Recent news of the emergence of the omicron COVID variant has generated uncertainty in financial markets. This is to be expected given the virility of the delta variant and the prevalence of so-called “breakthrough” cases in vaccinated individuals. Only the passage of time will provide sufficient information as to the impacts of this new strain of COVID both here in the U.S. and across the globe.

Equity markets did not react well to this news, as well as some other bits and pieces of economic information. Broad stock market indices were down significantly under heavy volatility, and some individual stocks far more substantially, as news broke last week and early this week. In fact, The Dow Jones Industrial Average experienced its worst day of trading since October of 2020 on the Friday after the Thanksgiving holiday (down over 900 points) and was negative for the second month in a row.

As can be imagined, interest rates generally fell across the interest rate spectrum of the U.S. Treasury curve, although the impacts to shorter maturities (two-years and less) were muted. The benchmark 10-year U.S. Treasury Note fell from about 1.65% in mid-November to its current 1.44%.

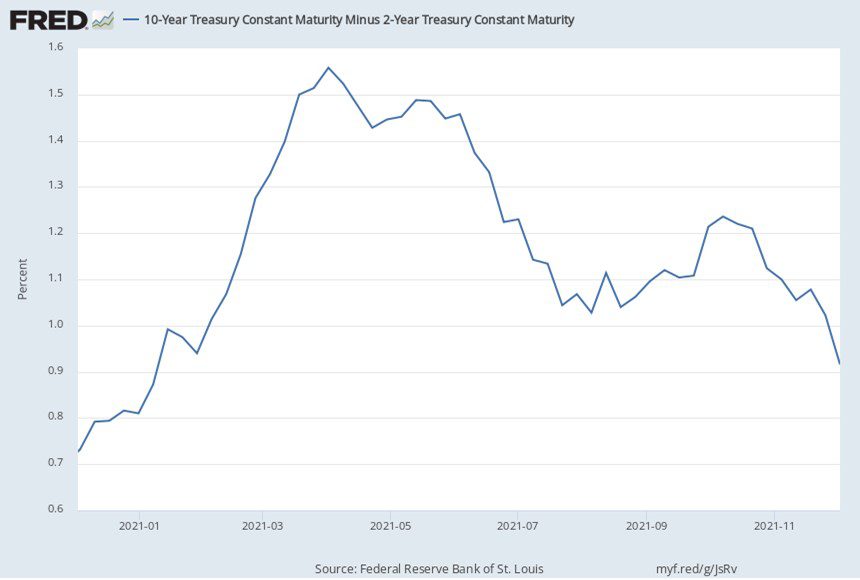

These recent moves in rates have resulted in the “flattest” curve in months, with the popular measure of the 10-year minus 2-year yield presently at a little less than 0.90%, roughly equivalent to where it was in January of this year. This difference between the two maturities is down thirty (30) basis points in just the last two months and reverses a steady march upward that began in the summer months.

It’s too early to discern whether this recent flattening is any indication of market sentiment around future growth prospects, as a compression in the spread between short- and long-term rates can be considered a harbinger of slowing economic growth. This dynamic is certainly in stark contrast to recent sentiment that inflation expectations were the proximate cause for increases in intermediate and long-term rates.

There seems to be a bit of a contradictory tone in the fixed-income markets presently, some of which is likely attributable to Fed Chair Jerome Powell’s and Treasury Secretary Yellen’s comments to the Senate Banking Committee this week. The markets have been anxious about inflation and tapering of the Fed’s bond purchases. On the one hand, higher inflation expectations tend to push rates higher. Further, the Fed’s actions of reducing its monthly bond purchases would similarly cause a general increase in rates, as the largest buyer suppresses its appetite against a backdrop of the same (or even greater) supply of those bonds creating lower prices for those assets.

However, reducing asset purchases is a tightening of monetary policy, which tends to tame inflation. The markets seem to be putting more weight on the “reduced inflation” side of the scales at present in light of Chair Powell’s hawkish statement to the Senate Banking Committee that it’s “a good time to retire” the word “transitory” in relation to inflation. The Fed Chair has used the term “transitory” to describe inflation for many months now – that is, inflation is likely to abate as the supply chain repairs itself from the damage of COVID impacts. For those of us living in the real world, the increased costs of goods and services certainly do not seem to be transitory. Additionally, Chair Powell alluded to quickening the pace of the Fed’s reduction in asset purchases “by a few months” as a result of these persistent inflationary pressures. The Fed’s monetary policy-setting body, the Federal Open Market Committee (FOMC), meets in mid-December where the matter will be discussed and likely communicated in greater detail to the market. Prior FOMC statements have been clear that changes to the fed funds rate would come only after the asset purchase program was wound down, or at least substantially diminished.

