This week markets will continue to be sensitive to world events. As the 2020 primary elections begin, the United Kingdom officially leaves the European Union and the impeachment trial of President Trump presumably comes to an end.

However, reaction to the spread of coronavirus is also affecting markets this week. Virus containment and market stabilization efforts have included extending the Lunar New Year through Monday and keeping markets shuttered.

Chinese stocks dropped 8% on Monday as the country continues to respond to the spreading virus, now reportedly infecting over 20,000 people worldwide. The drop wiped away nearly half a trillion dollars in value for the Chinese economy. In response, the Chinese government injected ¥1.2 trillion into the market by purchasing short-term bonds. We will continue to watch and see if the Chinese government attempts to further prop up stock prices by using their sovereign wealth fund, similar to what they had previously done in 2015 during a period of economic uncertainty.

U.S. markets have not been spared. As markets work to understand how the Chinese containment efforts may impact economic activity, the S&P 500 dropped 58 points on Friday, nearly 2%, but rebounded through this week on positive corporate earnings data (CNN Business). Friday’s market repricing and “safe haven” flow from equities to treasuries sent the yield on the benchmark 10-year Treasury yield plummeting to 1.51% – its lowest point since September 2019 (see chart below for further detail).

The equity rollercoaster also caused Federal Reserve observers to consider how the central bank may react. The CME FedWatch tool briefly showed a 20% probability of a quarter-point rate cut at the FOMC’s March meeting. With equities rebounding to begin this week, that probability has returned to near 10%, where it has been trending lately.

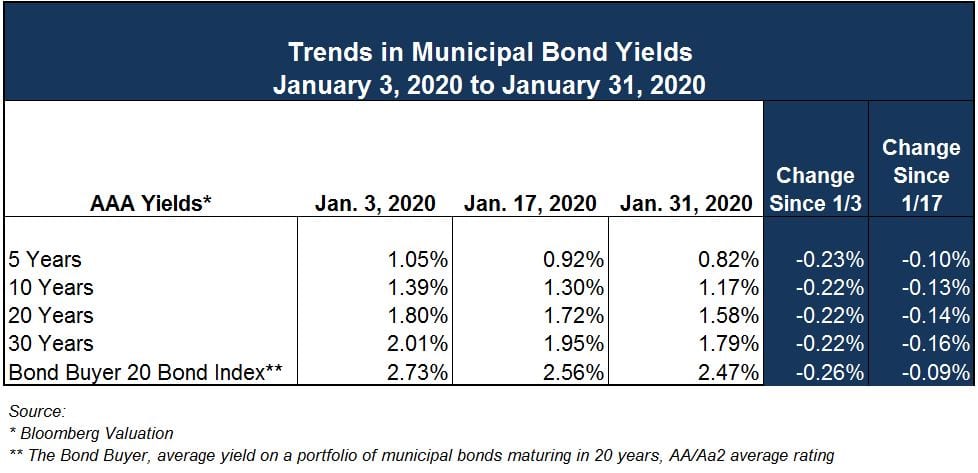

Municipal Yields Up From Record Lows

Municipal yields reached historic lows last week and are up just slightly this week. The 10-year AAA municipal yield reached 1.15% last Friday according to Refinitiv Municipal Market Data – the lowest level ever recorded! Kim Olsan from FHN Financial says that muni yields can expect to find “piercing resistance levels [at] an upward climb, if for no other reason than where both absolute yields and relative value ratios stand.” (The Bond Buyer) Even so, despite the rallies in both treasuries and munis early this week, we can expect increases in munis to be somewhat tempered as the market reassesses current supply/demand trends.

For this week, Refinitive Municipal Market Data shows the 10-year AAA yield was steady on Monday but increased 3 basis points to 1.18% on Tuesday; the 30-year yield also was steady on Monday but increased 3 basis points to 1.83% on Tuesday. Yields at these levels still represent an enormous opportunity to reevaluate refunding opportunities that may have seemed trivial or on the margin before.

The Bond Buyer reports that municipal funds are still reporting weekly inflows of over $1 billion which contributes to the sustained run of lower yields. The biggest story with municipals this week, like treasuries, is the back and forth with equities as investors look to reduce risk.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.