U.S. stock markets experienced a mild rally after Congress passed the funding bill on February 14 to avert another government shutdown. The rally lasted until about last Friday, March 1. Since then, major U.S. stock indices have declined somewhat, partly due to concerns about a growing U.S. trade deficit and federal budget deficits.

On March 5, the Census Bureau reported that the U.S. trade deficit grew to $59.8 billion in December – the highest level since October 2008 and higher than what most economists expected. Also on March 5, the Treasury Department announced that the federal budget deficit for the first four months of the federal fiscal year (October 2018 – January 2019) increased by 77 percent over the same period the year before. Primary causes of the increased deficit are increased federal spending and reductions in revenue due to the December 2017 changes in tax law.

Meanwhile, market participants are adjusting to the Federal Reserve’s more “dovish” tone. Instead of expecting more increases in the federal funds target rate in the next year, some traders are now anticipating a possible rate decrease in the next year. This has generally diminished expectations for increasing interest rates more broadly.

A more thorough discussion of the Federal Reserve and its impact on current financial markets follows in our Investments Update.

Muni Yields Steady, Despite Increases in Treasury Yields

As the table below shows, muni yields were almost unchanged from February 15 to March 1. in contrast, yields on U.S. Treasuries and other fixed-rate securities generally increased over the same period. For example, the yield on the 10-year Treasury Note increased from 2.67% on February 15 to 2.76% on March 1.

One of the closely watched indicators in the muni market is the ratio of the yield on a 10-year, AAA-rated muni to the yield on the 10-year Treasury Note. In general, a lower ratio indicates stronger investor demand for munis. The Bond Buyer[1]reported that this ratio reached 78.3% on Friday, March 1, well below the average of 84% for the past year. In fact, there are times in recent years when this ratio has been well above 90%.

Strong demand for munis may be partly due to a supply-demand imbalance. The supply of new muni issues declined dramatically in 2018, in large part due to the prohibition of tax-exempt advance refundings as part of the December 2017 tax reform package and a general dearth in refunding activity, overall. New issue volume is still low compared to the levels of 2017 and other recent years. At the same time, the volume of redemptions of existing munis is relatively high, and investors who were holding those redeemed bonds often reinvest in other tax-exempt munis. Patrick Luby of CreditSights is predicting $11 billion of muni bond redemptions in March through May and another $20 billion in June through August.[2]

Another sign of strong investor demand is net inflows to municipal bond mutual funds. Lipper has reported positive net fund inflows for eight consecutive weeks, with an average of well over $1 billion per week. [3]

At Ehlers, we have seen more direct evidence of this strong demand in recent bond sales we have conducted. Our issuer clients selling bonds competitively have received as many as ten bids on some highly-rated issues, and interest rates have generally been well below our pre-sale estimates.

If you are considering issuing debt, we encourage you to visit with your Ehlers municipal advisor to discuss the latest market conditions and to get your sale scheduled.

[1] The Bond Buyer, March 4, 2019 [2] The Bond Buyer, March 4, 2019 [3] The Bond Buyer, March 1, 2019

Investments Update

Market watchers were understandably focused on Fed Chair Powell’s recent semi-annual monetary policy testimony to Congress. Most summaries of that testimony highlighted his dovish-minded position, emphasizing his view that the Fed will take a patient approach with monetary policy and that the Fed is close to agreeing on a plan to end the balance sheet runoff. Those summaries were on conventional point, yet they all missed an opportunity to highlight the unconventional point that Mr. Powell simultaneously painted a case for the next rate hike. The stock market — and Treasury market for that matter — has latched onto Mr. Powell’s stipulation that the Fed is going to be patient with its approach to policy. For many market participants, being patient means not raising the target range for the fed funds rate again for a long time. In fact, the CME FedWatch Tool shows fed funds futures traders assigning almost no probability to another rate hike this year; moreover, the probability of a rate cut in January 2020 (11.2%) exceeds the probability of a rate hike (6.0%). That is the distant future in the financial markets, yet there is no mistaking the fact that the fed funds futures market is not fearing the Fed. The stock and bond markets aren’t really either.

That’s an important point, because an attitude shift on the interest rate outlook could ultimately drive a material shift in both markets. In other words, there is an inherent risk wrapped up in the complacency regarding the path of policy rates. That’s why it is important to take stock of the rate-hike warning that was wrapped up in Mr. Powell’s testimony when he stated “While we view current economic conditions as healthy and the economic outlook as favorable, over the past few months we have seen some crosscurrents and conflicting signals. Financial markets became more volatile toward year-end, and financial conditions are now less supportive of growth than they were earlier last year. Growth has slowed in some major foreign economies, particularly China and Europe. And uncertainty is elevated around several unresolved government policy issues, including Brexit and ongoing trade negotiations. We will carefully monitor these issues as they evolve.” Although not an explicit warning, a tacit one nonetheless.

Importantly, the Fed still views the economic outlook as favorable. The Fed may still be inclined to raise the target range for the fed funds rate sometime this year more so than it is inclined to lower the target range for the fed funds rate. Recall that less than three months ago the median estimate among FOMC members was for two rate hikes in 2019. Everyone will be anxious to see if that median estimate gets dialed back when the Fed releases an updated dot plot following its March 19-20 FOMC meeting.

The Fed has expressed its willingness to be patient with its monetary policy, but if things continue their current course, that patience may be tested, and Fed officials may start using broad strokes again to paint the case for a rate hike that no one sees coming right now.

If interest rates rise it is important not to abandon a laddered maturity approach to your investment portfolio. While maintaining this strategy, consider shortening portfolio weighted average maturity and positioning maturities more frequently. Contact an Ehlers Investment Advisor today for assistance in evaluating your current investments and developing a strategy for consistent and predicable revenue.

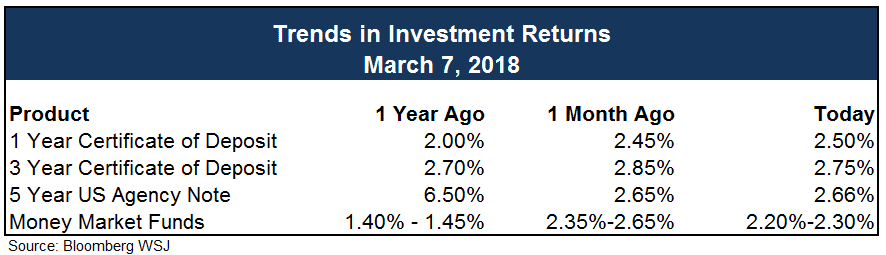

Trend Watch

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.