Change is in the air, as a chill can be felt in the breeze and Fall colors emerge. Change may be similarly felt in the economic winds. Economic indicators suggest growth and momentum, though still moving in a generally positive direction, has slowed and the economic rebound of summer may have lost some of its prior pace.

The monthly jobs report comes on Friday from the Labor Department, which will be the last jobs report before the general election. Additionally, several other final figures, including those on consumer confidence, are due this week. And, if that wasn’t enough, the first of three presidential debates kicks off tonight.

New jobless claims for the week ending September 19 were 870,000, slightly higher than the prior week but making it the fourth consecutive week below the one million level. In keeping with the good but not great expectations, initial predictions of the unemployment rate is anticipated to be at 8.2%, marginally lower than last month.

The University of Michigan’s most recent confidence report had better-than-expected readings on sentiment and current conditions than the month prior. For reference, the sentiment indicator covers how consumers view their personal finances as well as business and buying conditions. The index rose from 74.1 to 78.9 in September, its highest point since the pre-pandemic high reading of over 100, as we continue “getting back to normal.” However, the survey also suggests over the next several months, there are two factors that could cause volatile shifts and steep losses in consumer confidence: how the election is decided and delays in obtaining vaccinations.¹

Continued Impact of COVID-19 on States

As we enter budget season, states will begin updating their revenue outlooks. Michigan finalized their state budget in a better position than originally projected. Revised budget projections showed a $3 billion improvement from May’s. Income tax withholding increased due to an “unprecedented” withholding of income taxes on unemployment benefits, and sales taxes came in better than expected. Florida also saw a small turnaround in their sales tax collections in August. Certainly, the pains of the pandemic are still hampering state and local budgets. Sizable expenditure cuts, deep dives into the use of budget reserves and to a lesser extent, increased revenues will all play into how governments seek to plug budget deficits.

Washington’s Attention Divided

The death of Supreme Court Justice Ruth Bader Ginsberg, who will become the first woman to lie in state at the Capitol – a huge honor – turned Washington’s and the country’s attention towards filling the vacancy. What was briefly thought to be just one more diversion heading into the election, taking attention away from other matters like the new coronavirus relief bill and a potential federal budget agreement, now seems to be swiftly playing out.

President Trump’s rapid nomination of Amy Coney Barret and the Senate’s affirmation to hold confirmation proceedings before the election has shifted from a drawn-out debate to a quick process that may lead Congress to return their focus back to negotiating a new round of coronavirus relief funding.

Markets

This past week was another consecutive week ending losses in the stock market, seemingly confirming the aforementioned economic slowdown. After four weeks of consecutive losses in two of the three major equities indices, all three indices are up this week. Many investors believe the conversations around a stimulus package will help to bolster consumer spending and aid struggling business.

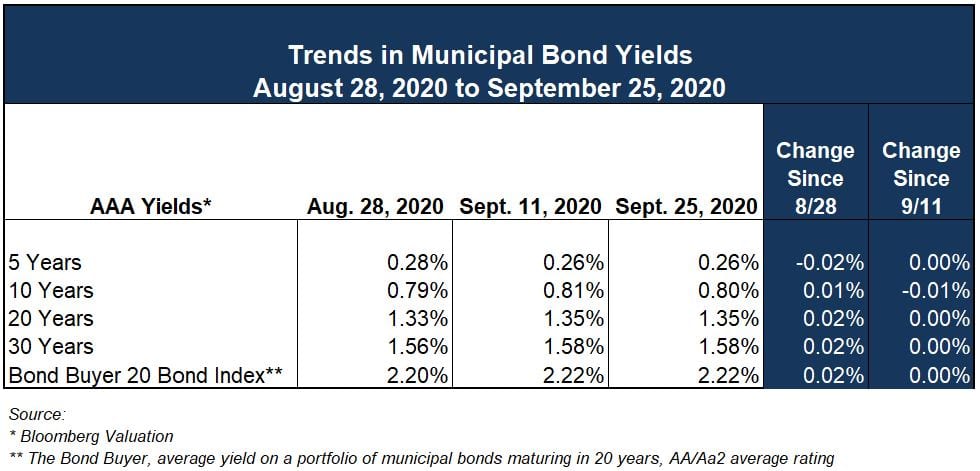

Despite the fluctuating stock market, the 10-year treasury yield has been mostly constant over the last month and the 10-year muni-to-Treasury ratio stood at 123.9%, continuing on its slow downward trend from a high of over 200% in March.

As illustrated in the table below, yields on municipal bonds have followed the trend of the 10-year treasury and remained almost unchanged, according to data reported by Bloomberg Valuation. Going back to May 22, prior to the Memorial Day weekend kicking off the start to the summer season, the 10-year AAA muni yield was 0.82%.

Demand for muni bonds continue as Refinitiv Lipper reported almost $499 million of net inflows to long-term municipal bond funds in the week ending September 23rd. This marks the 20th consecutive week of positive inflows. For the upcoming week, taxable and healthcare deals make up the majority of new issue volume. Citigroup analysts suggest that in spite of little movement in municipal bond prices over the past several weeks, the pace of new debt combined with unpredictable results of the upcoming election, may bring a period of volatility, albeit possibly brief.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.