In this holiday-shortened week, there continues to be positive news regarding municipal bond yields. Yields ended last week down across the entire curve. The 10-year AAA MMD finished Friday at 0.84% and the 30-year ended at 1.65% compared to 2.81% on March 20, 2020 amid the start of the COVID-19 concerns, resulting muni-to-Treasury ratio was a whopping 302%. The 10-year muni-to-treasury ratio this past Friday was 127.1%.

The preference for the safety of treasury securities has subsided somewhat and investors also seem willing to invest further out on the yield curve. According to the Bloomberg Barclays Municipal Bond Index, municipals are likely to see a 2.7% total return since the beginning of the month, the largest one-month return since 2009. According to data from Refinitiv Lipper, tax-exempt mutual funds had inflows of $1.840 billion the week ending May 20th, following inflows of nearly $582 million the week prior.

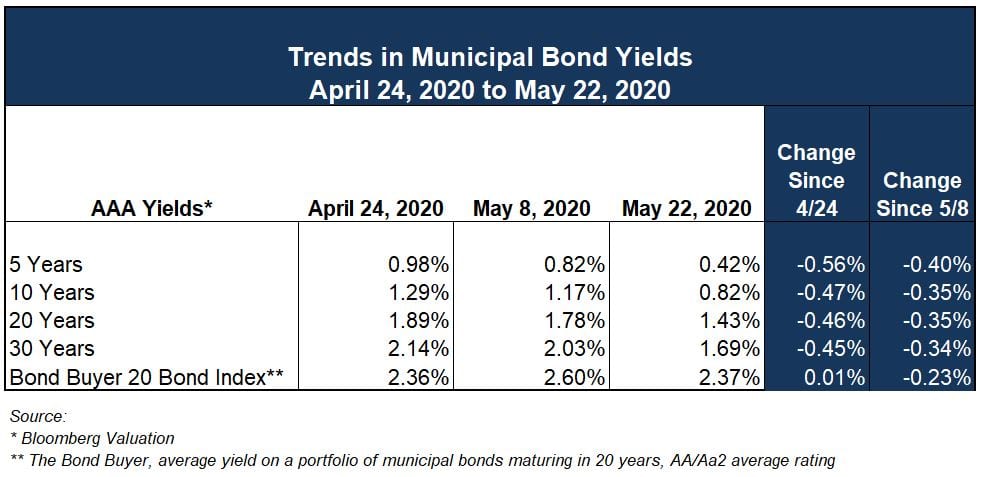

Municipal yields also saw declines across the yield curve the past two weeks, as reported by Bloomberg Valuation.

What to expect from rating agencies amid COVID-19

As expected, all major rating agencies are making additional inquiries regarding the impact of COVID-19 on the immediate and long-term fiscal health of local governments. The effects of COVID-19 are still being evaluated within the overall methodologies and frameworks each respective rating agency uses to assign a credit rating, so it is important for issuers to remember that these frameworks still apply to local governments nationwide – not just within a region or State.

At the peak of market volatility in late March/early April, there was ample media coverage questioning the resiliency of the municipal bond market. Recall that many institutional investors and dealers were indiscriminately selling bonds in the secondary market to raise cash and almost no new issuance activity was occurring. As market volatility has subsided, attention has now turned more acutely towards local government credit. Given the anticipated dramatic decline in revenues for some local governments, agencies and non-profit borrowers resulting from the economic shutdown the focus is on liquidity and financial flexibility. Hard hit revenue sources include (but are not limited to) hotel occupancy taxes, public transit and transportation, public surface parking and structures, convention and tourism, and local sales taxes. Other core revenues such as utility fees and property tax payments (while potentially subject to deferrals or delays in payment) have less volatility and the long-term impact on these revenue sources, if any, will depend on the prevalence of impacts specifically related to COVID-19 and the broader pace of economic recovery.

The extent to which COVID-19 effects a specific local government’s credit profile seems to mirror the diversity of revenue sources and services provided. Property tax dependent budgets with minimal or no exposure to highly sensitive economic revenue streams may weather COVID-19’s financial and economic effects better if liquidity was strong going into the economic shutdown. Larger cities battling the impact of COVID-19 in more densely populated areas have seen more drastic and sharper declines in revenues and increased costs due to higher public safety and public health expenditures. However, that does not mean small municipalities have been unscathed.

Since the methodologies used by the rating agencies are applied broadly across the local government sector, expect inquiries to focus on broad themes some of which may not impact all issuers:

- Do you anticipate any one-time or substantially increased expenditures associated with the COVID-19 pandemic?

- Do you have any revenue sources that you believe are likely to be pressured?

- Are you taking any steps currently to adjust operations considering volatility?

- Do you expect that the cash and cash equivalents will improve, deteriorate, or stay the same over the next few years?

- Discuss the next fiscal year’s budgeting assumptions and how the sudden downturn in the economy related to the COVID-19 outbreak is (or isn’t) changing the assumptions?

- Do you have any indication from the State that the suddenness and severity of the economic downturn could delay or reduce a portion of aid payments?

- Could tax payment delays potentially require cash flow borrowing?

- What level of cuts could by sustained before core public services would be meaningfully affected?

- What are your assumptions concerning federal reimbursements for COVID-19 related costs?

In addition to providing updates on larger employers or taxpayers, issuers should be prepared to discuss the immediate and long-term impact of COVID-19 on the current fiscal year and how it is impacting local government operations in detail. While the impact can vary significantly from state to state, and from community to community, this will remain a significant focus going forward. This is a good opportunity to revisit existing long-term financial projections or develop a multi-year plan that incorporates operational and capital needs. A cash flow analysis would be useful to understanding any exposures that may surface during the current fiscal period. Contact an Ehlers Municipal Advisor if assistance is needed.

Investments Update

Yields across all fixed income assets with maturities of five years and less experienced a slight decline during the month of May. It’s important to remember that government pools, money market funds and other cash-like products have not been immune to declines in yields, as these products will soon approach yields of 0.00% – 0.20%. Declines in stated returns on these vehicles generally come with a lag as underlying investments mature and reinvestments occur.

The Federal Reserve seems to have alleviated much of the anxiety surrounding illiquidity and volatility in both equity and debt markets, pledging to keep monetary policy highly accommodative as long as needed. The Fed has fully committed to use all tools necessary “to the absolute limit of those powers,” as Chairman Powell stated in his comments following the conclusion of the Federal Open Market Committee’s (FOMC) April meeting.

During these times municipal investment portfolios need to be carefully examined to protect revenue and provide a reliable source of income, to the extent feasible. There is incremental return to be gained at the present time by moving out on the yield curve. For instance, the 3-year Treasury yields 23 basis points, representing a 21% increase in yield when compared to the 1-year Treasury bill at 17 basis points. Additionally, alternatives to traditional investments such as U.S. treasuries, agencies and brokered CDs can prove valuable, although purchasing these instruments may require amending your investment policy to widen the universe of permissible investments. These alternatives don’t necessarily increase portfolio risk when appropriately considered in the context of a diversified portfolio. Our Investment Advisors can partner with you to review policies and help you get an understanding of your financial profile, risk tolerance and cash flow needs.

Ehlers would like to remind our clients that the market and rates do fluctuate, and even recessions are inevitable. Our recommendations may vary based on circumstances, but it is always wise to maintain a balanced portfolio that provides reliable income with the ability to seize on opportunities when they present themselves. We continue to focus on safety of your principal, liquidity needs through asset allocation strategies, and an eye towards a competitive rate of return.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.