On the heels of the latest federal COVID pandemic relief package, the American Rescue Plan, focus is shifting to future initiatives and how to pay for them. The $1.9 trillion COVID package passed last week will rely on increasing the federal debt as its funding source. Most likely, future federal legislative packages will be financed by a combination of new debt and tax increases, according to Treasury Secretary Janet Yellen.

Tax increases under consideration include raising the corporate income tax from 21% to 28%, pairing back tax preferences for pass-through businesses such as limited-liability companies, raising marginal income tax rates on individuals earning more than $400,000 per year, expanding the reach of the estate tax, and higher capital gains tax rates for individuals earning at least $1.0 million annually. [1] These proposed increases are consistent with what President Biden discussed during his presidential campaign. That said, the overall legislative or tax proposals have not been announced yet. And, there are rumblings of a forthcoming infrastructure package that may dwarf the most recently passed COVID package in terms of size, which is proposed to be partially funded through the aforementioned tax increases. We expect this debate to intensify as Republicans indicate they are prepared to fight proposed changes that are likely to reverse portions of President Trump’s 2017 tax law changes. Further, the “funding,” or revenue, proposed to come from tax increases is no more than a budgetary projection. These projections rarely bear a resemblance to reality.

While fiscal policy matters loom on the horizon, this week market observers await comments from Fed officials upon conclusion of the Federal Reserve’s Federal Open Market Committee (FOMC) meeting, although we don’t expect much to change. Federal Reserve Chair Powell has commented in recent weeks he expects faster economic growth this year to drive unemployment down and prices up as economic activities deferred during the pandemic and consumer demand pick up. Fed officials are expected to revise their forecasts for economic growth this year to perhaps 6% or more, an increase from the 4.2% projected last December. Any increase over 5% would be the fastest annual pace since the 7.2% in 1984, when the U.S. economy emerged from a true “double-dip” recession.

Despite recent increases in borrowing costs that seem to be largely the result of expectations for stronger economic growth and perhaps higher inflation, most market observers forecast no fed funds rate hikes into 2023 when perhaps the Fed’s goals of maximum employment and sustained 2% inflation will be met. However, any actions with respect to the fed funds rate are only one component of the Fed’s monetary policy prerogative. Its nearly $100 billion of monthly U.S. Treasury and agency mortgage-backed securities purchases are equally, if not more, important to interest rate expectations.

The University of Michigan released its latest consumer sentiment index on Friday, and it grew to 83.0 on March 12th from 76.8 on February 26th, representing its highest level in a year. The survey questions consumers on their views of their own personal finances, as well as the short-term and long-term state of the U.S. economy. The gains were widespread across all socioeconomic subgroups and all regions, although the largest monthly gains were concentrated among households in the bottom third of the income distribution, as well as those aged 55 or older. For consumer finances, consumers’ judgements about their own financial situations posted no gains in early March, largely due to very small expected gains in household incomes over the next year.

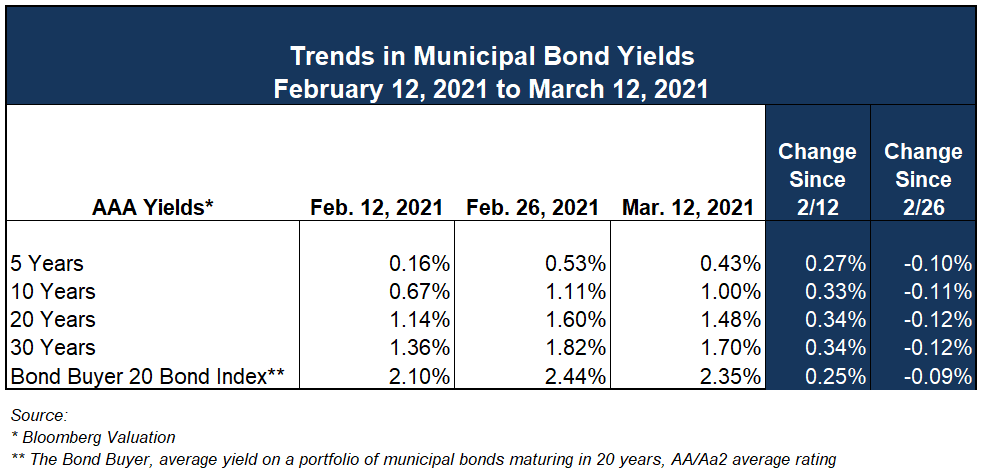

Municipal Bond Yield Trends

Municipal bond yields have declined modestly over the past two weeks, but this is welcome news after a sharp uptick at the end of February. Yields are firm heading into this week, with a fairly large increase in expected new issue volume of $11 billion, the largest so far in 2021. Investor demand remains strong, even with talk of changes in individual and corporate taxes.

Update on Federal Municipal Bond Legislation

As we mentioned in this Commentary earlier this year in January, there is a push from several government lobbying groups including the National Governors Association, the U.S. Conference of Mayors, the National League of Cities, the National Association of Counties, and the Government Finance Officers Association to reinstate tax-exempt advance refundings, tax credit bonds (including direct-pay bonds, like the prior Build America Bonds), and raise the limit on bank qualified debt to $30 million through a “bond modernization agenda”, all of which were discussed last week at a hearing of the House Ways and Means Subcommittee on Select Revenue Measures.

Reinstating Tax-Exempt Advanced Refundings: The 2017 Tax Cuts and Jobs Act eliminated the ability to issue tax-exempt advance refunding bonds. An advance refunding occurs when refunding bonds close more than 90 days prior to the first available call date of the refunded bonds, with proceeds of the refunding issue deposited into a defeasance escrow. Mayor Stephen K. Benjamin of Columbia, South Carolina, a former president of the U.S. Conference of Mayors, testified there were 12,000 tax-exempt refunding issuances between 2007 and 2017 which generated over $18 billion of savings. Reinstatement of this provision is estimated to “cost” the federal government $1.8 billion annually.

Increasing Bank Qualification Limit: The $10 million annual bank qualification limitation has remained unchanged since its introduction in 1986, other than occasional temporary increases. Eligible financial institutions that purchase tax-exempt, bank qualified debt enjoy tax advantages that provide more attractive after-tax yields than non-bank qualified alternatives. This often results in lower interest rates for the issuer. Presently, issuers that reasonably expect to issue no more than $10 million in tax-exempt debt in a calendar year can avail themselves of bank qualified status on those obligations.

These public finance proposals are being brought forth as strategies to foster investment in critical infrastructure. The Bond Buyer reported Republicans did not offer any specific objections to these requests for changes, rather general concerns were raised about overall federal government spending and money following the latest COVID relief package. Key takeaway: while these proposals have some bipartisan support, the extent of that support is unclear, so it is difficult to predict which (if any) of these proposals may come to fruition. Additionally, when so many dials are being turned simultaneously, it’s difficult to assess what likely outcomes and impacts may be. The fact remains, interest rates remain low from a historical perspective. Issuers should consult with their municipal advisor about their specific situations and whether or not it may be warranted to proceed under current circumstances or delay financing as potential legislative matters unfold that might provide favorable conditions. Often times a well-crafted financing plan outweighs the unknowns surrounding market dynamics.

[1] https://finance.yahoo.com/news/biden-eyes-first-major-tax-060001525.html

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.