The monthly Consumer Price Index (CPI) data was released by the Labor Department on Tuesday and to no one’s surprise it provided a grim confirmation of the continued inflationary pressure we are all experiencing. Top line inflation was up 8.5% (annualized) in March from a year earlier, a rate not seen since December 1981. This surge continues to be largely driven by food and energy costs, however the core inflation number, which excludes food and energy, was also up 6.5% in March.

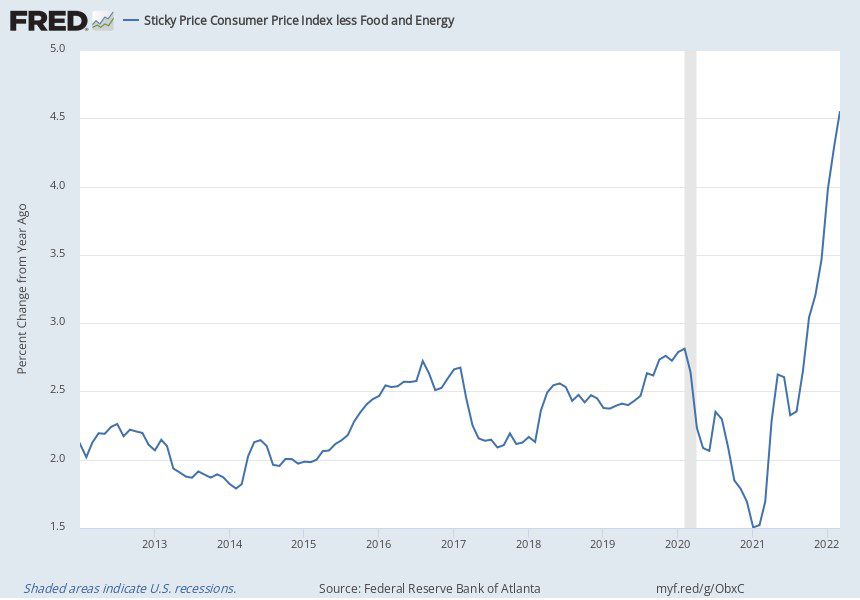

The Federal Reserve Bank of Atlanta maintains a subset of the CPI called the Sticky Price CPI, which excludes many volatile items and focuses on goods and services that have historically slow-moving price changes. This is meant to give a sense of the trajectory of overall inflation. A chart of the past 10 years of the Sticky Price CPI is below, showing that even items such as furniture, auto maintenance, auto insurance, infant clothing and other items that have historically demonstrated stable prices are also surging in this current environment.

So now what? The question for market participants, economists and pretty much anybody right now is: are we seeing peak inflation? In other words, we’ve seen and experienced the surge, but will it ever slow down?

Here are two causes for some optimism that perhaps the worst is behind us or will be soon. First, the core inflation index, which rose by 0.3% from February to March, increased at the slowest pace in six months. Second, the largest driver of growth in core inflation over the past year has been used car prices (which anybody who has tried to buy a car recently can attest to) and used auto prices actually decreased 3.8% from February to March.

Despite those glimmers of hope, the reality is we are still sitting in a moment of unprecedented inflation, and without a singular cause there is also no singular solution. However, there are levers to be pulled that may help to ease the situation, and we will likely see those in the form of monetary policy in the coming weeks.

