Last week’s Fourth of July holiday week was headlined by June’s better-than-expected employment report. The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls increased 224,000 in June, surpassing projections of 160,000. However, employment growth has averaged 172,000 per month so far this year as compared to 223,000 in 2018. ¹ As such, the unemployment rate increased modestly 3.6% to 3.7%.

Elsewhere, the Institute for Supply Management released its manufacturing and non-manufacturing Purchasing Managers Indexes (PMI)² for June. The manufacturing index declined modestly to 51.7% from the prior month’s 52.1%.³ Similarly, the non-manufacturing index fell to 55.1% from 56.9% in May. Both readings were consistent with market expectations – meaning, June was the third straight month with slowing PMI expansion (any reading above 50 indicates growth). More importantly though, the PMI simply indicated soft economy growth, not a decline as many had feared. Even so, Federal Reserve Chairman Jerome Powell, at his semi-annual monetary policy report to Congress yesterday (Wednesday, July 10th), indicated that an interest rate cut is under consideration at the end of July.

One would have thought, based on the minutes from the prior FOMC meeting, that the Fed was not in a rush to cut rates. In fact, Chairman Powell has previously stated several times that they will “act as appropriate” to maintain the economic expansion without indicating a timeframe for any possible rate cuts. One voter – Federal Reserve Bank of St. Louis President, James Bullard – went on the record in favor of a 25 basis point (bps) cut at the last FOMC meeting, but most Fed officials have stated that they would want to see some hard evidence that the economy is materially worsening, e.g. weaker than expected jobs report or significant declines in PMI and other forward-looking indicators. According to the Fed, there are still risks that something could derail the U.S. economy later this year (hence the openness to rate cuts), but so far it appears to be slowing but otherwise doing okay.

At his address to Congress though, Powell indicated that the U.S. economy is doing “reasonably well” but that business investment has “slowed notably” and “uncertainties about the [global economic] outlook have increased in recent months.” In short, while he did not explicitly say an interest rate cut is coming, he pointed to growing economic concerns and made no effort to walk back the market already pricing in a July rate cut. Moreover, his comments come despite last week’s strong U.S. jobs report and an easing of trade tensions with China, which had led some market analysts to believe a rate cut at the end of July was not likely.

Looking forward, this week’s economic calendar will be dominated by readings on inflation. BLS is scheduled to release the June Consumer Price Index (CPI) today (Thursday, July 11th) and the Producer Price Index (PPI) on Friday, with most market pundits expecting June CPI to increase by 0.2% over May and that PPI will remain unchanged.

Beyond the inflation readings, the economic data calendar is very light with the National Federation of Independent Business Small Business Optimism Index for June and the BLS Job Openings and Labor Turnover reading for May released on Tuesday, and minutes from the June 19, 2019 FOMC meeting released yesterday, so we should learn more about discussions regarding possible future rate cut(s), any softening in the Fed’s economic forecast, and the Fed’s approach to their 2.0% inflation target.

¹ https://www.bls.gov/news.release/empsit.nr0.htm

² For background, the Purchasing Managers Index (PMI) is a forward-looking economic indicator consisting of a monthly survey of supply chain managers across 19 industries.

