Market Overview

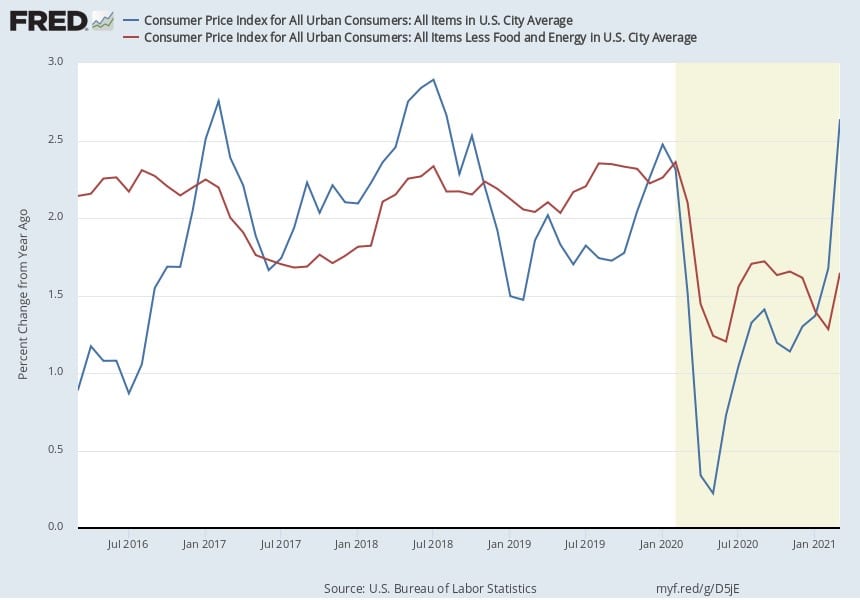

On Wednesday, the Bureau of Labor Statistics (BLS) released its monthly Consumer Price Index (CPI) for March 2021. CPI is largely used to track inflation. The data showed that the basket of goods and services making up the index increased 0.6% in March after having increased 0.4% in February. The March number was the largest 1-month increase since August 2012. The 12-month CPI increased by 2.6% – forecasters expected 2.5%.

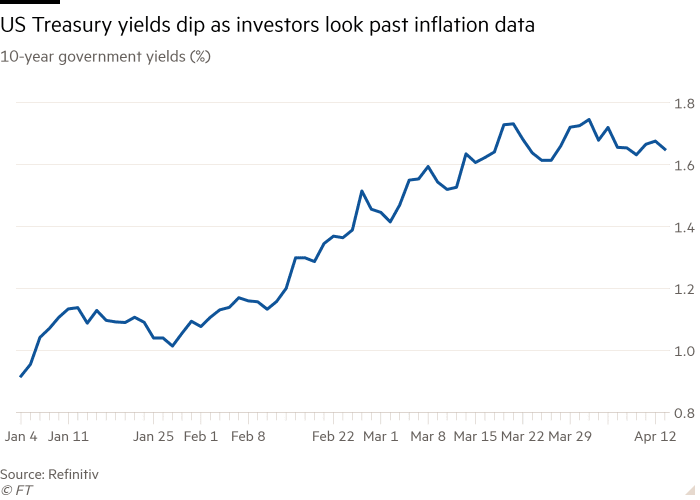

The markets reacted quickly to the news of the higher than expected inflation numbers and the yield on the 10-year U.S. Treasury note increased by 5 basis points (1 basis points = 0.01%) to 1.70%. However, it appears investors have given these data a big shrug, as the 10-year note yield then fell to 1.62% by the end of the day Tuesday. Overall, it seems that market participants had been prepared for an increase in the inflation index and there was no cause for panic, and the increase was already priced in. “Everyone knew prices were going to jump and it will take a string of months of significant surges with prices to get a bigger reaction in the market” said Edward Moya, Senior Market Analyst at online brokerage OANDA.

“The real question remains to what extent these figures prove transitory, as the Fed expects, or something longer lasting and we won’t know that until later this year” said John Leiper, Chief Investment Officer at Tavistock Wealth (MarketWatch).

