While it is clear the COVID-19 pandemic is causing significant disruptions to worldwide economic activity, there are still more questions than answers about the details – including the ongoing impact on employment, corporate earnings, governmental finances, and many other factors. Two months ago, many public officials suggested that a graph of economic activity through the contemplated end of the pandemic would be “V-shaped”, with a sharp decline, a defined low point, and a rapid recovery. We have recently read comments suggesting that the graph will look more like the trademark Nike “swoosh,” with a long and slow recovery – or even like a “W”, with a partial recovery, another slowdown if the spread of the virus remerges, followed by a second longer recovery.

The monthly report on U.S. jobs, released by the Bureau of Labor Statistics (BLS) last Friday, included some important data[1]. Nonfarm payrolls declined by 20.5 million in April and the unemployment rate soared to 14.7%. This was the highest monthly reported jobs loss and the highest unemployment rate since the federal government began tracking and reporting these figures (in 1939 and 1948, respectively). It is widely believed that these numbers may understate the true impact of the pandemic on jobs. However, none of this came as a surprise, given the number of businesses that have either temporarily or permanently closed and the record numbers of unemployment claims over the past month. In fact, some economists pointed to positive signs in the report, including the fact that most of the unemployed workers were classified as temporary layoffs.[2]

U.S. stock markets seemed to shrug off the negative jobs report. All three major U.S. stock indices increased by over 1.5% during the day of May 8, continuing a trend that has persisted since late March. For example, although there have been lots of up and down fluctuations, the S&P 500 has recovered over half of the losses that occurred between its last record high on February 20 and its recent low on March 23. Although the S&P 500 dropped slightly this week, it is currently at about the same level as it was a year ago. The broader stock market seems to have established a relative form of “immunity” to COVID-19 well in advance of the U.S. population.

Impact on State and Local Budgets

We are beginning to see preliminary reports about the anticipated financial impacts of the pandemic on state revenues and budgets. Last week, State of Minnesota officials announced a preliminary budget forecast showing a $2.4 billion deficit for the biennium ending June 30, 2021; the previous forecast released in February had shown a $1.5 billion surplus. The State of California released a similar preliminary forecast showing a deficit of $54.3 billion over the same period. State officials are discussing preliminary deficits of up to $2 billion for Wisconsin and up to $3 billion for Colorado.

All four of these states had healthy reserves going into the current fiscal year, but it seems highly likely that all four will have to reduce expenditures significantly. This includes the potential for reduced state aids for school districts and other local governments, which may also be hit with decreases in revenues from property taxes, sales taxes, and other sources. From our discussions with clients, we know that all local governments are struggling to develop accurate estimates of current year revenues and budget forecasts for the next year.

Interest Rates and Muni Market Trends

Interest rates in general have achieved some level of stability over the past six weeks. For example, from March 26 through May 11, the closing yield on the 10-year U.S. treasury note stayed in the relatively narrow range of 0.57% to 0.76% (presently around 0.60%).

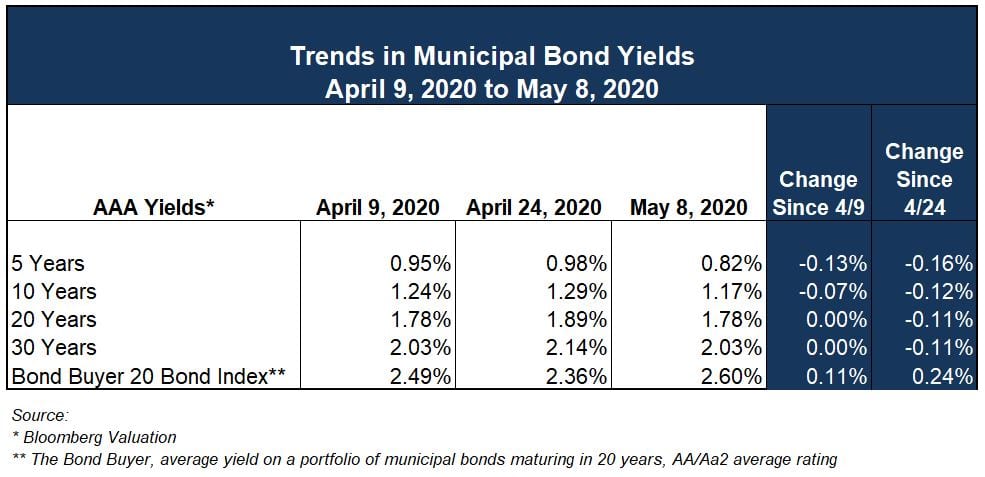

The market for municipal bonds has also continued to stabilize. As shown in the table below, yields (as reported by Bloomberg Valuation) decreased by 11 to 16 basis points across the maturity spectrum from April 24 to May 8, with the largest decreases for shorter maturities. Muni yields continued slightly lower on Monday and Tuesday this week. At the end of day on May 11, the ratio of the 10-year AAA muni yield to the 10-year treasury yield was at 156.1%. That ratio was in the range of 70% to 80% for most of the past two years but rose to well over 200% for much of March and April, as investors showed a strong preference for the safety of treasury securities and dislocations occurred in the muni market. At the current level, munis are still seen as attractively priced for investors, which is helping to keep muni yields down and demand strong.

