As the coronavirus (or COVID-19) has spread more widely across the globe over the past two weeks, the impact on economic activity worldwide has become clearer. Many businesses, schools, and other institutions in China are completely shut down at least through the end of April. Consumer spending in China and other affected countries has slowed. Since so many companies worldwide have production facilities in China and/or purchase supplies from Chinese companies, this has slowed economic activity worldwide. Europe, primarily Italy, now seems to be in the grips of the virus, with significant impacts on public events and institutions. Pockets of cases in the U.S. are being reported, which was fairly-widely expected. What can’t be expected with any precision is the further trajectory or severity of the virus, the potential for containment, and possible therapies to mitigate its effects.

Although economic activity has been slowing for the last year primarily due to trade tensions between the U.S. and China, the impact of the virus has had an even greater impact on the global economy. Mark Zandi, chief economist for Moody’s Analytics, said “The trade war put the economy on its heels, and it would not take much of a push to put it flat on its back. COVID-19 may be more like a full-body blow.”¹

Until about two weeks ago, U.S. stock prices seemed “immune” to the virus. In fact, the S&P 500 Index hit several new record highs in February, peaking at 3,386.15 on February 19. But stock prices then declined sharply for the next seven trading days. The S&P 500 bottomed out at 2,954.22 on Friday, February 28, a decline of over 12.5% from its peak nine days earlier. The Dow Jones Industrial Average and the NASDAQ composite followed similar trajectories over this period.

Many nervous investors sold stocks and retreated to the relative safety of bonds, particularly U.S. Treasury bonds and notes. This drove up bond prices and dropped yields – which were already at historically low levels – to new record lows. The yield on the benchmark 10-year Treasury note, which had been as high as 3.2% in October of 2018, dropped from 1.573% at the close of February 18 to 1.127% at the close of February 25.

In the current week, the markets have been very volatile. Stock prices increased sharply on Monday, with the Dow Jones Industrial Average experiencing its largest single day point gain in history. Stock prices declined on Tuesday, and increased again on Wednesday, with some analysts attributing Wednesday’s gains to reactions to the “Super Tuesday” primary results. Stocks generally opened lower on Thursday.

Bond yields have also been volatile this week, with large swings in yields every day. The end of-day yields on the10-year Treasury note declined from 1.127% on Friday to 1.088% on Monday, 1.01% on Tuesday, and 0.992% on Wednesday.

The Fed Steps In

Early Tuesday morning of this week, the G-7 group of nations issued a joint statement reaffirming its “commitment to use all appropriate policy tools to achieve strong, sustainable growth and safeguard against downside risks.” Shortly after that announcement, the Federal Open Market Committee (FOMC) announced that it was cutting the fed funds target rate by 50 basis points (1 basis point = .01%) to a range of 1.00% to 1.25%. This was a highly unusual move, coming two weeks before the next scheduled meeting of the Committee. The committee further stated that they will be “closely monitoring developments and their implications and will use its tools and act as appropriate to support the economy.” But after three 0.25% cuts in 2019 and the 0.50% cut on Tuesday, there is not much room for further reductions in the fed funds target rate should the U.S. economy slow further.

Even after the FOMC made its unexpected rate cut, a state of inversion persists out to about 10-years. The effective fed funds rate has been near the low end of the new range, just above 1.00%. The 2-year Treasury yield stands around 0.70% and the 5-year at roughly 0.75%.

Impact on Muni Yields

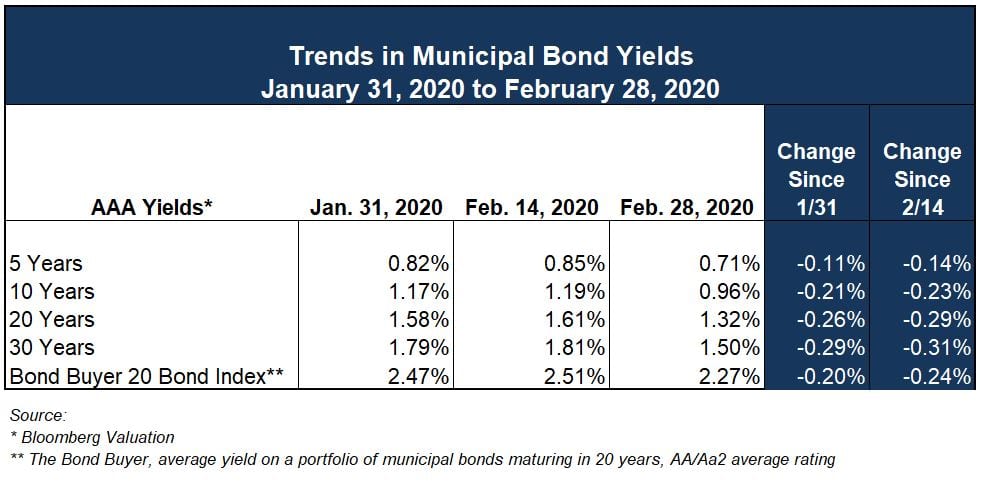

The good news for state and local governments is that the “flight to quality” movement by investors has driven muni bond yields ever lower, particularly at the longer end of the yield curve. As shown in the table below, muni yields (as reported by Bloomberg) dropped by .14% (at 5 years) to .31% (at 30 years) between February 14 and February 28. Municipal bonds are very much in demand, and we have seen very aggressive bidding on competitive sales of bonds.

After the Fed’s announcement on Tuesday morning, treasury yields continued to decline, but muni yields did not follow suit. In fact, The Bond Buyer² noted that muni yields were up slightly on the day. That would suggest that there is room for muni yields to go even lower if current economic trends continue. This may also be evidenced by the current state of taxable/tax-exempt ratios. In some parts of the maturity spectrum, tax-exempt yields are lower than taxable-equivalent Treasuries. The ratio is a little greater than 90% at ten-years. These ratios are much higher than in recent past, which could indicate that cross-over buyers may step into the market.

If you are considering issuing debt in the near future, we urge you to contact Ehlers to discuss your options. We are also talking to lots of our clients about opportunities to take advantage of these historic low rates to reduce and restructure future debt payments through refundings, including through taxable advance refundings.

¹ CNNBusiness, March 3, 2020

² March 3,2020

Impact on Investments

The recent market activity, resulting from coronavirus fears and Fed action, has also significantly altered the investment landscape for municipal investors. Gone are the days of investments earning over 2%, as was the case less than a year ago. The flight to quality for investors has pushed down Treasury yields to under 1% and for just about all Treasury and Agency investments, maturing in five years and less. We expect municipal investors to continue to see early optional redemption of their callable Agencies, requiring them to reinvest at lower rates. Yields for near-cash instruments, like money market funds and pool products, will continue to decline as these funds have been and will continue to be reinvesting at lower yields

Portfolio strategy is extremely important in periods of an inverted or flat yield curve with an expectation of even lower short-term rates in the near future. Investors may also need to potentially expand their universe of other, available investment products that don’t necessitate significant reductions in credit quality. Understanding your need for liquidity at these moments in time is critical. Ehlers team of investment and treasury services professionals can assist you in evaluating your current set of circumstances and formulating a plan that meets your needs.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.