Where Were We A Year Ago?

“No one knows with any certainty where the economy will be a year or more from now,” stated Fed Chair Jerome Powell in December 2021 press conference. He was right about that.

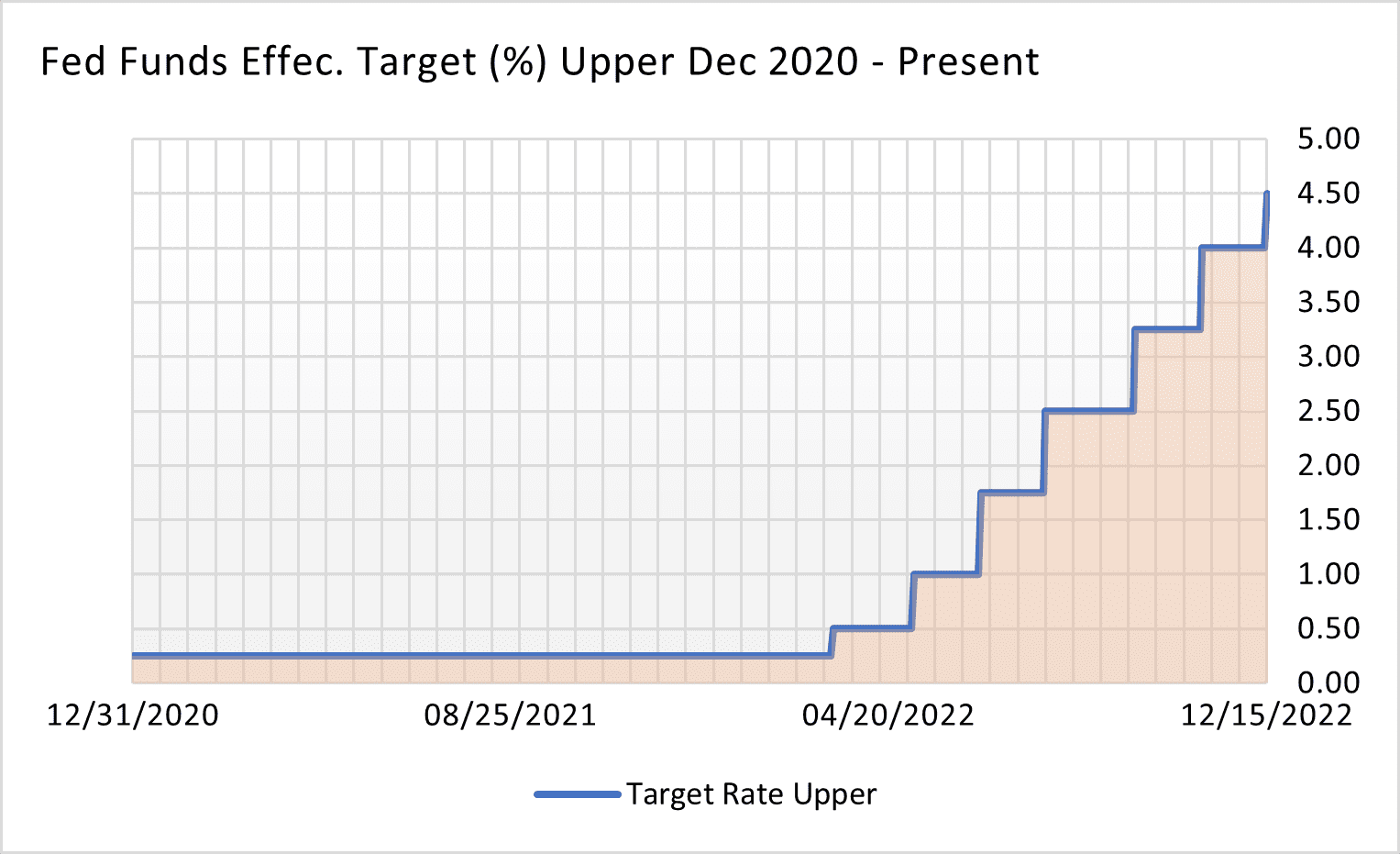

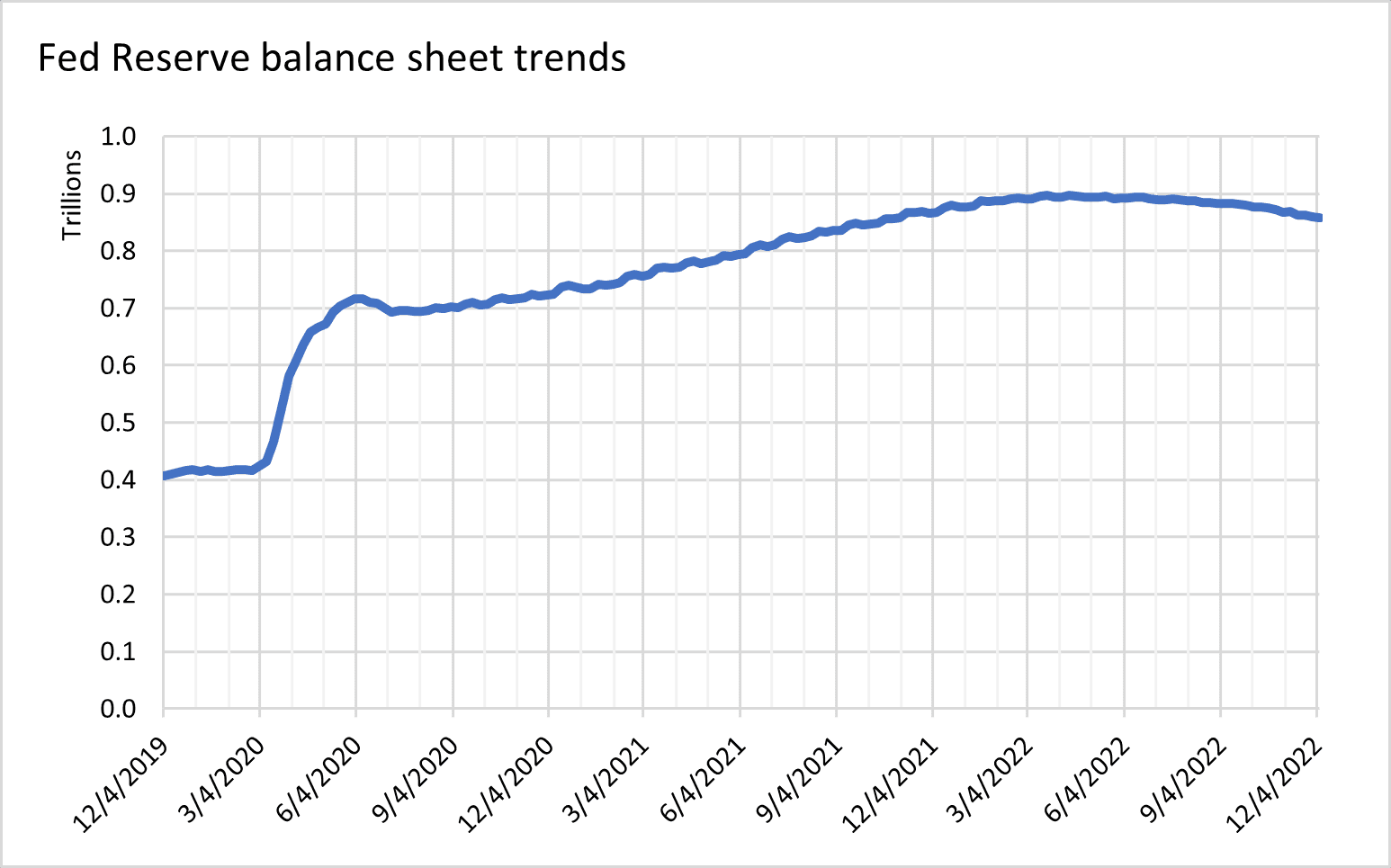

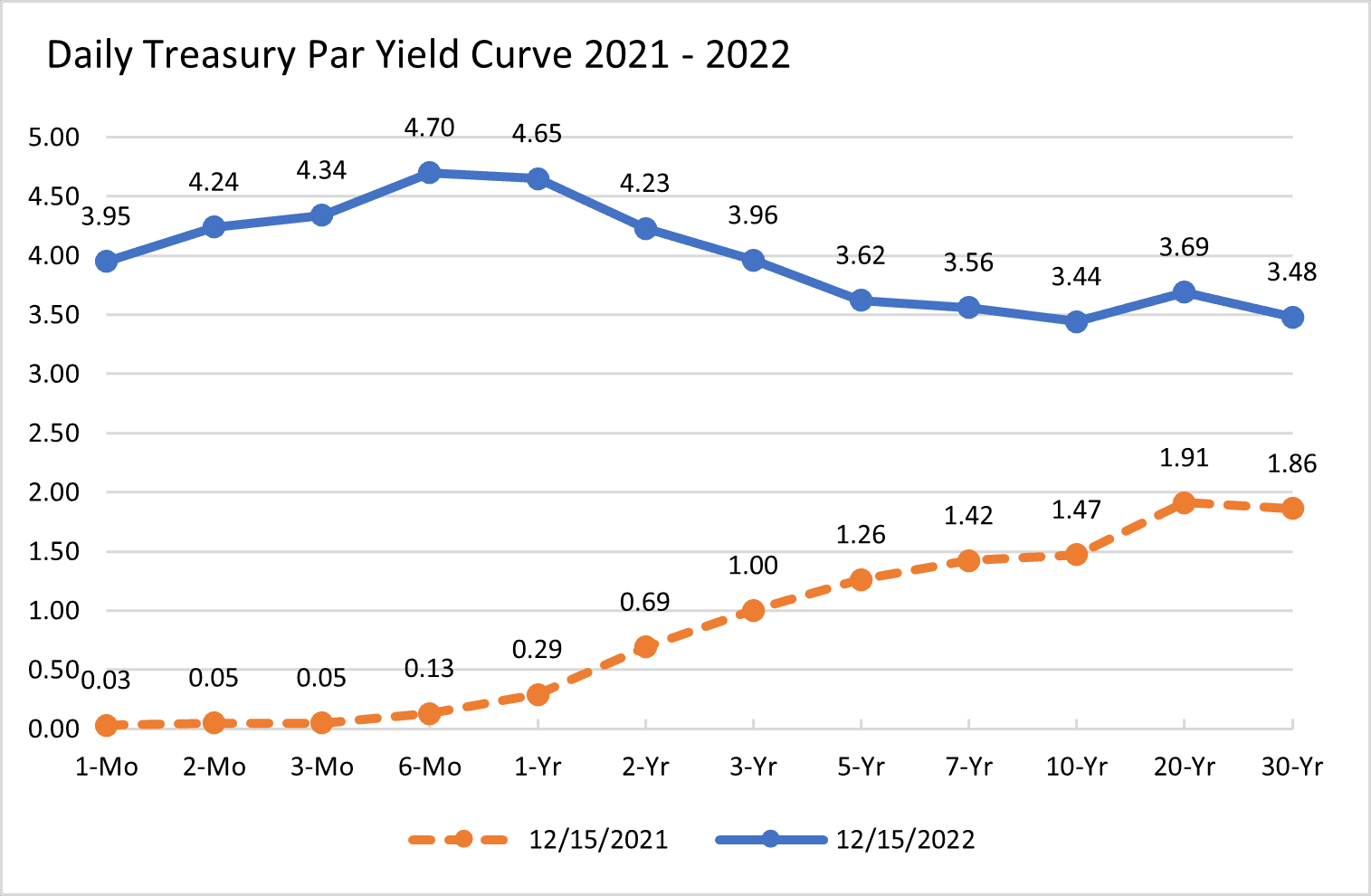

To say a lot has changed in the bond market this year would be a major understatement…changes that can largely be attributed to the actions taken by the Federal Reserve to combat persistent inflation. As of December 2021, the effective federal (fed) funds rate was only 0.08% (8 bps), the same as it was in April 2020. Since then, we have seen seven rate hikes attempting to stem stubborn inflationary pressures, resulting in a current effective rate of 4.33%. Additionally, the Federal Reserve has been shrinking its balance sheet by not reinvesting when it receives cash flows from its massive bond portfolio (quantitative tightening) since mid-2022 to regain price stability.

