Inflation, tapering, potential rate hikes, and ongoing pandemic worries dominate economic landscape

As COVID-19 cases spike (largely the result of the spread of the Omicron variant), inflation worries continue, and businesses deal with supply and labor market challenges, expectations for economic growth have slowed.

Economists surveyed in January by The Wall Street Journal ratcheted down their forecasts for annual growth in Gross Domestic Product to 3.3% for the current year from 3.6% in October 2021. In comparison, the consensus forecast for final 2021 nominal GDP is 5.2%.

Other notable results from The Wall Street Journal’s economists survey include:

- By the end of 2022, wage inflation is expected to cool slightly to an estimated 4.5% year-over-year increase in average hourly earnings.

- Survey respondents expect annualized inflation, presently at 7%, to moderate to 5% by mid-year. By the end of 2022, annualized inflation is expected to decline further to 3.1%.

- More than half of economists surveyed expect supply chain disruptions to persist at least until the second half of this year, with one third expecting disruptions to continue until 2023 or later.

- Two thirds of economists surveyed expect the Fed to start increasing the target range for the fed funds rate at its March 2022 policy meeting. Over half of the economists surveyed expect three, quarter-point increases to the fed funds rate this year, and nearly one-third expect more than three. By comparison, last October 5% of survey respondents expected a fed funds rate increase in March and over 40% expected no rate increases at all in 2022.

The CME’s FedWatch Tool implies a 91.6% probability of the target range for the federal funds rate increasing to 0.25% – 0.50% at the March meeting.

Inflation worries persist

Last week the U.S. Department of Labor reported that inflation finished 2021 at its highest levels since 1982, as measured by the consumer price index, which was up an annualized 7% in December verses a year earlier. December marked the third straight month in which inflation exceeded an annualized rate of 6%.

A report released by the Conference Board, a business research group, which surveyed more than 900 global CEOs found more than half expect price pressures to persist until at least mid-2023. U.S. executives cited labor shortages as the top concern for the year, followed by inflation and supply chain challenges, and ongoing COVID-19 disruptions. It is worth noting this data was collected prior to the Omicron outbreak.

How the Federal Reserve will respond to ongoing inflation concerns remains at the forefront for many market observers. Last year, the Fed largely viewed inflation as a “transitory” concern. The Fed’s response to this “transitory” inflation was slow and focused on keeping interest rates low with the expectation inflation would subside as the year unfolded, believing high inflation stemmed from supply chain bottlenecks associated with reopening the economy.

Late in 2021, comments from Fed officials, especially those of Fed Chair Jerome Powell, dramatically changed tone, striking the “transitory” qualifier when speaking about inflation and crafting policy statements upon conclusion of Federal Open Market Committee (FOMC) meetings. In prior periods of heightened inflation (e.g., the early 1980s), the Fed would generally embark on a campaign of increases to the fed funds rate, which has historically been its primary monetary policy tool. The trick was to do so at a pace and magnitude that wouldn’t necessarily hamper economic growth or spur a recession. Whether or not the Fed has been successful in those efforts is another discussion, entirely.

However, this time things are, indeed, different. The Fed’s balance sheet has grown to almost $9 trillion since 2008, about half of which is a result of its most recent asset purchase activities, which had previously been considered an “emergency measure.” The Fed’s first phase in normalization of monetary policy is to wind down asset purchases to zero, then evaluate prevailing data as it transitions to potential increases to the fed funds rate. The market has quickly migrated to a consensus that intermediate-term rates are likely to increase in the near term and an expectation that a series of fed funds rate increases will unfold over the remainder of the year. There is still plenty of uncertainty about the “when” and “how much” in this saga. This is further complicated by the activities of other global central banks and their progression towards removing policy accommodation, as well.

During congressional testimony last week, Fed Chair Powell stated inflation was a severe threat to the economy. In addition, there has been a steep drop in the number of Americans seeking jobs despite the higher numbers of job openings. Chair Powell noted in his testimony a strong rebound in hiring to draw workers into the workforce that aren’t actively seeking jobs now will require a period of long economic expansion, which in turn requires price stability. High inflation is a severe threat to achieving maximum employment. It might also be that it’s becoming abundantly clear that low interest rates are having no further practical effect on employment. Price stability has become the primary motivator of Fed policy, but there is little certainty that changes in monetary policy will alleviate the current logistical disruptions prevailing across the globe.

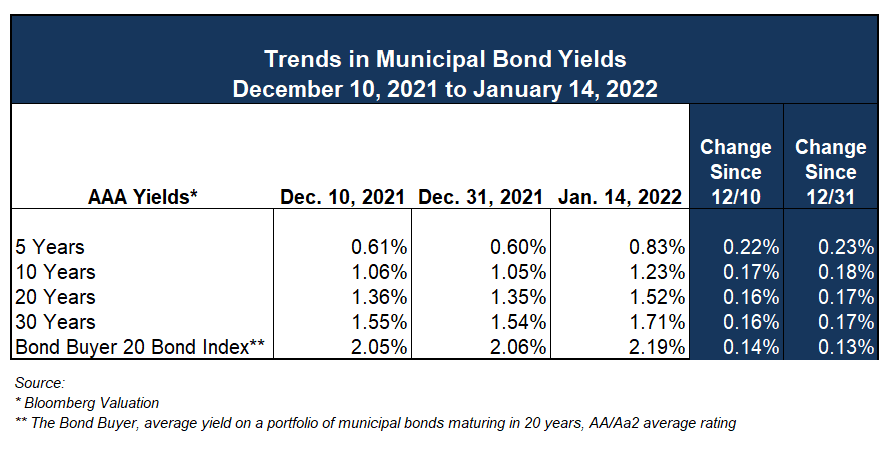

Trends in Municipal Bond Yields

Municipal bond yields have increased steadily across the curve since the beginning of the year. However, since the end of last week, yields have been mostly flat.

Strong demand was a large factor driving the municipal bond market in 2021. The S&P Municipal Bond Index had a total return for 2021 of 1.76%. That compares to -2.13% for the S&P U.S. Treasury Bond Index and -1.79% for the S&P U.S. Investment Grade Corporate Bond “A” Index. The S&P Municipal Bond High Yield Index had a total return of 6.77% for the year, as investors sought higher yields and credit spreads tightened dramatically.

New issue municipal bond volume is $7.12 billion for this holiday-shortened week, but volume is expected to pick up over the next few months, especially as issuers seek to secure funds for spring capital projects. Tax-exempt municipals still remain “rich” compared to taxable Treasury equivalents. We also note that rates in the 1 – 5-year portion of the curve are migrating higher compared to intermediate and long-term rates due to the anticipated effects of the Fed’s removal of monetary policy accommodation. We generally expect a higher level of volatility in rates, as the market sorts through the seismic shifts and related impacts. It is worth noting that, while rates are up from recent lows, they are still quite favorable from a historical perspective. Now is an excellent time to discuss capital plans in greater depth with your Ehlers advisory team.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.