Tracking Fed Rate Increases

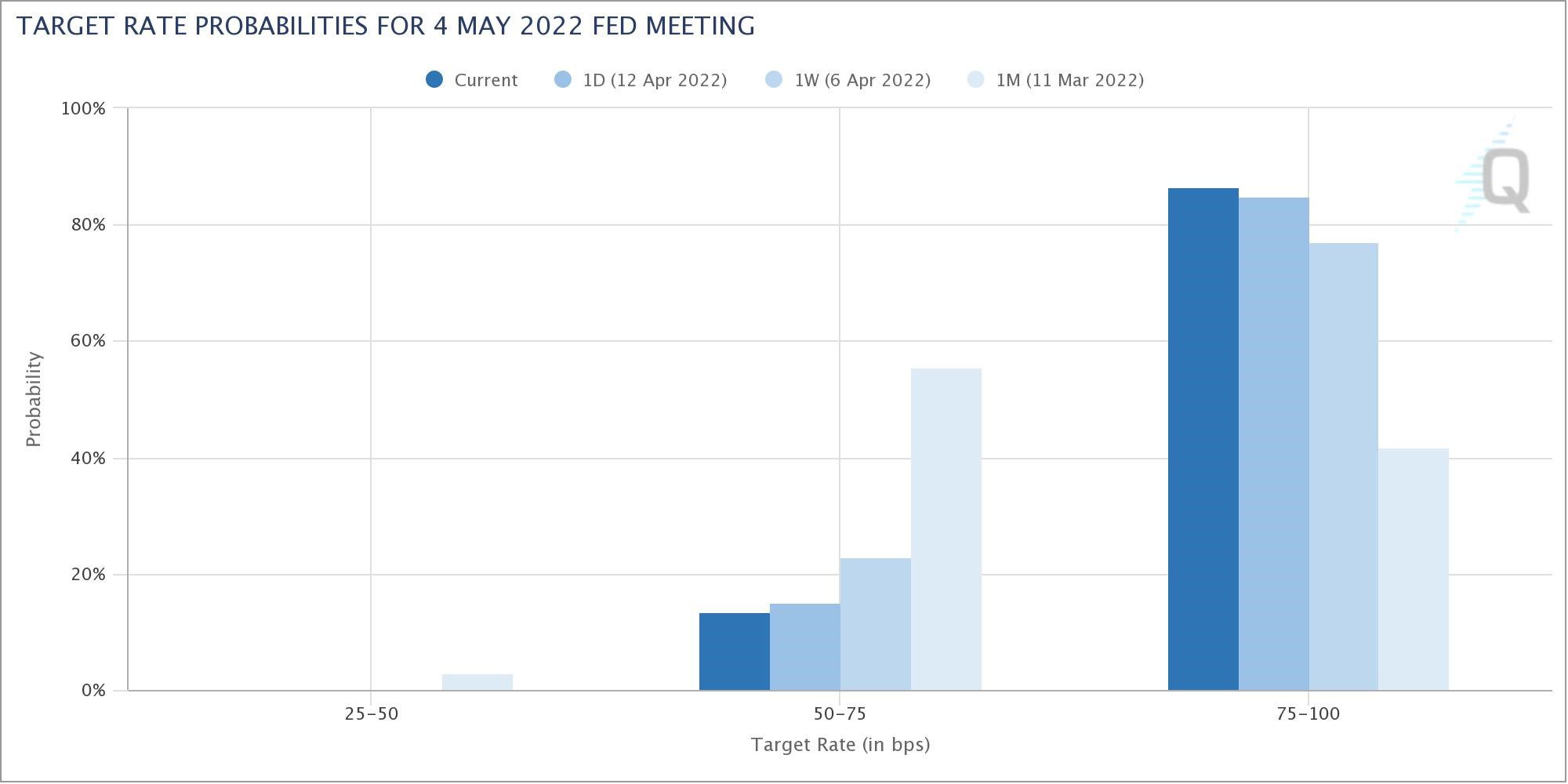

The Federal Open Market Committee (FOMC), which is the group that sets monetary policy on behalf of the Federal Reserve, will be looking to continue to manipulate said policy levers to mitigate surging inflation. Primarily, this means increases to the target range for the fed funds rate. The CME Group publishes data that uses fed funds futures pricing to derive probabilities for expected FOMC rate decisions at future meeting dates.

The chart below demonstrates the market’s evolution of thought regarding the magnitude of a potential increase to the fed funds rate at the FOMC’s next meeting in early May. One month ago, expectations were very nearly split between the probability of either a 25 or 50 basis point increase (1 basis point = 0.01%), with a bias towards 25 basis points (the current range is 25 – 50 basis points). Clearly, market expectations have dramatically shifted into the camp of a 50-basis point increase at over 80%, and 25 basis points at under 20%. The consensus is that the FOMC needs to act more boldly to combat the inflation dynamic.

