In normal times, bond markets are typically quieter during the summer months – new issuance slows, investors step away from their desks, and monetary policy makers pause. However, this past summer was like no other. Per The Bond Buyer, year-to-date gross issuance stands at $311 billion, almost 28% higher than the same period last year, primarily due to taxable issuance (up 264% from last year’s levels). As we reported in our prior Market Commentary, issuance has spiked in recent months as municipal borrowers take advantage of low rates to reduce their interest expense. It also appears investors have become more comfortable with credit fundamentals despite predicted declines in state and local government revenues and delays in additional monetary stimulus from the federal government.

All in all, markets have been walking a fine line with a still-struggling economy on one side and optimism for a COVID-19 vaccine breakthrough on the other. Heading into the fourth quarter, there are both encouraging signs and cause for caution.

Some Good News – Getting Back to Normal

Since we’re about six months from the point where Covid-19 turned the world upside down, it makes sense to take a look at where we’ve been and what may lie ahead for the municipal market. To recap the past six months:

- Employers have started to rehire workers (as evidenced by the declining number of those applying for unemployment benefits) and layoff announcements have tempered, but the number of permanent job losses has increased.

- Productivity (one of the main drivers behind GDP) appears to have increased, aided by a general shift to working remotely, which could be a positive for corporate profit margins and possibly the stock market.

- GDP, down by over 31% in the second quarter (measured on an annualized basis), is expected to rebound by over 30% in the third quarter, per the Atlanta Federal Reserve Bank’s GDPNow September 10 forecast.[1]

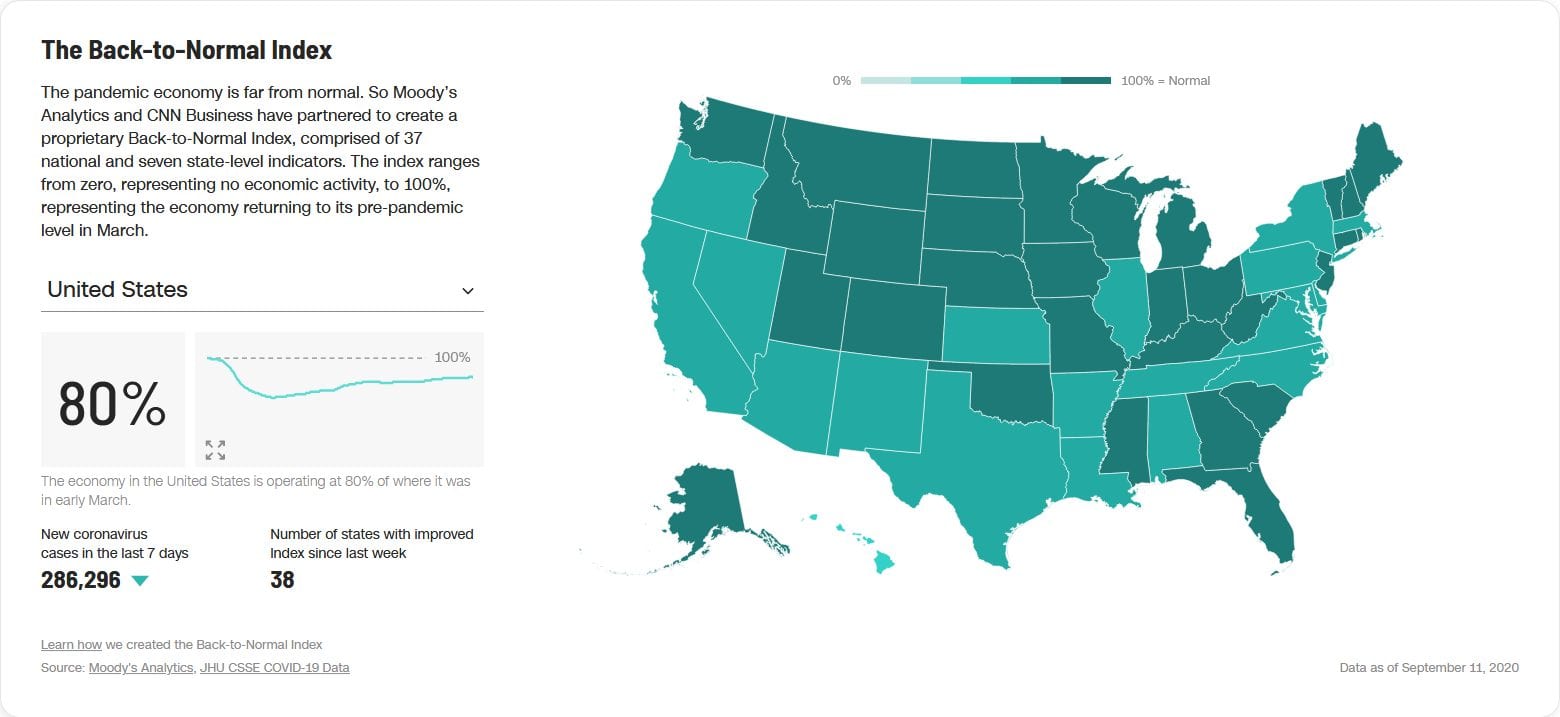

The good news is that it seems things are starting to get back to normal. On that point, it is worth taking a look at CNN Business and Moody’s Analytics’ chief economist’s “Back-To-Normal” index, which is meant to gauge how far the nation as a whole and individual states are from their pre-pandemic levels. The index is comprised of 37 indicators, ranging from traditional data points like retail sales and housing starts to non-traditional statistics like OpenTable restaurant bookings and Google mobility data.

