Economic metrics send mixed signals; GFOA disclosure workgroup discuss interim financial reporting with SEC.

An inverted yield curve (when short-term rates are higher than long-term rates) is commonly cited as an indicator of a future recession because the yield curve has inverted before every U.S. recession since 1955. An inversion can happen years or months or days before the start of a downturn – meaning, there is no set timing between an inverted yield curve and the beginning of a recession. To be fair, there have also been occasions where recessions have not manifested subsequent to inversion. However, given the correlation, the yield curve has been monitored closely this year during periods of inversion.

There is some cautious optimism as the yield curve has started to steepen. As with other economic indicators, the yield curve can be influenced by many factors from international developments to actions by the Federal Reserve. The Federal Reserve announced on October 11 it intends to purchase $60 billion per month in short-term Treasury bills to increase liquidity in money markets. These purchases increase prices for short-term bills, thus lowering their yields. Demand for U.S. Treasuries from overseas investors has also increased as negative yields persist in countries across Europe and in Japan, pushing down yields here at home. The yield curve will be one of many data points taken into consideration when the Federal Open Market Committee (FOMC) meets on October 29 – 30.

Economists have noted a drop in retail sales and a contraction in manufacturing activity, raising concerns about a slowing U.S. economy. The Federal Reserve reported U.S. factory output declined 0.5% in September and total industrial production declined 0.4% last month. The Commerce Department reported this week U.S. retail sales in September fell for the first time in seven months. Retail sales dropped 0.3% as households cut spending on building materials, online purchases, and especially automobiles.

The CME FedWatch Tool currently projects a 94.6% probability that the target rate for the federal funds rate will be lowered from 1.75% – 2.00% to 1.50% – 1.75% at the conclusion of the FOMC meeting next week. This is slightly higher than last week’s implied probability of about 90% and significantly higher than one month ago at 55%.

SEC Chairman discusses interim financial disclosure

The Bond Buyer reported Securities and Exchange Commission (SEC) Chairman Jay Clayton discussed more timely annual financial reporting and more frequent periodic reporting through the dissemination of unaudited interim information as a means to improve secondary disclosure in the municipal market. These comments were made this week during a conference call with the Government Finance Officers Association’s (GFOA) new disclosure working group and officials from the SEC’s Office of Municipal Securities (OMS).

An area of focus is exploring methods to bridge the gap between filings of audited financial statements to improve the timeliness of information made available to investors. GFOA officials commented that interim financial reporting could be challenging for less frequent issuers and could delay the availability of audited financial statements. Other call participants questioned if discrepancies between interim financial statements and audited statements could be construed as misleading investors or even rise to the level of fraud? OMS officials explained there would need to be a deliberate intent to defraud, and if an issuer is attempting to provide updated information the issuer and its officials would not be exposed to greater risk by disclosing interim information.

GFOA’s disclosure working group is still clarifying where to focus its attention next and does not yet have specific answers on how it will approach Chairman Clayton’s agenda. This working group was established this year to provide input on disclosure within the municipal market. The group includes representatives of the National Association of Bond Lawyers, National Association of State Treasurers, the National Association of State Auditors, Comptrollers and Treasurers, the National Association of Health and Educational Facilities Finance Authorities, the National Association of Municipal Advisors and the National Federation of Municipal Analysts.

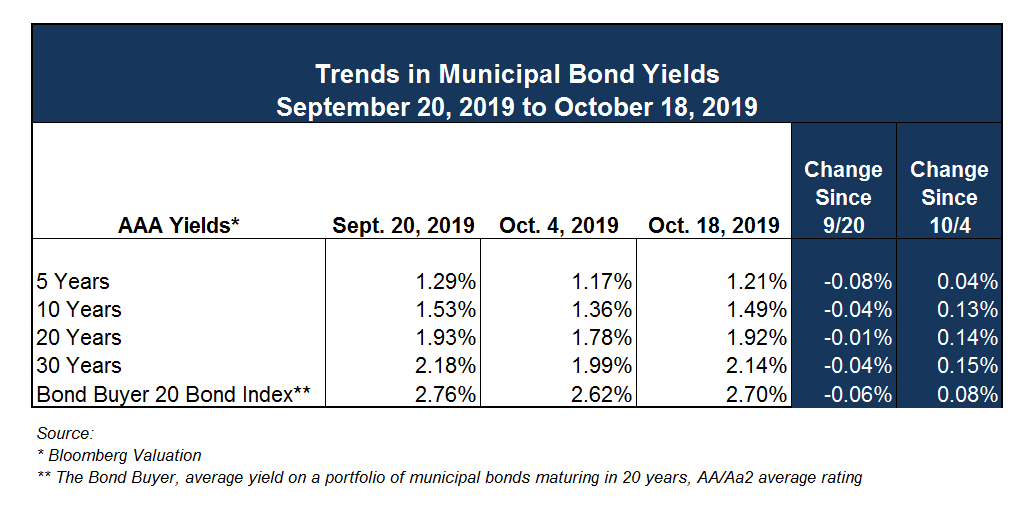

Trends in Muni Yields

Municipal bond yields have increased across the yield curve the past two weeks. Although, as we have commented for several weeks, there still seems to be strong demand for municipal bonds, as evidenced by continued inflows to long-term municipal mutual funds and ETFs.

As we approach the end of the calendar year, issuers should be mindful to work with their municipal advisor to review the new issue calendar when selling bonds competitively. Deal volume can increase from week-to-week as issuers seek to get transactions completed prior to year-end. Additionally, there are refundings that will be day-to-day in the negotiated market. Accessing the market on heavy volume days or even certain times of day can lead to results that may be less than ideal. Ehlers often seeks feedback from underwriting desks on desirability of days and times, depending on the nature of our clients’ transactions. The goal is to maximize bidding interest for competitively-offered issues on the selected day of sale. Your advisor can recommend flexible approaches for your particular debt issue, if needed.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.