In an interview with Bloomberg, St. Louis Federal Reserve Bank President James Bullard said that it’s too early to assess the Fed’s position on potential changes to the current “very easy monetary policy” (Bloomberg). Bullard said that inflation data are currently distorted based on how it compares to a year ago and that they will not consider substantial policy changes until the U.S. reaches the end of the “pandemic tunnel”. For example, Bullard stated that the he would consider policy changes to the Fed’s bond buying program once vaccinations reach about 75-80% and the Centers for Disease Control and Prevention (CDC) starts to acknowledge things are reaching the end (Bloomberg).

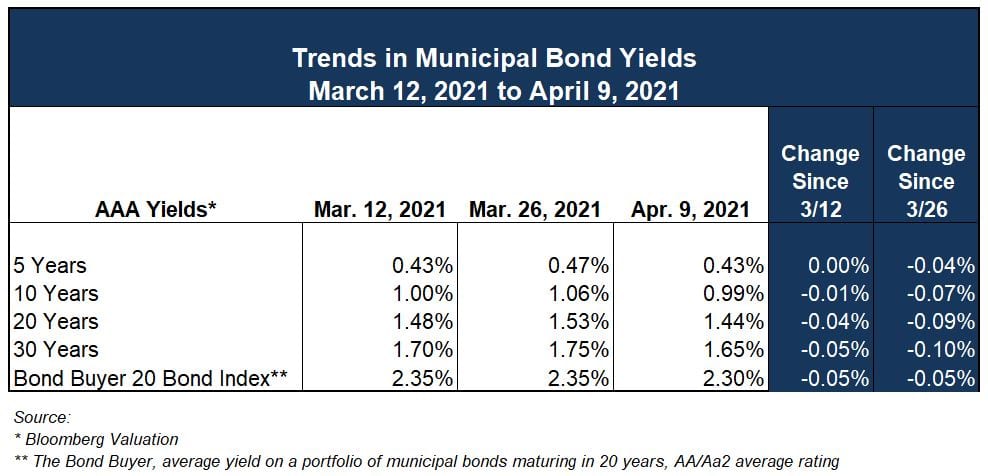

Trends in Municipal Yields

The latest data on municipal yields are showing a trend that is remaining mostly flat in April. Though indices had increased modestly in late February, they have remained mostly flat since then. According to Bloomberg Valuation (BVAL), the 10-year AAA municipal yield decreased by 1 basis point from 1.00% on March 12th to 0.99% on April 9th. This is consistent across the yield curve and shows that the uptick in yields that took place in late February and early March has subsided for now.

The 30-day visible supply as compiled by The Bond Buyer is higher than last month at just over $12 billion in competitive and negotiated issues expected to reach market in the next 30 days. This number was $10.8 billion a month ago on March 12th. However, 30-day visible supply is lower than it was a year ago and lower than the long run average for April ($13 billion).

President Biden Publishes Budget Guidance

President Biden’s administration released a $1.5 trillion outline for the 2022 Federal budget last week. The outline includes several areas targeted for major investments in the next Federal budget cycle. Below are some highlights from the document provided by the Office of Management and Budget (OMB) that relate most specifically to governmental entities:

- Overall discretionary spending increased by 16%

- Federal funding to school districts and individual schools with a concentration of low-income families would increase from $16.5 billion to $36.5 billion

- Overall K-12 funding would increase by 41%

- Transportation spending would increase by $317 million, including $110 million for a grant program to address transportation equity and capacity building.

- Community Development Block Grants to local government would increase by $295 million

- $3.6 billion would be spent on water infrastructure improvements for community systems, schools and homes

One major focus of the outline is that non-defense spending would increase to proportions more representative of historical federal spending, says NBC News. Though defense spending increases by 1.7% in the proposed plan, non-defense appropriations would reach the level of 3.3% of gross domestic product (GDP), which is closer to historical levels.

The deadline for Congress to adopt a 2022 budget is October 1st. Congress does have the ability to pass a continuing resolution, however if no deal is accomplished by the deadline. There is also the ability to pass a leaner budget with promises to address some of the bigger issues in separate legislation. Though, according to The Bond Buyer, it is expected that the 2022 budget negotiations will likely wait until after action is taken on the President’s infrastructure proposal.

Sources:

https://www.bondbuyer.com/news/biden-requests-16-federal-spending-increase-for-fiscal-2022

https://www.npr.org/2021/04/09/985718925/biden-proposes-1-5-trillion-federal-spending-plan

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.