While the Russian invasion of Ukraine will be watched closely for how it impacts the global economy (particularly energy), it has not changed immediate expectations that the Federal Reserve will embark on a series of increases to the fed funds rate throughout 2022.

The CME FedWatch tool projects an 87.6% probability the target range for the federal funds rate will increase 25-50 basis points (1 basis point equals 0.01%) at the March 2022 meeting of the Federal Open Market Committee.

Inflation remains elevated. The Commerce Department last week reported its personal-consumption-expenditures index measure of core inflation (the Federal Reserve’s preferred measure) rose an annualized rate of 5.2% in January from a year ago. That is up from 4.9% in December and marks the sharpest 12-month increase since April 1983.

Other data released by the Commerce Department indicates inflation is taking its toll. Income after taxes (adjusting for inflation) fell for the sixth straight month in January. The savings rate, defined as the share of income left over after paying expenses, fell to 6.4% in January, its lowest level since December 2013.

In addition, the University of Michigan Surveys of Consumers reported last Friday its measure of consumer sentiment fell to 62.8 in February, its lowest level in more than a decade. According to Director Richard Curtin, the drop was entirely due to a 12.9% decline among households with incomes of $100,000 or more. Interviews were conducted prior to the Russian invasion. “The Russian invasion of Ukraine is likely to increase inflation and job losses. This makes the task of the Fed even more challenging,” Curtin said. “Accelerating inflation has caused financial harm and growing angst among consumers, and prospects for retaliatory cyberattacks could cause added concerns about jobs and access to household funds. This will make finding the balance between the two Fed objectives (price stability and full employment) even more difficult and more critical.”

Looking ahead, geopolitical factors will be monitored closely. With inflation far above the Fed’s stated goal of 2.0%, the impact of the Russian-Ukraine conflict could push prices higher, especially for energy and other commodities, putting more pressure on the Fed to pursue more aggressive rate increases.

So far, only two Fed officials have publicly made comments in favor of increasing the fed funds rate by a half point at upcoming policy meetings. If there was an increase of a quarter point at each of the seven remaining Fed meetings in 2022, the fed funds rate at year end would range between 1.75% and 2.00%. This range is slightly higher than two years ago prior to the pandemic.

Federal Reserve Chair Jerome Powell has stated that inflation above 3.0% by the end of the year is unacceptable. While escalating inflation at the beginning of the year due to brisk demand and supply shortages was expected, the recent data is worse.

As we have stated repeatedly in this Commentary for the past several weeks, it is not about when the fed funds rate will increase it is about how quickly these future increases will occur. That still holds true, although economic shock could dampen the tone of Federal Reserve officials. Additionally, it remains to be seen how much impact removal of monetary policy accommodation will truly have on supply chains, many of which are global in nature.

Municipal Bond Issue Volume Drops Sharply

The Bond Buyer reports municipal bond issuance volume decreased 28.5% year over year in February. Total volume was down $10.571 billion. Taxable issuance was down 79.9% and new money issuance was down 28.1%. The light supply has produced an imbalance, as demand remains strong for bonds. Ehlers conducted 9 competitive bond sales the week of February 21, 2022 and the average number of bids per issue was six, even as global tensions were apparent.

