Market Overview

Market participants are keeping a watchful eye on economic indicators, searching for any data or trends that may compel them to shift expectations for growth and inflation, all of which play into views on the timing and magnitude of the Fed potentially tapering its bond purchases.

Federal Open Market Committee (FOMC) members, both voting and non-voting, have provided some visibility into their respective thoughts on the possibility of reducing the Fed’s monthly asset purchases. Chair Powell has given explicit guidance that the Fed and FOMC will clearly communicate their intent upon the conclusion of each policy meeting. However, minutes from recent meetings and Powell’s policy comments have largely revolved around “discussing about discussing” the matter in future meetings. Recent reports of economic data have been considered to be generally positive, market observers have by and large had a point of view that the Fed will gradually reduce (or “taper”) its monthly bond purchases this calendar year, perhaps even as early as this Fall. Fed officials are also on record as stating that any future actions are data-dependent, meaning things like deteriorating employment, economic, or other data may result in a delay of any tapering.

With respect to anecdotal data on economic activity, Q2 Corporate earnings reports have been strong so far, pushing the idea that growth has not been immediately sapped by the emergence of the Delta variant across the country. One area of potential concern, aside from some recent labor and sentiment data, is home sales and construction activity, which data suggest both may be “cooling” from their record highs earlier this summer. With higher construction costs, and less than ample land ready to build on, there is a concern that the supply/demand dynamic may be materially shifting as people stop looking and settle in for the fall/winter. This may put downward pressure on labor numbers and price increases of existing housing stock, but it remains to be seen, as these trends take meaningful time to unfold. When this sort of information is put in context with inflation measures and recent uninspiring consumer sentiment reports, the level of uncertainty has increased marginally.

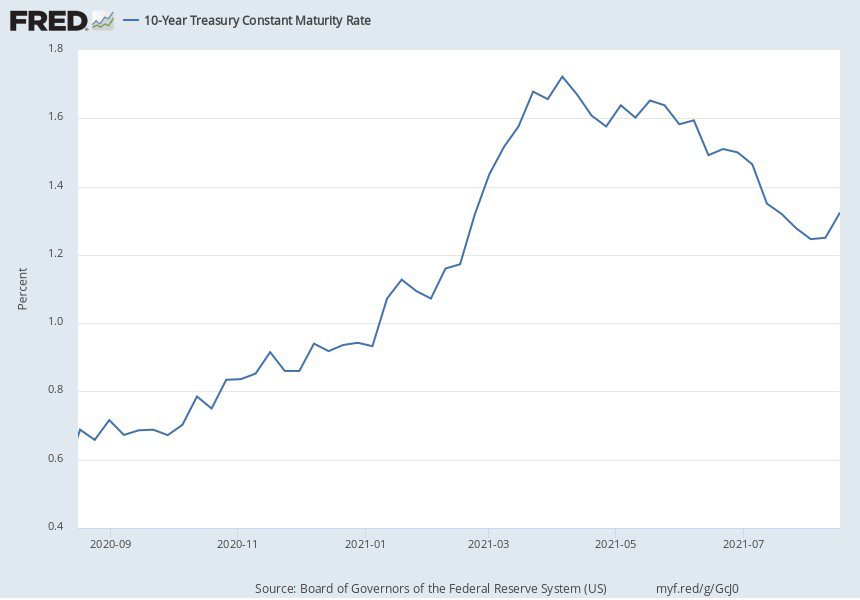

Treasury Yield Trend

Treasury yields have declined from their recent highs. The benchmark 10-year U.S. Treasury was yielding 1.26% at the end of the day Monday, August 16. Down around 10 basis points (1 basis point = 0.01%) from highs of the week prior.

Shadow of 2013?

