In mid-December, the Federal Reserve’s Federal Open Market Committee (FOMC) met and made the decision to end its asset purchase program more rapidly than originally announced. Prior to December, the stated plan had been to begin tapering asset purchases (U.S. Treasuries and agency mortgage-backed securities) in January with the expectation to wrap up the program entirely by summer of 2022. At that time the FOMC would then potentially turn to increases in the target range for the fed funds rate. The FOMC voted unanimously at the December meeting to end the program by March. Though the FOMC didn’t provide specific guidance on the anticipated timeline for increases to the fed funds rate other than consistently communicating it would only come after the end of the asset purchase program, the expectation is that one to three rate increases can be anticipated prior to the end of 2022. Fed funds futures pricing currently indicates a 75% chance of three quarter-point rate increases by the end of the calendar year. The FOMC has always specified that any future increases to the fed funds rate are entirely data dependent.

The minutes of the December FOMC meeting, released on January 5th, offered more specifics. The first increase to the federal funds target rate could come as soon as the FOMC’s second policy meeting of the year, scheduled for mid-March. The minutes also revealed that the members discussed the idea of shrinking the Fed’s balance sheet, in addition to increasing the target rate, in order to address inflation. The size of the Fed’s balance sheet is maintained when it purchases securities in an amount equal to those maturing and can be reduced by purchasing less in securities than the amount of securities maturing, or even outright sales of its holdings (sales would be highly unlikely).

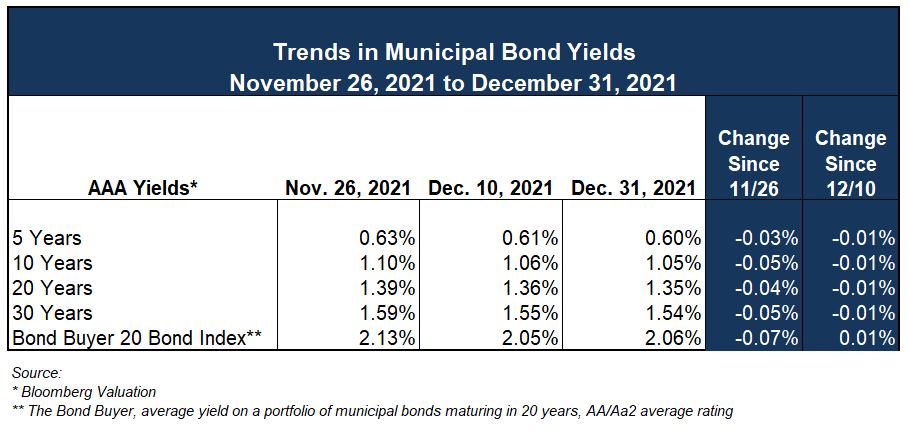

Between the mid-December FOMC meeting and the release of the minutes from that meeting that further detailed the collective desire to accelerate tightening of monetary policy, U.S. Treasuries (UST) experienced some volatility with a trend of increasing yields across the maturity spectrum while municipal bond yields held relatively steady. Prior to the onset of the pandemic, there was a predictable relationship between U.S. Treasury yields and municipal bond yields. Since that time, however, the two paths have diverged. The Bond Buyer reports that the 10-year UST closed 2021 at 1.51% and was up 12 basis points (1 basis point = 0.01%) on the first trading day of January – the single largest daily increase in three years in that benchmark. The 10-year Treasury note currently yields about 1.75%. Movement in muni bonds was muted and, according to Bloomberg, the 10-year AAA yield was down 5 basis points since the last week in November.

The relationship between treasury yields and municipal bond yields is represented by the Muni-to-Treasury ratio. For the past month, change in that ratio was driven mainly by upward movement in Treasury yields. Refinitiv reports the 10-year Muni-to-UST ratio at 63%, while ICE Data Services had the ratio at 65%, down from approximately 70% as of our last Market Commentary.

2021 Stock Market Wrap Up and Response to the Release of Fed Minutes

Broad U.S stock market indices were all higher for the month of December, rallying through the end of 2021, with the three major U.S. stock indices increasing between 3% to 7%. The Dow Jones Industrial Average and the S&P 500 reached record highs at the start of 2022 and Apple was the first company to reach the $3 trillion mark in market value. Even with uncertainties associated with the pandemic and speculation that Omicron could continue to put a drag on the supply chain, further major disruptions are not widely anticipated at this point due to the less severe nature of the variant, despite being highly contagious.

Following the release of the FOMC minutes this week, significant declines in the stock market ensued. Market participants digested the news of the mid-December meeting and fully anticipated a response to rising inflation. The surprise in the details of the minutes, at least according to the markets, appears to be the faster than expected timeline and the additional notion of potentially reducing the Fed’s balance sheet at some point in the future. The rapid rise in bonds yields this week also took its toll on some more speculative stocks and risk assets.

Municipal Issuance and the January Effect

In 2021, total municipal bond issuance was a remarkable $475.3 billion, though down from the total issuance in 2020, which was a record year. Breaking down the market further into the components of municipal issuance, new money borrowing was up, while refundings were down. Tax-exempt issuance increased year-over-year, while taxable issuance declined.

The spread between taxable and tax-exempt yields was narrower in 2020 than in most of 2021. Increases in taxable yields outpaced increases in tax exempt yields, which played a role in the decrease in taxable issues, notably taxable advance refundings, between calendar year 2020 and 2021. This is in direct correlation to the dynamic of very low ratios of tax-exempt yields to comparable taxable Treasury yields. Also, with that widening spread and the continuation of very low yields on the short end of the interest rate curve, forward purchases to achieve tax-exempt current refundings grew in popularity and total volume, both in the public and private markets.

The first quarter of the calendar year represents a period with large amounts of scheduled principal payments and optional redemptions for municipal bonds. This puts cash into the hands of investors looking to reinvest those dollars. Therefore, the supply and demand imbalance can be highly pronounced this time of year, with the benefit accruing to municipal issuers. Many market watchers and prognosticators believe this dynamic will manifest again this year.

We look forward to partnering with you on your capital financing plans for 2022. Here’s to a great New Year for all our readers!

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.