Trends in Municipal Markets

Once an issuer sells bonds and receives the proceeds, that’s not the end of the story. Daily, municipal bonds are traded on the secondary market. On average, about $10 billion of municipal bonds are changing hands each day. Issuers are typically unaware as it doesn’t affect the interest rate or the payment the issuer received at the time of issuance. If you hold any bond mutual funds, this secondary market is the market those funds are most often trading in. Based on data compiled by Bloomberg, the par amount of bonds traded so far this year has marked a 22-year low. This trading slump leaves investors, including those sitting in cash, eager for any new offerings. Bloomberg has also tallied $10.6 billion of new municipal offerings that are scheduled during the next month. The Bond Buyer’s 30-day visible supply is just under $14 billion. By either measure, this amounts to about $10 billion less than the amount of cash that will be returned to bondholders as debt matures and is called for redemption. Investors will be looking to reinvest their cash. This demand for new issues is one of the primary factors keeping municipal borrowing rates from increasing.

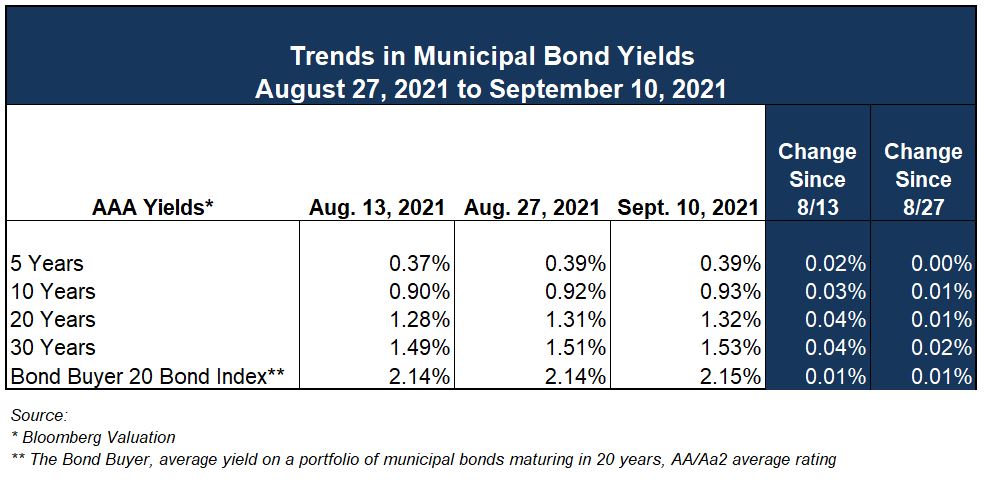

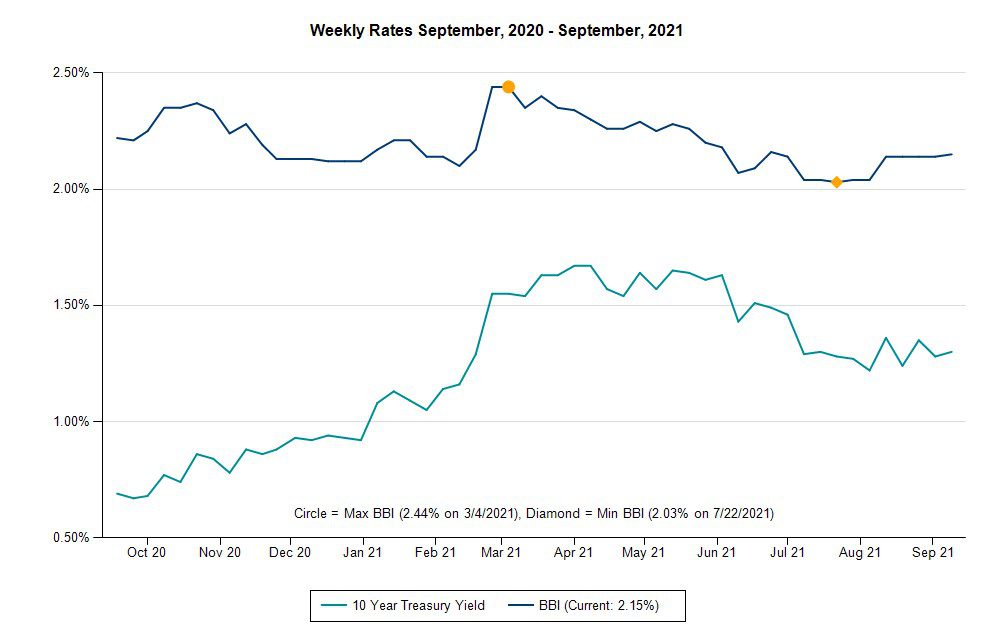

Recently, municipal bond yields have exhibited tremendous stability, as demonstrated in the table above and the chart that follows. Municipal bond yields have been far less volatile than U.S. Treasury yields at nearly every point along the maturity spectrum, including the benchmark 10-year Treasury.

We do not anticipate this trend reversing through the end of the year, as heavy maturities and redemptions occur in December and January, while new issue volume wanes during the holiday period. In fact, many of our clients are proceeding with refundings that will be priced in the next couple months, assuming rates remain stable.

