In a recent research report, S & P Global cited a trend of slowing economic growth across the world.¹ They cited U.S.-China trade tensions as the “primary driver” of the slowdown, but also listed political tensions in numerous countries and regions as a contributor, including:

- Possible impeachment hearings in the U.S

- The continuing Brexit impasse in the U.K.

- Elections and policy uncertainty in Latin America

Central banks in many countries have responded to slower growth by lowering short-term interest rates and implementing other “monetary policy” tools. The S & P report states that these actions are likely to prevent a global recession, but they still estimate the risk of a U.S. recession within the next 12 months at 30% – 35%.

In the U.S., the Federal Open Market Committee (FOMC) has already reduced the federal funds target rate twice in 2019 (in July and September), and a third reduction seems likely in October. As of October 9, the CME FedWatch Tool is citing an 81% probability of a 0.25% reduction in the fed funds rate at the October 30 meeting of the FOMC.

Fed Chair Jerome Powell also announced that the Fed will resume purchases of Treasury securities in an effort to avoid the disruptions in the overnight repurchase agreement (repo) market that were discussed in the last edition of this commentary. He stressed that this is not a return to the Fed’s large-scale purchases of treasuries, referred to as quantitative easing. By resuming securities purchases, the Fed seeks to increase the amount of excess reserves in the banking system on a more consistent basis. The Fed has intervened in the repo market the last few weeks with temporary cash infusions. Outright securities purchases will offer a more stable solution for this part of the market, rather than introduce the unknowns associated with periodic and temporary actions.

Could Interest Rates Go Lower?

Interest rates have declined significantly for most of 2019 and are certainly low by historical standards. For example, the 10–year treasury yield is at approximately 1.54% on October 8. This is 1.67% lower than the yield a year ago (3.21%) and near the all-time low of 1.38% set in July 2016. So it seems counter intuitive to suggest that rates could go lower. But some economists are suggesting that could occur.

Current yields for U.S. Treasuries are a function of a number of factors, including persistently low inflation and slower economic growth, both at home and abroad. Neither of those factors seem likely to change soon. In a Weekly Market Outlook report, John Lonski, Chief Economist at Moody’s Analytics, wrote that the next U.S. recession could drive the 10-year treasury yield to a range of 0.50% to1.00%.² This would be consistent with trends in other nations, where government bond yields have gone into negative territory.

¹ S & P Global, Global Credit Conditions, QC 2019, October 1, 2019

Impact on Muni Yields

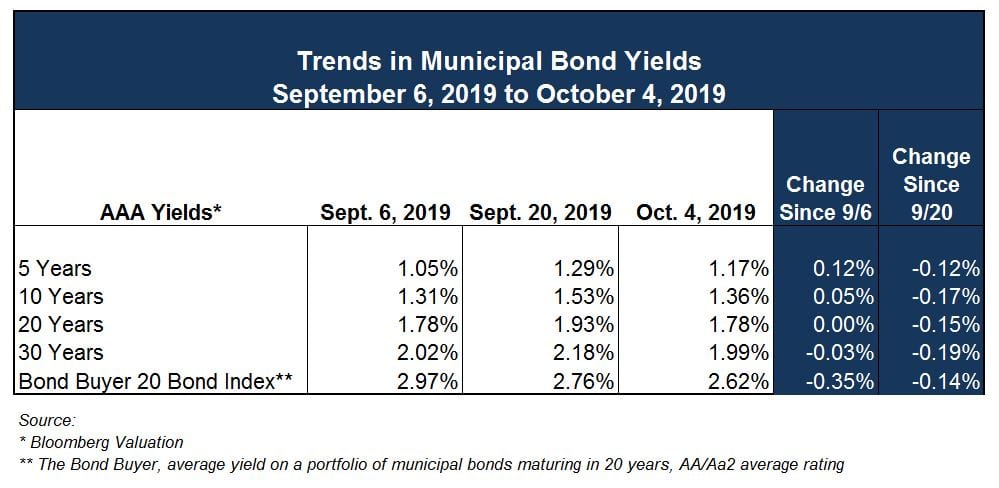

Yields on municipal bonds have followed a pattern similar to Treasuries. After declining for most of this year, they increased moderately from late August to mid-September. Since mid-September, they have declined again, and are now only slightly higher than the historically low levels seen in August.

As shown in the table below, during the two weeks from September 20 to October 4, yields on AAA-rated munis have declined by 0.12% to 0.19%.

Yields over the past two weeks may have been affected by the relatively low volume of new bonds being sold. After several weeks with the volume of new bonds sold nationally exceeding $10 billion, the new issue volume declined to $6.99 billion the week of September 30 and is projected at approximately $6.4 billion in the current week.³ Furthermore, a substantial portion of the new-issue volume is taxable bonds.ˆ So the supply of new tax-exempt bonds is even lower. During this period, demand has not seemed to have abated. Long-term municipal bond funds have seen an influx of funds for an unprecedented 29 consecutive weeks.

Some of the taxable bond issuance consists of advance refundings of existing tax-exempt bonds. The federal tax reforms enacted in December 2017 prohibited almost all tax-exempt advance refundings but did not prohibit taxable advance refundings. Even though taxable bonds have higher yields than tax-exempt bonds, overall yields have declined to the point that some taxable advance refundings may succeed in reducing debt service costs. A relatively flat yield curve also provides somewhat favorable reinvestment opportunities in refunding escrows

At Ehlers, we advise our clients to consider taxable refundings of tax-exempt bonds very carefully. Even if yields increase in the future, you may be able to save more by waiting to execute a tax-exempt current refunding of an existing bond (within 90 days of the call date) than you would save with a taxable advance refunding now. We can provide our clients with estimates of the impact of both options. Additionally, we regularly review alternative refunding structures, such as “Cinderella bonds” (initially taxable during the escrow period, then switch to tax-exempt) and forward purchases and rate locks. Issuers must be informed of all options and understand the risk profile for each, which includes a point of view on simply waiting for a current refunding opportunity.

² Moody’s Analytics, Weekly Market Outlook, October 3, 2019

³The Bond Buyer, October 4, 2019

ˆ The Bond Buyer, October 7, 2019

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.