Economic Stimulus

What was shaping up to be a bipartisan agreement on the next COVID-19 relief package after announcements of both a Biden plan and Senate Republican package, is now leaning more towards slight modifications to the larger plan the President proposed. Earlier this month, President Biden commented on the proposal, indicating his intentions “[t]he way I see it, the biggest risk is not going too big.” While the White House seemingly believes the higher price tag of $1.9 trillion will be non-negotiable, the President has offered that some provisions within the administration’s plan may be negotiable. Some economists, notably Larry Summers, have cautioned on the size and scope of the plan, commenting that the proposal is larger than the projected shortfall in economic output, inflation, and an[1] infrastructure investment down the road.

Conversely, Treasury Secretary Janet Yellen, who was confirmed as the first female Treasury Secretary on January 25, 2021, expects full employment next year if the President’s stimulus package is passed. Full employment is considered to be achieved when the unemployment rate is near 4%, it currently stands at 6.3%. The unemployment rate recently peaked at 14.8% in April of 2020.

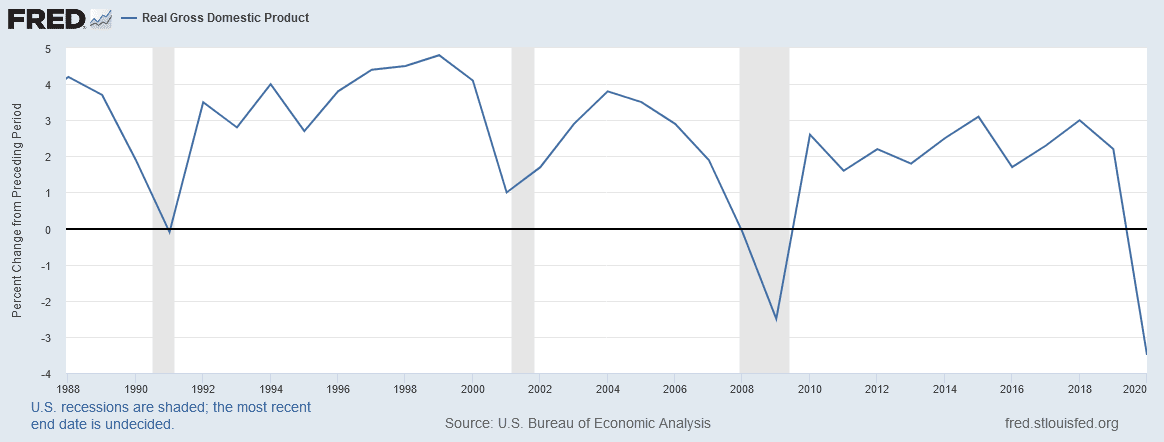

The size of the stimulus package seems to be highly correlated with estimates of expected growth in GDP. Many Wall Street banks are adjusting GDP forecasts to better align with the larger influx of federal dollars expected from the stimulus. Their previous forecasts had additional federal stimulus factored in, just not at current levels. The Federal Reserve expects year-over-year GDP growth of 4.2% for 2021, which forecast accounted for higher unemployment than Secretary Yellen is currently suggesting following the announcement of the President’s stimulus package. Expectations of GDP growth in excess of 5% for 2021 are not out of the question.[2] To put that in context, annual change in GDP has averaged 3.5% over the last decade.

Consumer Sentiment

Many economists believe the ongoing vaccine rollout and proposed fiscal stimulus, which some anticipate will be on the President’s desk by early March, will lead to a booming summer. However, despite the positive expectations for 2021, the University of Michigan Surveys of Consumers preliminarily reported a drop from January’s 79.0 to 76.2. The surveys measure consumer expectations on their spending and saving behavior. Though the nominal value may not be expressly indicative of where the economy is heading, the change compared to the prior month as well as the change relative to expectations has been shown to a leading economic indicator. The authors cited government restrictions on consumers and businesses as factors threatening the outlook for economic growth. In addition, Richard Curtin, the survey’s chief economist, commented that “Households with incomes in the bottom third reported significant setbacks in their current finances, with fewer of these households mentioning recent income gains than any time since 2014.”[3] This drop in the sentiment index was unexpected news as economists polled by Reuters had anticipated a small upward movement in the index to 80.8.[4] For a benchmark, prior to the pandemic, the index was 101 points. In light of the January jobs report though, the drop in consumer sentiment may not be all that surprising. U.S. employers added a mere 49,000 jobs in January, but the unemployment rate fell by 0.4 percentage points to 6.3%

Trends in Municipal Yields

There is a light calendar of new issues this abbreviated week due to the President’s Day holiday, with total volume estimated at $5.7 billion. Of the total issuance volume, about $3.8 billion is tax-exempt and $1.9 billion is taxable. The 2020 weekly average for tax-exempt sales is $6.1 billion. Despite the economic slowdown for most of 2020, the municipal bond market remained strong with demand remaining robust, along with limiting tax-exempt volume with the help of the influx of taxable bonds. As mentioned in past Market Commentaries, the new issue volume in the municipal bond market is historically made up of 90% tax-exempt issues. More recently, taxable issues have increased to make up approximately 30% of the overall supply.

Washington may also have its thumb on keeping municipal borrowing rates steady. Once the economic stimulus package is addressed, the Biden Administration may look next to tax policy. Changes to personal and corporate income tax structures that increase effective tax rates may similarly increase demand for tax-exempt debt. There are enough variables in play that the outlook on the impact to tax-exempt rates is difficult to discern.