Credit quality continues to be very important to investors. Tim Heaney, senior portfolio manager at Advisor Asset Management, referred to a “bifurcated market” for munis.[3] Lower-rated issues, particularly those secured by sensitive revenues or annual appropriation pledges and those for transportation and higher education, are receiving less interest from investors and underwriters than higher-rated issues and therefore selling at significantly higher yields (lower prices). But there is a much stronger market for higher-rated bonds, particularly general obligation bonds and those secured by essential service revenues.

Since April 28, Ehlers clients have conducted 11 competitive sales of general obligation bonds, receiving an average of 5 five proposals per issue; all of these issues were under $10 million. The most recent larger sale for our clients was on April 23; we conducted a competitive sale of a $28 million general obligation issue for a school district and received nine proposals. This bidding activity is more representative of what we were seeing prior to the COVID-19 pandemic.

As mentioned earlier, short-term treasury and muni yields have declined more than longer-term yields, so the yield curve for both has steepened over the past two weeks.

The Push for More Financial Information

Well before we had even heard of COVID-19, there had been vigorous discussion in the municipal bond market about enhancing the frequency and timeliness of financial and operating information that issuers provide to investors and the public. Many investors that participate in the municipal market are also active in the corporate securities market. Those investors are accustomed to corporate-style reporting, which in many cases includes quarterly financial reports and forward-looking guidance. Investors and analysts who are accustomed to the corporate disclosure regime are often frustrated that governmental issuers only file annual financial reports, which are often not available until six months or more after the end of the fiscal year. Additionally, municipal disclosures are nearly always backwards looking in nature.

Securities and Exchange Commission (SEC) chair Jay Clayton has made it clear through various mediums over a number of years that he would like to see improvements in financial disclosures by municipal issuers – both timelier annual financial reporting and interim unaudited financial reports and operating data. Groups representing investors, including the National Federation of Municipal Analysts, have also been advocating for similar enhancement to municipal disclosures. Meanwhile, groups representing municipal issuers, including the Government Finance Officers Association, have expressed concerns about the time and expense of preparing interim reports, and have pointed out that many municipal issuers are much smaller organizations than publicly traded companies.[4] Further, municipal issuer officials are concerned about the regulatory liability associated with providing unaudited financial information and other interim data, as well as any form of forward looking guidance, even if accompanied by disclaimers and cautionary statements.

This tension has been heightened since the onset of the COVID-19 pandemic. Investors are naturally concerned foremost about the ability of governmental entities to make debt payments, but also about the overall financial health and operating profile of debt issuers, which could impact credit ratings and the value of municipal securities. Issuers are not accustomed to producing and regularly posting interim data and forecasting in an environment of such uncertainty is fraught with its own perils.

On May 4, the SEC released a statement that stressed the increased importance of disseminating timely disclosures to investors due to the potential financial impacts of COVID-19 and encouraged municipal issuers to voluntarily provide meaningful “forward-looking” information with respect to both issuer and issue-specific implications of the pandemic. The SEC would like issuers to post such information on the EMMA (Electronic Municipal Market Access) web site, which is maintained by the Municipal Securities Rulemaking Board (MSRB) and is available to anyone free of charge.

The SEC statement encourages issuers to include cautionary statements regarding the accuracy and completeness of the information posted, and also offers some reassurances to issuers about the possibility of enforcement actions, including this statement: “We would not expect good faith attempts to provide appropriately framed current and/or forward-looking information to be second-guessed by the SEC.” Many issuers and attorneys welcomed that language. Dan Deaton, a partner at Nixon Peabody, said “as long as the nature of what is being communicated is correctly included in those statements, then that does, under the antifraud laws, give considerable protections.” [5]

Earlier this week, we sent an alert regarding the SEC statement to clients who contract with Ehlers for continuing disclosure services. That alert is available here.

At Ehlers, we are constantly monitoring the state of municipal disclosures to keep our clients informed of industry standards and best practices. While we recommend consulting with legal counsel before issuing any voluntary disclosures, our professionals are fully prepared to help our clients with any disclosure filings they may need.

[1] CNN Business, May 8, 2020

[2] The Bond Buyer, May 8, 2020

[3] The Bond Buyer, May 12, 2020

[4] The Bond Buyer, January 29, 2020

[5] The Bond Buyer, May 5, 2020

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.