Has the U.S. economic expansion finally come to end? Or is it just adjusting to slowdowns elsewhere around the globe? Officials in the U.S. seem to think the latter.

Treasury Secretary Mnuchin said this week, “I don’t see in any way a U.S. recession” (The Bond Buyer, September 9th). Federal Reserve Chair Jerome Powell previously pointed out the current risks to the health of the U.S. economy including slowing global growth, uncertainty around trade policy, and inflation not meeting expectations. However, he went on to state that “[the] most likely outlook for our economy remains a favorable one with moderate growth, a strong labor market and inflation moving back up close to our 2% goal” (Powell Waves Off Recession Fear While Leaving Rate Cuts on Table, Bloomberg.com, September 7th).

All eyes are affixed on economic data due to be released this week: the Producer Price Index will be reported on Wednesday; the Consumer Price Index on Thursday; and, monthly retail sales and consumer confidence reports on Friday. These figures will be woven into the fabric of recent reports along with the slightly worse–than–expected jobs report released last Friday which indicated employers added 130,000 jobs in August compared to the 156,000 jobs per month average over the last three years. Positively, the unemployment rate remained unchanged at 3.7%.

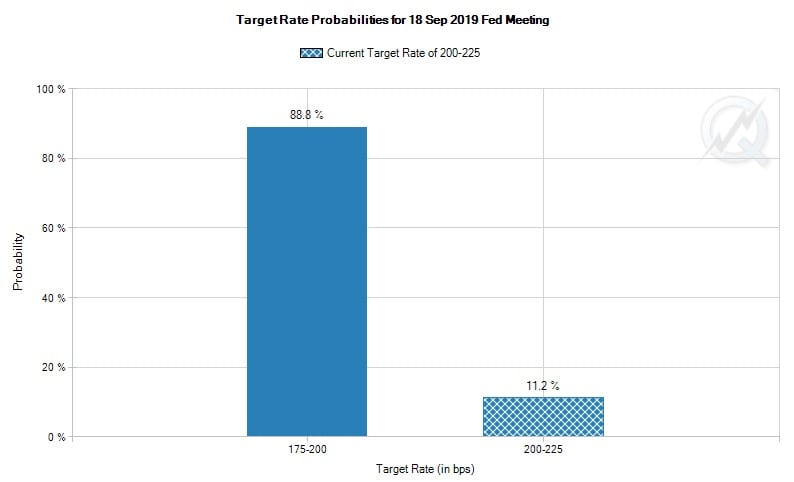

The Federal Open Market Committee (FOMC) meets next Tuesday and Wednesday to assess the state of the U.S. economy and determine whether to cut the fed funds rate any further. The CME FedWatch Tool (which tracks the probability of FOMC rate actions implied by the fed funds futures markets) currently shows an 89% probability of a quarter-point cut next week to a range of 1.75% – 2.00% and a roughly 50/50 chance of a further quarter-point cut in October.

Source: CME Group

As far as how consumers are reacting to the recent mixed economic news. The Bond Buyer reports that the Money Anxiety Index, which claims to have predicted the 2008 recession, was unchanged from July to August. This suggests that despite some concerning economic data and media stories about looming recession potential, that consumers have not changed their behavior.

For now, it’s continue to wait and see…

Sources:

https://www.wsj.com/articles/tech-work-is-a-bright-spot-in-lackluster-jobs-report-11568067021

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://www.bondbuyer.com/news/market-will-get-inflation-consumer-data-ahead-of-fed-meeting

Trends in Municipal Bond Yields

New issue volume scheduled for this week is estimated at $10 billion, a sign that issuers are welcoming low interest rates and ready to push forward with borrowing. Given the interest rate backdrop, it is likely that volume will continue to be higher going forward this fall. Observers note that the change from a supply-constrained environment to a high-volume market should be a welcome “reset” for the muni market. Any impact the anticipated increased issue volume might have on yields remains to be seen (The Bond Buyer, September 10th).

Municipal Market Data’s quoted yield on the 10-year AAA muni has moved up 11 basis points since hitting a record low of 1.21% on August 28th and the 30-year AAA muni is 10 basis points above its low of 1.83% reached on the same date. Inflows into muni bonds funds have continued for the 35th straight week; however, the most recent week of $820 million was the smallest inflow since July 31st.

Federal Transportation Funding Cuts on the Horizon

Local and State governments may be facing a massive cut to transportation funding, as automatic federal spending cuts loom unless Congress can pass a 2020 budget bill or stopgap funding measure to address the budget going into the new fiscal year (beginning October 1st). The Highway Trust Fund is seeing shortfalls and the Congressional Research Services (CRS) estimates the cut to transportation grant programs would be as much as $1 billion. Note these funds are used to provide formula grants to state and local highway and transit systems for vehicle replacement, facility improvements, and in some cases operating expenses.

Without a new budget, state and local governments would be asked to take on more of the burden of funding capital for transportation, which could have compounding impacts as federal highway programs are already scheduled for a $7.6 billion funding reduction in July of next year unless Congress acts to stop it.

At a time when local and state governments are awaiting a proposed (and often teased) infrastructure bill from the federal government, it could spell disaster for transportation infrastructure to now lose a substantial amount of annual formula grant funding. Municipal lobbyists are pushing hard for Congress to act, but with a massive deal ahead to set the budget for FY 2020, that requires prioritizing transportation over other major items.

Again, it’s continue to wait and see..

https://www.bondbuyer.com/news/automatic-cuts-to-transit-aid-highways-face-congress

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.