The graphic below demonstrates that as of September 11th, the index stood at about 80% for the nation, a significant improvement from its nadir of 59% on April 17th.[2] As one might expect, Hawaii’s tourism-dependent economy has the longest road back to normal because no one is traveling right now and visitors to the state are subject to a 14-day quarantine. Perhaps not surprisingly, the less urbanized farm belt and northern Rocky Mountain economies are faring the best; Maine currently has the highest index in the country at 93%. As for Ehlers’ regional markets (as of September 11th), Colorado stands at 82%; Minnesota at 85%; Wisconsin at 86%; Kansas at 80%; and Illinois at 75%.

Looking to the 2020 Election

As we are less than two months out from the 2020 Elections, it’s time to start thinking about how the outcome could affect the municipal market. Budgetary pressures and shifting political stances could mean higher income taxes at both the state and local level, which would generally bolster demand for tax-exempt municipal bonds. Case in point, California is already considering higher income taxes and potentially even a wealth tax to close the state’s budget deficit.

At the federal level, the potential for Democratic control of both the White House and Congress significantly increases the likelihood for higher personal and corporate income tax rates, which could spur demand for tax-exempt munis from banks and insurance companies – reversing the trend seen since tax rates were lowered as part of the 2017 Tax Cuts and Jobs Act. Additionally, a Democratic administration will likely attempt to implement an infrastructure plan, which may increase bond issuance and increase yields. But if something like the Build America Bond (BAB) program is launched, it could mean more taxable municipal bonds instead. Conversely, if a Republican president prevails, it is more likely that income tax rates will stay at or near current rates (at least in the near term) given the fact the U.S. deficit is growing.

In sum, it seems regardless of who wins the 2020 Election, rates continue to be at or near historic lows, thus making it a good time to lock in those interest savings and/or to finance new projects. A word of caution though – as we move closer to the November election, the markets may become more volatile and we may see a disjointed market for some time after November 3rd, particularly if we end up in another situation where the winner isn’t known until December. As such, vigilant monitoring of yields and new issue volume may be necessary when seeking to tap the capital markets these next few months.

Municipal Bond Trends

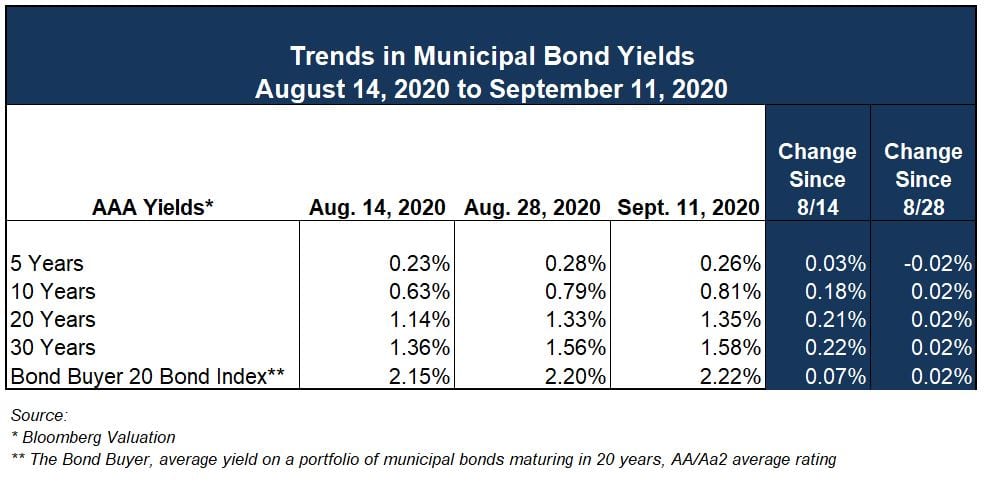

Municipal bond yields are steady week over week, but the interest rate curve is starting to steepen and yields are creeping up in the intermediate and long end of the curve. As of September 11, AAA yields at 10-years stand at 0.81% and 1.58% at 30-years, approximately 121% and 110% of their Treasury equivalents, respectively. Municipal bond demand remains steady as inflows for muni bond funds continue for the 18th consecutive week at $1 billion v. $139 million the previous week.

That said, with the Fed announcing this week they expect to keep the fed funds rate at or near 0% through 2023 and depending on who wins the White House (and what party takes control of Congress), we could see low borrowing rates (relative to historical levels) for the near future.

[1] https://www.frbatlanta.org/cqer/research/gdpnow

[2] https://www.cnn.com/business/us-economic-recovery-coronavirus

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.