In the last edition of our Commentary, we stated that the U.S. and China appeared to be inching toward a trade deal. Since then, trade tensions between the world’s two largest economies have increased significantly. On Friday, May 10, the Trump administration raised tariffs on $200 billion of Chinese imports to 25% and stated that further tariffs would be imposed on additional imports. On Monday, May 13, the Chinese government retaliated by imposing tariffs as high as 25% on up to $60 billion of U.S. goods.¹

The rising trade tensions seemed to spook investors, and all three major U.S. stock indices dropped during the week of May 6, and especially on Monday, May 13. As investors retreated to less volatile investments, interest rates declined. On May 15, the yield on the 10-year U.S. Treasury note closed at 2.379%, close to the lowest level since December 2017.

For some, the latest trade tensions have sparked new speculation that the Fed may reduce short-term interest rates.² Persistently low inflation and sluggish economic growth certainly have added to that speculation. As described in more detail in the last section of this Commentary, the Fed Funds Futures market is showing a high likelihood of an increase in the fed funds target rate by December, and no likelihood of a decrease in the target rate. This is a dramatic departure from the mood of the last three to four years, during which the Fed has increased the target rate nine times.

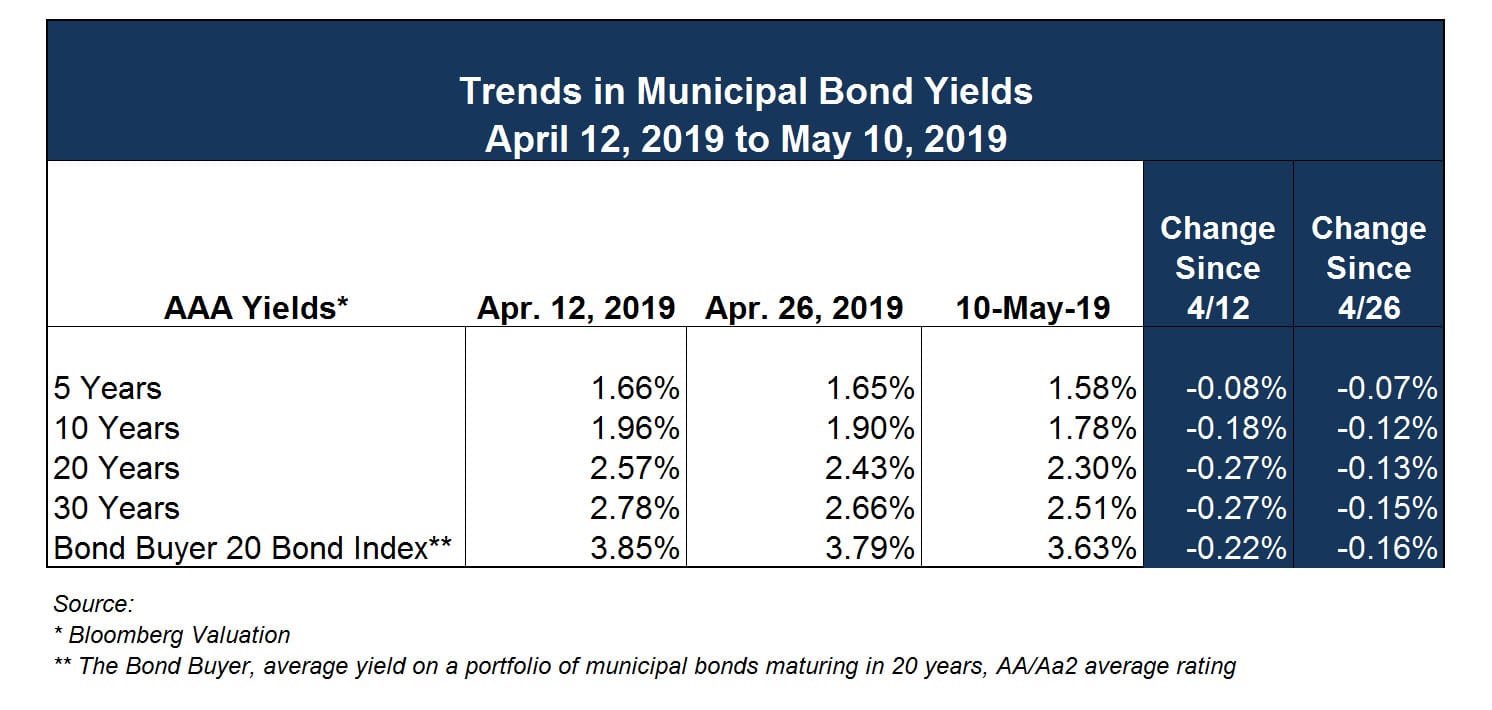

Muni Bond Yields Continue to Decline

We may sound like a broken record (or a defective song download) on this topic: Muni yields have decreased significantly since October of 2018, and that trend certainly continued over the past two weeks. As shown in the table below, yields on AAA-rated muni bonds (as reported by Bloomberg Valuation), declined by 7 to 15 basis points (1 basis point = 0.01%) during the two weeks ending May 10, and by 8 to 27 basis points in the four weeks ending May 10.