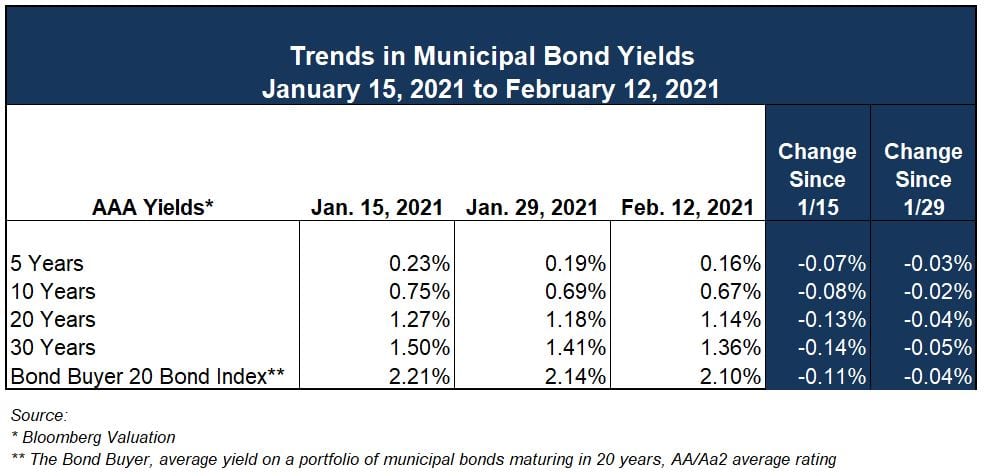

Taxable or tax-exempt, the lighter supply in the market is helping to keep rates low. AAA Municipal bond yields have been mostly unchanged for the past several weeks even in the face of increasing Treasury yields.

From January 15th to February 12th, the 10-year Treasury increased by 10 basis points (0.10%). This rise in the benchmark Treasury resulted in a lower muni-to-treasury ratio of 58% as of the close of last week, according to Refinitiv MMD. The recent ratio has averaged about 80% but went as high as 300% last March when munis yielded far more than Treasuries. The past month also illustrates the compression on muni yields. The spread in yield between the 10-year and 30-year “AAA” rated bonds was 0.75% in January, decreasing to 0.67% at the close of last week.

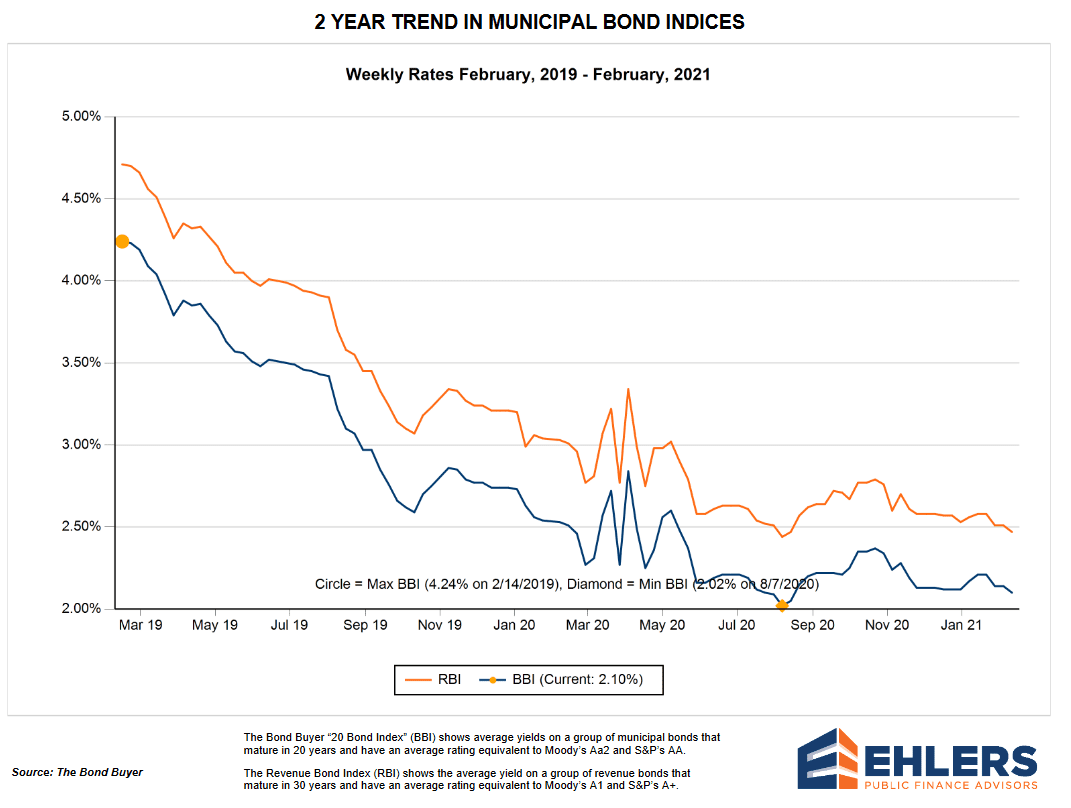

There’s little indication that rates will increase in the near-term. In addition, as illustrated in the chart below, the spread between taxable (orange line) and tax-exempt (blue line) rates is narrow. This is important now if you’re contemplating an upcoming refunding as a current or advance. As you are planning your future projects and refinancing opportunities, please contact your Ehlers Municipal Advisor. Rates remain low, and, while refinancing debt for savings in a low rate environment seems straightforward, it can be a more complex and nuanced decision than on its face. Be sure you have someone aligned with your interests assisting you with analyzing your refunding candidates.

[1] https://www.washingtonpost.com/opinions/2021/02/04/larry-summers-biden-covid-stimulus/

[2] http://lite.cnn.com/en/article/h_476e8ff62d54ed8e0a13e08d1eeb7f2f

[3] https://www.wsj.com/articles/u-s-consumer-sentiment-falls-in-early-february-11613146905

[4] https://finance.yahoo.com/news/price-gold-fundamental-daily-forecast-122209079.html

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.