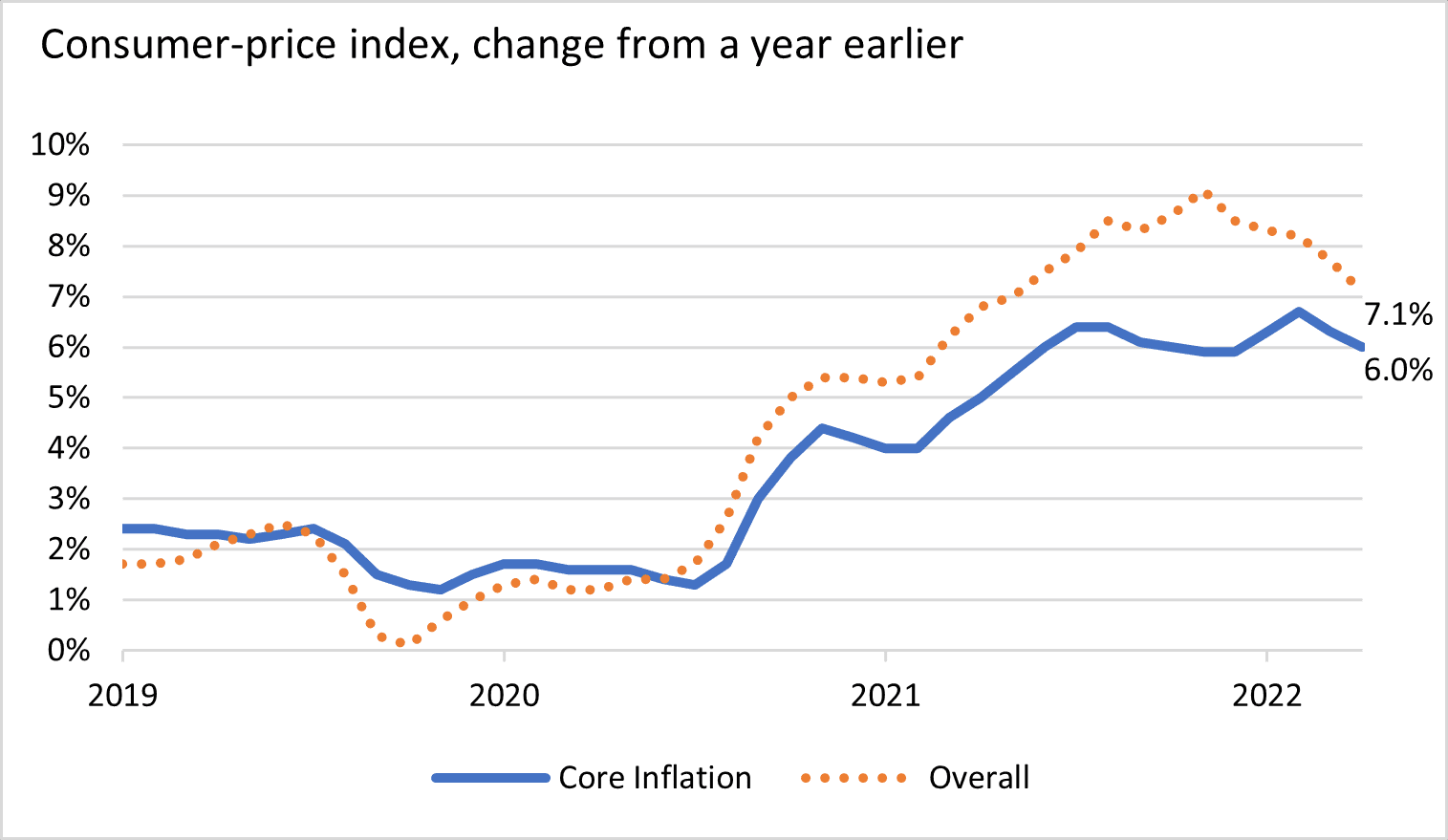

One year ago, the COVID variant Omicron still posed a threat to economic conditions and Fed members were growing increasingly wary of longer-term inflation. Chair Powell and other economists saw merit to the viewpoint of “temporary or transitory” inflation as late as Fall of 2021. In the municipal markets specifically, mutual fund redemptions and reduced demand from investors compounded the effects Federal Reserve tightening last Spring and Summer, resulting in higher borrowing costs across the board.

Where we are now?

The most recent release of the Consumer Price Index rising only 0.10% month-over-month is encouraging news. For municipalities as with most other entities, rising rates have meant greater borrowing costs on new issuances. Conversely, rising rates have increased interest earnings from investing cash and bond proceeds strategically. An inverted yield curve presents opportunities for shorter-term investing while maintaining greater levels of liquidity. Taming inflationary pressures should result in controlling project construction and building materials costs (although problems with supply and delivery remain a challenge).

Further encouraging news is the record levels of surplus for many states as legislators convene in the next calendar year to establish budgets. Priorities expressed in Minnesota for the 2024-25 biennial budget are education spending, tax relief, and a bonding package for capital projects. The state was also upgraded by Moody’s in July, now having three major rating