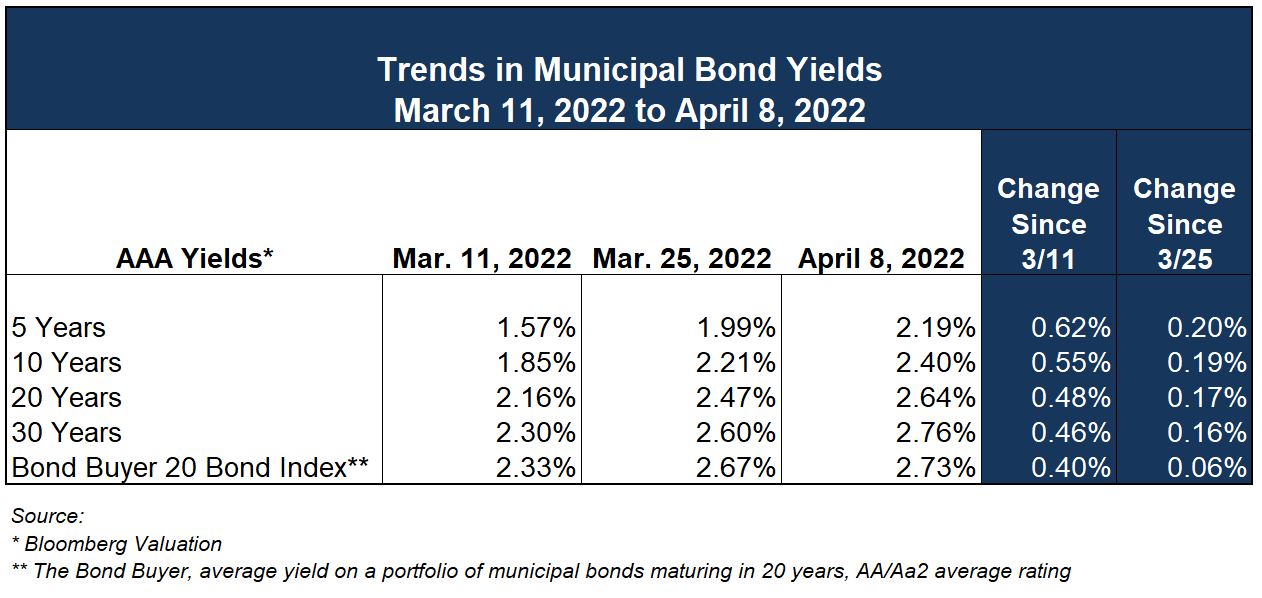

Trends in Municipal Bond Yields

Municipal yields increased another 15+ basis points across the interest rate spectrum in the week ending April 8th, according to Bloomberg Valuation (BVAL). The 10-year AAA-rated muni ended last week at 2.40%, up from 2.21% at the end of March and 1.47% in early February. This week is shortened due to the Good Friday holiday on Friday, and so light issuance is expected.

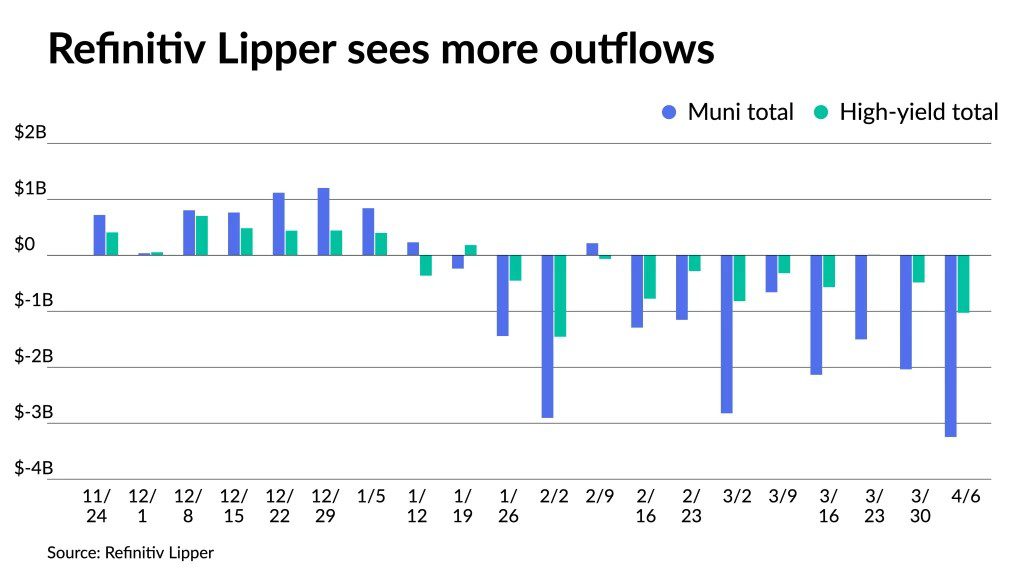

Data released last week showed that municipal bond mutual funds had their worst-performing quarter since 1980. This outcome can be mostly blamed on increases in yields, generally, and heavy fund outflows that led to portfolio managers selling bonds to meet investor redemptions. Returns on the Bloomberg Municipal Bond Fund Index were negative 6.39% to end the first quarter. Aggregate outflows from municipal bond mutual funds since December 31 of last year equate to about 3% of total mutual fund holdings.

Volatility throughout the municipal market is heavily correlated to US treasuries. There is hope that once treasuries settle from the current period of persistent instability, munis can expect the same. According to Matthew Gastall from Morgan Stanley, in past periods of volatility municipal funds have moved quickly to outperform treasuries as soon as the market found stability.

Ehlers municipal issuer clients can rely on their financing team to provide the most up-to-date data on bond pricing and market stability.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.