³ https://www.instituteforsupplymanagement.org/ISMReport/MfgROB.cfm?SSO=1

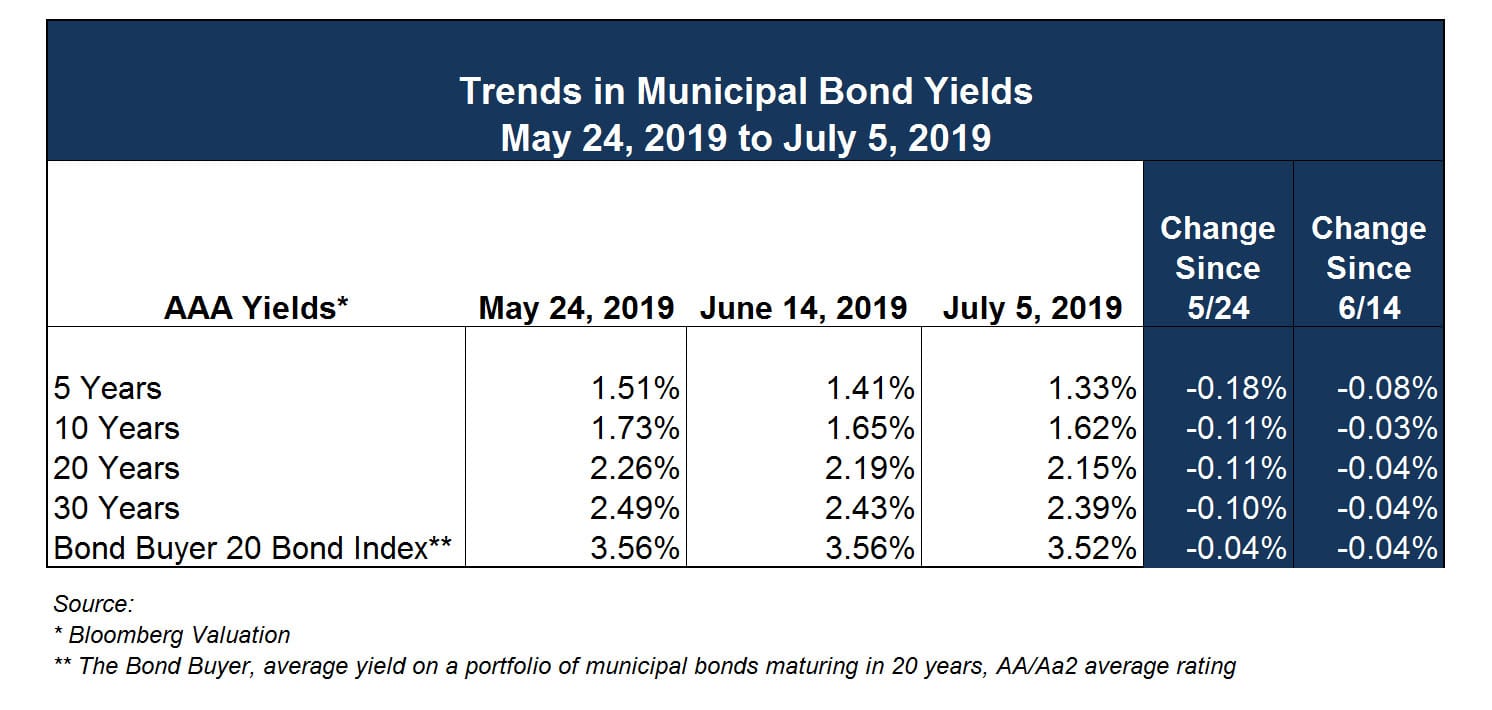

For the Numbers…Trends in Municipal Bond Yields

As we have previously written, the muni bond market has been on a tear so far this year largely because of increased investor demand and decreased supply. This trend has continued through last week with yields falling even further. If the Fed cuts interest rates in July (as the FedWatch indicates and as Chairman Powell has implied), investors will probably continue to chase tax-exempt income from municipal bonds and may push yields even lower. However, if legislation to restore tax-exempt advanced-refunding bonds succeeds or Congress manages to pass an infrastructure funding bill, municipal bond supply may increase, also possibly affecting yields. Nonetheless, yields are at historic lows, making it an excellent time to issue debt.

Investment Trends

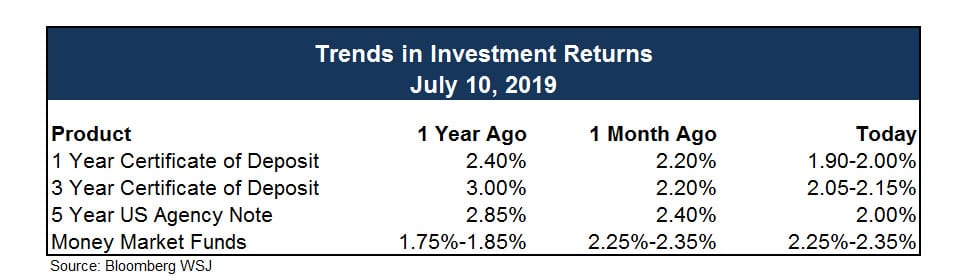

The slope of the Treasury yield curve flattened for the second consecutive week, as the 2s/10s spread narrowed by eight basis points to 18 bps while the 2s/30s spread tightened by eleven basis points to 68 bps. The spread between the 3-month bill yield and the 10-yr note yield narrowed by five basis points to -17 bps.

The fed funds futures market remains all but certain that a rate cut will take place in July, though expectations for a 50 bps cut are low after the release of the stronger than expected Employment Situation report for June. The fed funds futures market expects that a quarter-point July cut will likely be followed by another quarter-point rate cut in September (71.4%), and the chance of yet another in January (59.8%) – the July cut was more or less implied with Chairman Powell’s remarks to Congress on Wednesday.

JJ Kinahan, Chief Market Strategist at TD Ameritrade commented “I don’t see the Fed changing what they’ll do based on one jobs report. The market says the probabilities of a rate cut are 100%. The Fed has been backed into a corner because expectations are so high.”

Kinahan added, however, that the overall strength of the jobs market, as evidenced again by Friday’s report, could cause the Fed to just cut rates once, and then delay the timing of the next cut to get a better sense of the pace of the U.S. economic slowdown.

As the summer heats up so does the chatter and speculation around interest rates, especially in light of Chairman Powell’s recent comments to Congress, with all eyes on the Fed meeting July 30-31.

With a comprehensive cash flow forecast as a guide, Ehlers Investment Partners believes a properly laddered portfolio structure will meet or exceed all the investment objectives as outlined in an investment policy. Additionally, a laddered structure will allow for taking advantage of rising interest rates as maturing investments will be reinvested at higher rates and falling rates will not have a significant impact on overall portfolio performance.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.