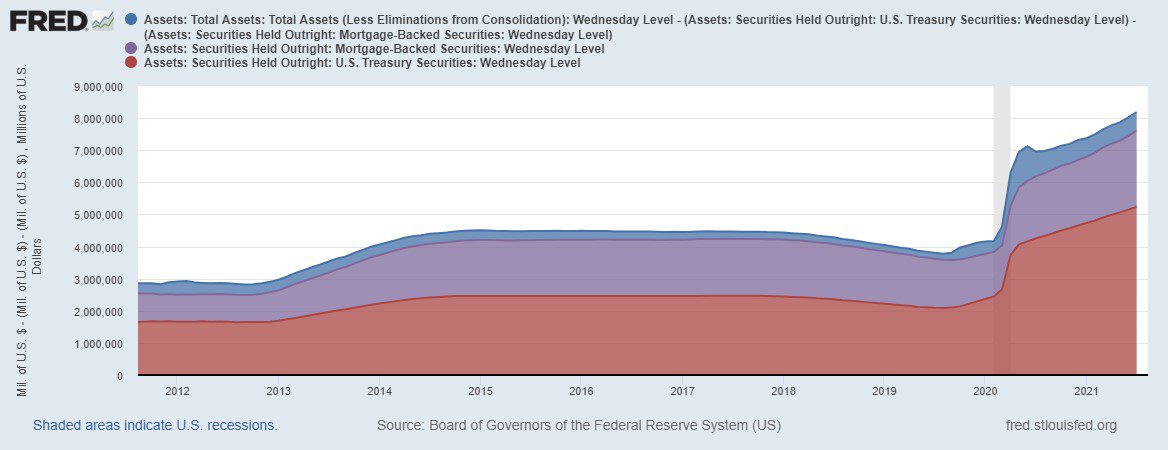

The Federal Reserve originally initiated an asset purchase program during the Great Recession. In response to the 2008 economic collapse, the Federal Reserve began a program of purchasing government bonds and other securities as a form of stimulus and interest rate control, often referred to as Quantitative Easing (QE). As the Fed purchases bonds, this injects reserves into the banking system, increasing the money supply, as well as increasing the prices of bonds due to the additional demand. Rates move inversely to bond prices, so the purchases tend to push down rates, all else equal. This was a novel concept at the time in response to the usual policy tool of the fed funds rate being reduced to the zero bound – negative overnight rates weren’t a “thing” at that time. This same policy has continued through today in response to the Covid-19 pandemic, with the Fed purchasing at least $80 billion of U.S. Treasuries and agency mortgage-backed securities each month. Whether or not these monetary policy measures actually stimulate economic activity and growth, can’t truly be known, as there is no control group to simulate against. It’s effect on interest rates, generally, cannot be argued though. The Fed returns a large proportion of the interest earned on its bond portfolio to the U.S. Treasury each year. The Fed presently tries to “neutralize” the potential for inflation by “borrowing” dollars from financial institutions under what is called a reverse repo program.

Market participants are always searching through historical precedent to find analogs to today’s circumstances, so they might forecast what may come. Similar to the present environment, as the economy more fully recovered from the Great Recession in 2013 the discussion at Fed meetings turned to the timing and magnitude of removing some or all of its QE efforts, a process referred to as tapering.

In May of 2013, then Fed Chair Ben Bernanke announced to the Congressional Joint Economic Committee that if economic data continued to show stability, the Fed would begin the tapering process over the course of the next few policy meetings. The markets’ collective reactions to this announcement sent bond yields abruptly higher and equities precipitously lower, in what became known as a “taper tantrum.” Essentially, the markets like cheap money, and when you take it away unexpectedly, folks get twitchy. This ultimately led to the Fed clarifying that any decisions around tapering were not yet made and would be based purely on economic indicators. Forward guidance become another important arrow in the Fed’s policy quiver.

As the current Fed Board contemplates a similar decision and its communication process on how and when to dial back stimulative monetary policies, it has been clear they don’t want to make the same mistakes and are very sensitive to the communication surrounding their decisions.

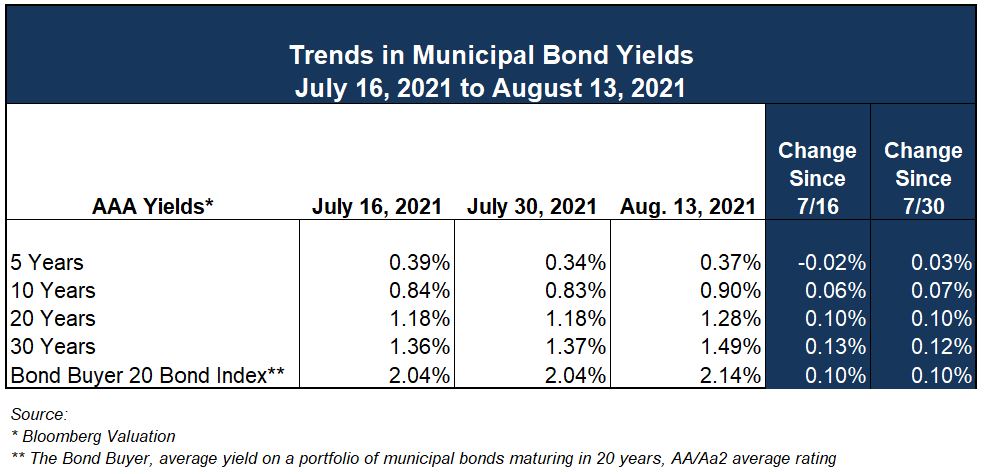

Trends in Municipal Yields

Stability has been the tone in the municipal market. Intermediate and long-term municipal bond yields were up about 10 basis points at the end of last week, in concert with comparable Treasury yields. According to Refinitiv MMD, the 10-year muni-to-Treasury ratio was at 70.1%, roughly unchanged from 2 weeks prior. Treasuries continue the trend of outperforming munis into this week, as those low ratios limit the attractiveness of tax-exempt vs. taxable yields.

Taxable municipal bond issuance accounted for 27% of new issue supply in July, the highest level since February, as lower interest rates made taxable advance refundings more popular. If your community has existing debt that may not yet be callable, but carries a relatively high interest rate, it is certainly worth considering a taxable advance refunding, as well as other refunding alternatives. Reach out to a member of the Ehlers team to learn more about your options and how to thoughtfully evaluate them.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.