To add further uncertainty, Treasury Secretary Yellen testified at the same Senate hearing regarding the current temporary federal budget fix and the need for a more permanent solution, including a requirement to suspend or raise the debt ceiling by December 15. The Treasury has enacted “extraordinary measures” in light of the current situation. Just yesterday, the Congressional Budget Office released a projection that indicated the Treasury would run out of operations cash no later than the end of January, as a substantial payment is due earlier that month to the Highway Trust Fund.

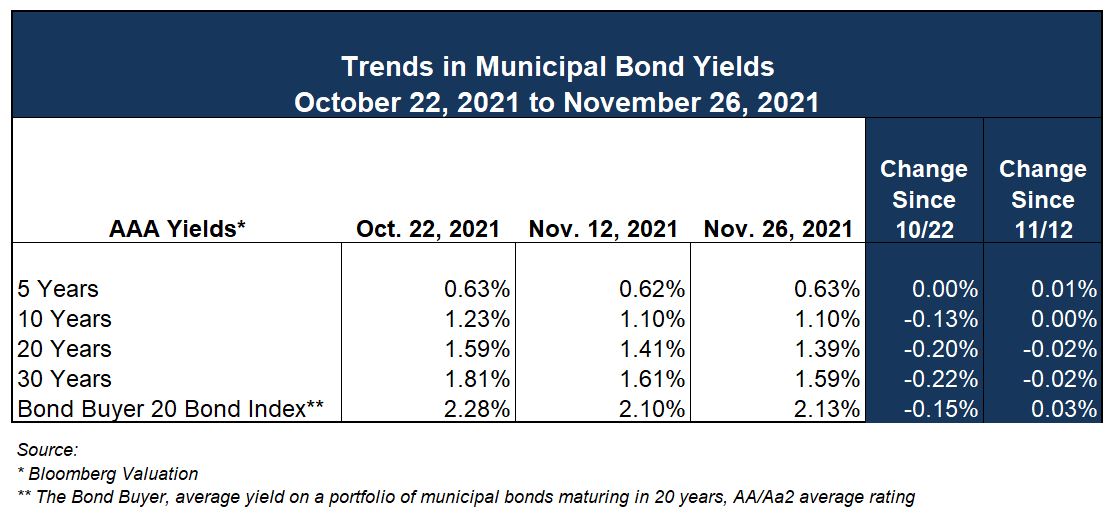

Municipal Yields Relatively Unchanged

AAA municipal yields as reported by Bloomberg valuation (and other sources) have been largely unchanged since mid-November and the last edition of our Market Commentary. They are down meaningfully month-over-month, with declines of roughly fifteen (15) – twenty (20) basis points for long-dated maturities. Short and intermediate maturities are generally unchanged over this time.

Ratios of tax-exempt to taxable equivalent Treasury yields have been fairly stable at intermediate and long maturities, with the 10-year benchmark at about 74%. The ratio at five-years remains very low at about 50%, which indicates tax-exempts are trading at high prices in relation to comparable Treasuries in that part of the maturity spectrum.

Ratios of tax-exempt to taxable equivalent Treasury yields have been fairly stable at intermediate and long maturities, with the 10-year benchmark at about 74%. The ratio at five-years remains very low at about 50%, which indicates tax-exempts are trading at high prices in relation to comparable Treasuries in that part of the maturity spectrum.

Investor appetite has waned some, with inflows to municipal bond funds declining as we head into the end of the calendar year. Based on current pricing and seasonal activities, this is not unexpected. Inflows have been positive for 38 straight weeks, according to The Investment Company Institute.

New issue volume can be unpredictable this time of year, with many issuers on the sidelines, while others scramble to get deals priced and/or closed by the end of the calendar year. This is set against the backdrop of investors pausing to close out books, with limited trading activity in the secondary market.

We look forward to providing an update on federal matters with our next Market Commentary on the heels of the upcoming FOMC meeting, along with some highlights of much-anticipated market prognostications that will begin to fill our inboxes.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.