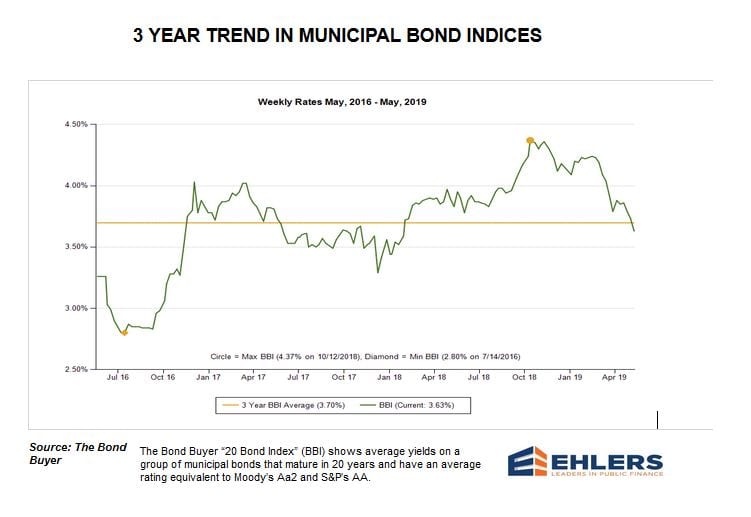

The graph below shows the longer-term trend in the Bond Buyer Index, which shows the average yield on munis rated Aa/Aa2 maturing in 20 years. The index is measured weekly. When it was set last Thursday, May 9, it was at 3.63%, which is the lowest level since January of 2018. Muni yields have decreased since May 9, so we expect the index to be even lower by the end of this week.

¹ Yahoo Finance, May 13, 2019 ² The Bond Buyer. March 10, 2019, “Why China Tensions May Prompt the Fed to Cut Rates”

In previous editions of this Commentary, we have reviewed some of the primary reasons behind declining muni yields, and those reasons continue. General economic conditions certainly contribute to declining yields; yields on other fixed-rate investments (e.g., U.S. Treasuries and corporate bonds) have also declined over this period. But muni yields have declined more than Treasury yields. On May 10, the 10 year “muni/Treasury” ratio (the ratio of the yield on a 10-year, AAA- rated muni to the 10-year Treasury note) stood at 71.1%, a level that some analysts have called “stunning.” The same ratio was at 90.0% in May of 2017 and has often been even higher.

There are two principal factors that continue to cause tax-exempt munis to “outperform” treasuries and other forms of bonds. The first is a combination of strong demand and limited supply of new muni bonds since the federal tax reform approved in December of 2017. That was exacerbated this month by $19.4 billion of muni bond redemptions on May 1.³ Many of the investors who owned those bonds will want to invest the redemption proceeds they received in other tax-exempt bonds. The second factor is the increased value of tax-exempt income for high-income earners due to the 2017 federal tax reform. Kim Olson of FTN Financial³ commented that, even with these low muni yields, the tax-equivalent yield of a 10-year muni for high-income individuals is still 0.75% to 1.00% higher than the yield on a 10-year Treasury.

³The Bond Buyer, May 13, 2019

The bottom line for state and local governments is that this is an excellent time to borrow money due to historically low rates. We expect that trend to continue for at least several months. If you are considering issuing bonds or other forms of debt, we encourage you to contact your Ehlers municipal advisor to discuss your plans.

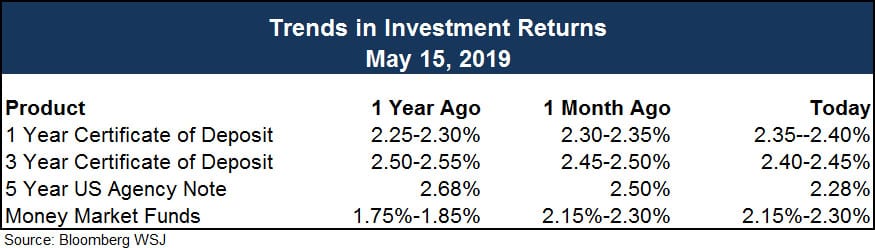

Investment Trends

It was a mixed week for the slope of the Treasury yield curve. The spread between 2- and 10-year Treasuries widened by a basis point to 22 bps and the spread between 2- and 30-year Treasuries widened by two basis points to 63 bps. This “steepening” occurred due to shorter-term yields declining more than longer-term yields. However, if we look at the shortest part of the curve, the spread between the three-month bill and the 10-year note tightened by nine basis points to just one basis points (As of May 14 the 3-month treasury bill yielded 2.41% while the 10-year treasury yielded 2.42%). These rate movements took place as the market grew anxious about the deterioration in U.S.- China trade talks.

Rate cut expectations began inching higher again, even though Fed Chairman Jay Powell said during his post-Federal Open Market Committee press conference that the Committee does not see the need to move the fed funds rate range in either direction at this time. The implied likelihood of a quarter-point rate cut in October increased to 55.0% from 41.9% two weeks ago. The fed funds futures market sees a 70.9% likelihood of a quarter-point rate cut in December, up from 57.4% two weeks ago while odds of a quarter-point cut in January 2020 increased to 73.9% from 62.1%.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.