Additional Unemployment Benefits Ending

In March, the federal government extended the $300 weekly enhanced unemployment benefit. Following the federal extension, roughly half the states chose to forgo the extended benefit in the face of unmet labor demand under the notion that enhanced unemployment benefits were inhibiting workers from re-entering the labor force. Last week marked the official end to the federal extension. We may not be able to tease out the effects of the additional benefits for quite some time, if ever, with noise in the data like varied reopening rates and employees choosing to stay home for a number of reasons beyond unemployment benefits. However, the initial comparison data suggest that the increased unemployment payments had no statistical impact on the labor recovery rate among states that ended those benefits early.

Employers may be holding on to employees that they would have otherwise let go in light of the reemergence of pandemic related restrictions in the hospitality industries in particular. This could be propping up the statistics in what otherwise could be another dip due to the uptick in restrictions.

August Inflation Data Released

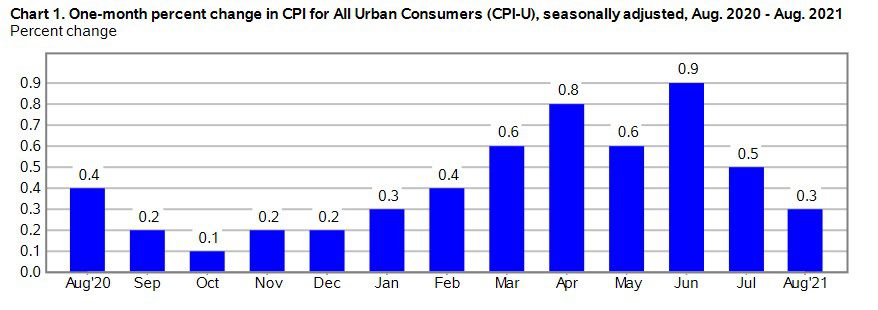

The U.S. Consumer Price Index (CPI) for the month of August, as reported by the Labor Department, rose a seasonally adjusted 0.3% in August from the prior month. The CPI measures the change in prices paid by consumers for a basket of goods and services. The chart below from the Bureau of Labor Statistics shows the 13-month high in June. The recent downward trend may be support for the Fed’s mantra that inflation is transitory, reinforcing its policy stance of keeping the fed funds target range unchanged. Thus far, it does not seem inflation data have been important to the Fed’s decisions regarding its asset purchase program, with unemployment and economic growth being the primary motivators of potentially diminishing the amount of monthly asset purchases.

The year over year increase in August is 5.3%, well above the Fed’s target rate of inflation of 2% (the Fed’s preferred measure of inflation is the PCE deflator). In addition to actual data, the Fed also considers consumer expectations of future inflation. The Federal Reserve Bank of New York’s Survey of Consumer Expectations reports that short- and medium- term inflation expectations rose to new series highs. Though respondents may not be “experts” in the area of economics and inflation, they buy “stuff,” nearly all of which has gone up in price or is subject to backlogs (or both). Additionally, the Labor Department reported its Produce Price Index for August, which surged to its highest annual rate since 2010 at 8.3% year-over-year. This was on the heels of a 7.8% increase in July, which had also set a recent record. While future increases in prices may be transitory (meaning they will ebb from current elevated levels), it is highly unlikely prices will subsequently fall once inflation data becomes muted.

Municipal Bond Tax Law Changes

This past weekend, the House Ways and Means Committee presented its= tax provisions as a part of the Democrats proposed reconciliation package, which includes three items this Commentary had mentioned in prior editions plus one additional policy proposal:

- Increase in the bank qualified limit to $30 million, from $10 million, and extended to the borrower level

- Restoration of tax-exempt advance refundings

- Creation of a new direct-pay tax advantaged bond program, much like Build America Bonds

- Expansion of the use of Private Activity Bonds (PABs)

The increase to the bank qualified limit affects issuers that reasonably expect to issue less than the stated threshold in a calendar year, which has not been increased since the tax reform act of 1986. Tax-exempt, comes with a tax-advantage which allows for more attractive after-tax yields for financial institutions, generally resulting in lower rates for the tax-exempt borrower.

Restoring the ability to issue tax-exempt advance refunding bonds has been regularly proposed since it was prohibited in the 2017 Tax Cuts and Jobs Act. If this provision is restored, tax-exempt advance refundings would allow issuers to refinance their existing debt with call dates greater than 90 days out at lower tax-exempt interest rates, thereby increasing savings (relative to taxable rates for advance refundings currently).

A new direct-pay bond program would mimic the program dynamics of the Build America Bond program of 2000. As was the case for the 2009 program, the issuer would pay the investors taxable interest that is subsidized by the federal government through a direct rebate to the issuer as a stated % of the interest amount. As a safety net, the current proposal alleviates the dynamic in which a portion of the subsidy was sequestered by the federal government, causing the net cost of such bonds to increase to issuers over time.

The final bulleted initiative, not previously packaged as part of municipal bond law changes, would allow additional access to the 4% federal low income housing tax credit by lowering the minimum financing requirement. Current law requires that multifamily housing projects must be more than half financed with PABs. The proposed legislation lowers the threshold to 25%.

Exciting as this may be for issuers of municipal bonds, the current proposal – the “Build Back Better” plan – has no Republican support.

We will all patiently await the outcome, or lack thereof, in Washington. In the meantime, investors are looking for new issues. As you’re planning your capital projects or looking to refund your outstanding debt, contact your Municipal Advisor – we look forward to partnering with you.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.