In the News:

- The Fed’s target interest rate level remains unchanged at 5.25% – 5.50% after the most recent FOMC meeting this week.

- Concerning the future path of interest rates and recent inflation data in the US, Powell stated [these] “haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road toward 2%.” Expectations of the first rate cut this year now center around the June 2024 meeting.

- Stocks rallied this week around optimism that the fed will be successful in orchestrating a soft landing for the US economy, pushing the S&P 500 towards its 20th record level this year.

Rate Indices:

Definitions:

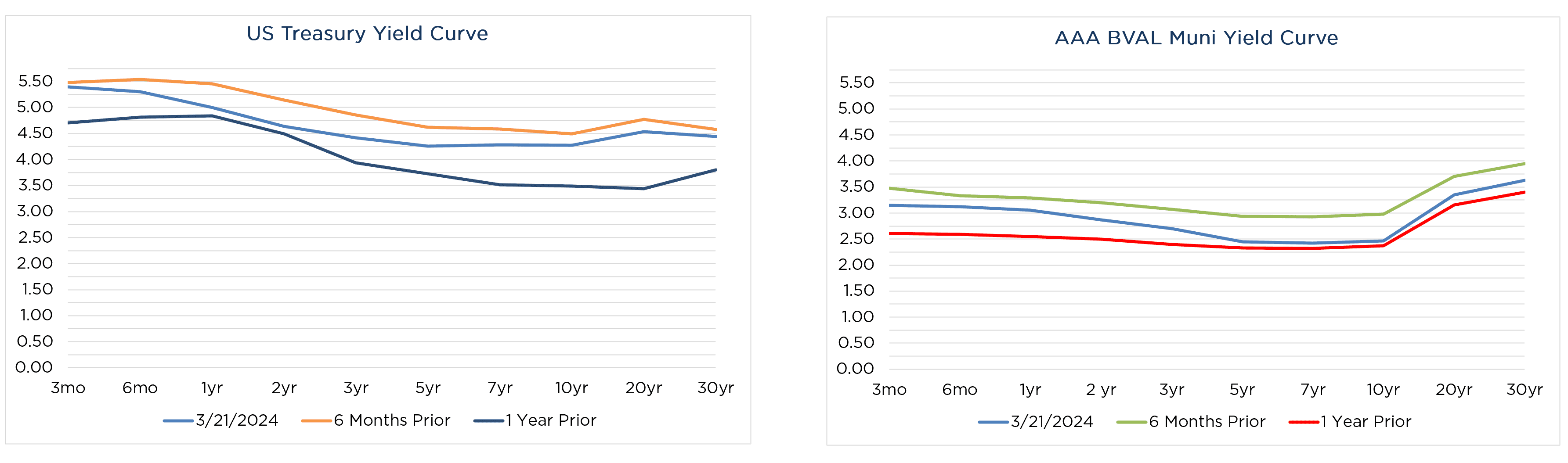

- BVAL AAA Curve = Bloomberg Valuation Service’s real-time and contributed sources tracking movement in the Municipal market.

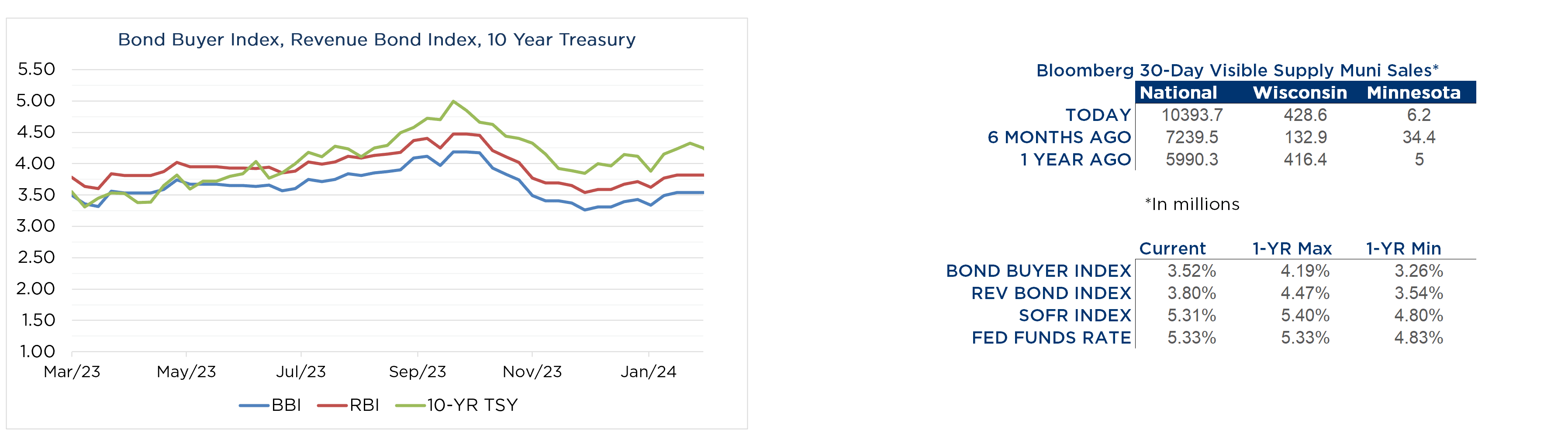

- BBI = Bond Buyer Index; a weekly index of municipal bond prices created by the Chicago Board of Trade and published by The Bond Buyer.

- RBI = Revenue Bond Index; a weekly index of interest rates on revenue bonds.

- 10-Year TSY = Yield of the 10-year U.S. Treasury on a constant maturity basis.

- SOFR Index = An extension of the Secured Overnight Financing Rate (SOFR), it measures the cumulative impact of compounding the SOFR on a unit of investment over time (i.e. One Year).

- Fed Funds Rate = Set by the Federal Open Market Committee, it guides overnight lending between U.S. banks.

*30 Day Visible Supply based on Bloomberg Fixed Rate municipal calendars. Excludes accreted value of capital appreciation bonds and short-term notes. Prior to March 7, 2005, values calculated using full calendar history.

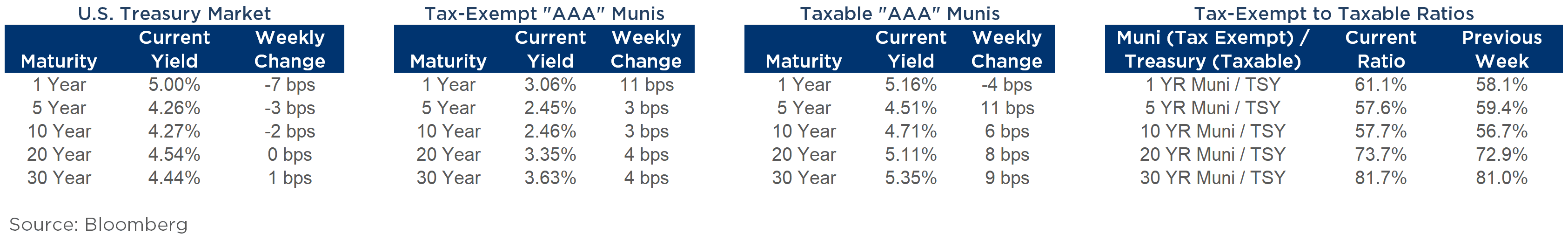

Source: Bloomberg – Rates as of 03/21/24

Resources:

EMMA New Issue Calendar

FRED Economic Calendar

Ehlers’ Upcoming Bond Sales & Recent Sale Results

Important Disclosures:

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.