agencies giving it triple-A status. In Wisconsin, revenue projections have improved since June to a record $6.6 billion. The state also boasts a AAA from Kroll and Aa1 and AA-plus from fitch and S&P, respectively. These strong ratings for both states will reduce borrowing costs over the long term, which benefits generally flow down to local units of government and taxpayers.

Where are we going in 2023?

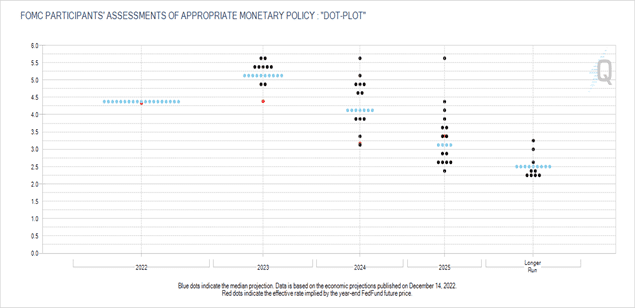

“I don’t think anyone knows whether we’re going to have a recession or not,” stated Powell, “and if we do, whether it’s going to be a deep one or not, it’s just, it’s not knowable.” The so-called ‘soft-landing’ whereby inflation is tamed without the broader economy falling into recession is still possible. It will be important for municipalities to prudently deploy resources to ensure long-term stability as we exit the greatest monetary policy experiment in human history. As of now, the prognostications by members of the Federal Open Market Committee (FOMC – the monetary policy body of the Federal Reserve) infer that the fed funds rate will increase another 1.00% in 2023, but this is based on current conditions and as we have seen in 2022. Further, these projections haven’t proved to be highly reliable over time. Abrupt monetary policy pivots can – and have been known to – happen.

Beginning on Friday, January 6, 2022, Ehlers will publish a weekly market commentary right here! We’ll send out a link each Friday via LinkedIn so be sure to follow us. You can always find the Market Commentary on our home page.