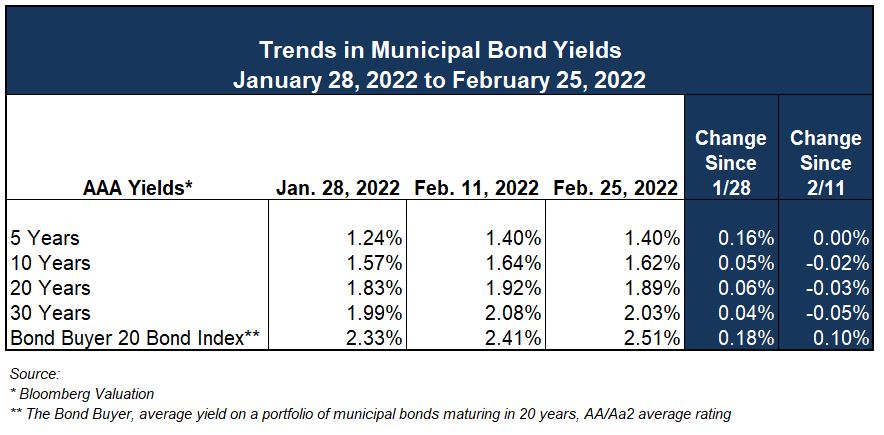

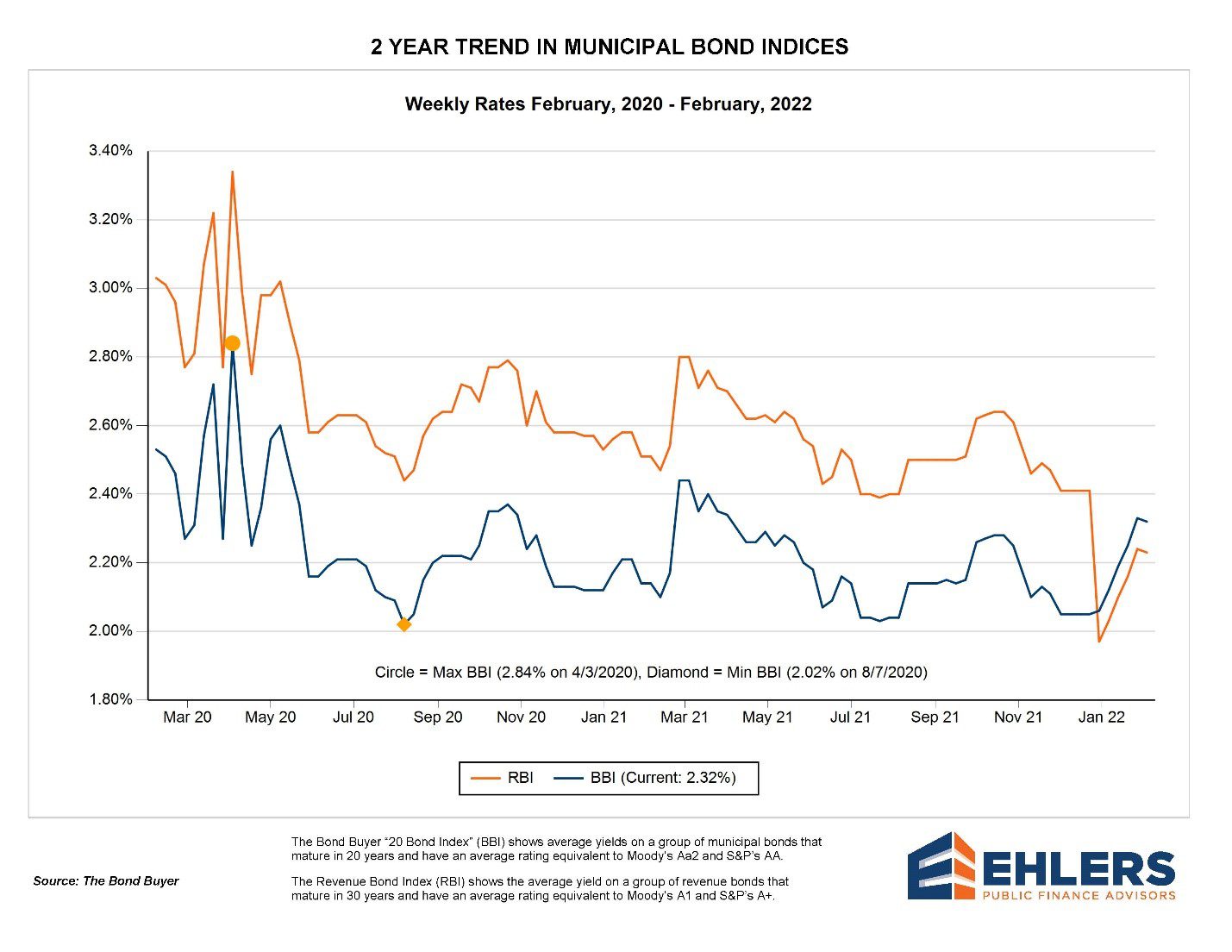

Over the past two weeks there have been modest declines across the yield curve. Ongoing conflict in Ukraine is compounding inflation concerns resulting in a flatter U.S. Treasuries curve and muni yield curve (short and intermediate rates stable and long rates declining). While rates increased sharply and more broadly at the beginning of the year, municipal bond indices are still below yields seen at the start of the pandemic.

Issuers still need to be mindful of long-term capital needs and investment. Please contact your Ehlers Municipal Advisor to discuss the current interest rate environment and evaluation of your capital and operational needs.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.