reported net inflows of $1.216 billion, diminishing net outflows for the year which now stands at $36.4 so far in 2022. With the significant back-up in yields since the beginning of 2022, this is certainly a sign that investors see value in munis again. Demand may have returned, but caution remains, Barclays’ Mikhail Foux wrote “The market is not out of the woods as of yet.” Just as we may be seeing demand return, concerns arise that issuance in the coming few weeks will add too much supply. Also, high yield borrowers are seeing increased credit spreads, demonstrating some apprehension on the lower end of the credit spectrum.

Notable takeaways from GFOA

The Government Finance Officers Association (GFOA) held its annual conference this week and some of the key takeaways for municipal issues were:

- Prior to its annual conference, the GFOA’s debt committee recommended repealing its current debt practices policy, which could be replaced as soon as next year’s GFOA Conference. Specific policies referenced by the committee included revising their best practices on issuing taxable debt, which has become a significant portion of the municipal debt market as interest rates dropped to historical lows. The committee also made mention of revising best practices related to variable-rate debt.

- One interesting panel at the annual conference was on the topic of recruitment and retention at state and local governments. Specifically, the discussion centered around the mass exodus of people from the municipal workforce – with Covid-19 being one of the major causes. According to MissionSquare research, local governments have seen their workforce decrease by over 4% (596,000 positions) since February 2020. This has led to a 20-year high in unfilled government positions, which is due in part to the challenges of recruiting good candidates to local and state government jobs but has been compounded by many accelerated retirements during the pandemic.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.