In the News

- The Next FOMC Meeting is July 26, 2023 with a 92.4% probability of a 25 basis point hike and 7.6% chance of no rate change according to CME Group’s FedWatch Tool.

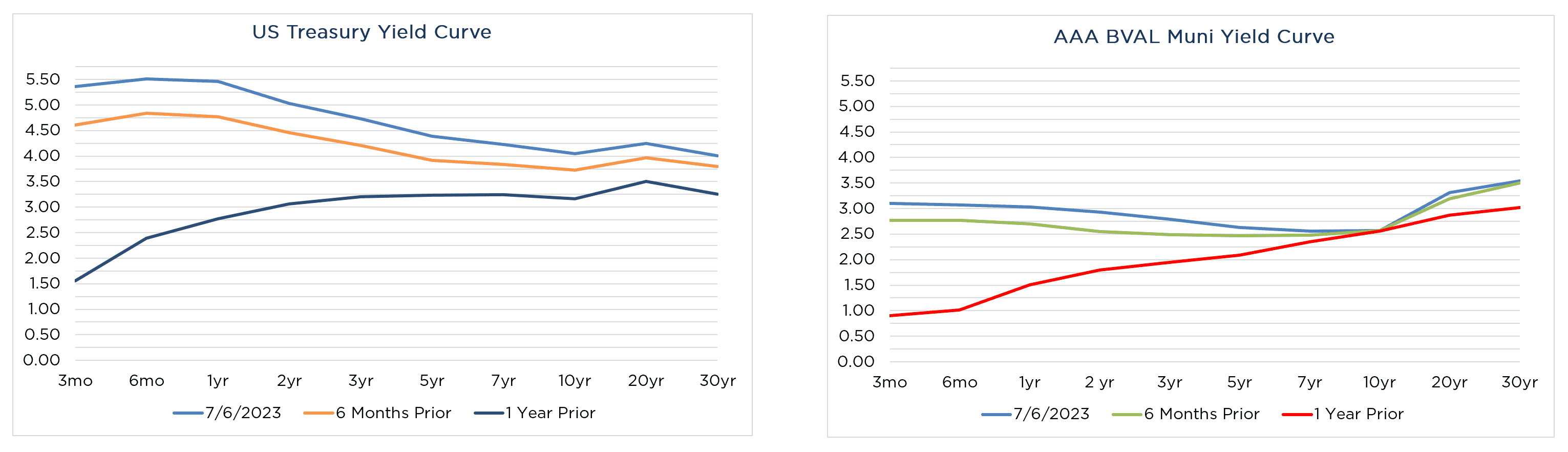

- Treasury yields rose across the curve after the ADP jobs report was released and extended their climb after data showing the service sector expanded in June at the fastest pace in four months.

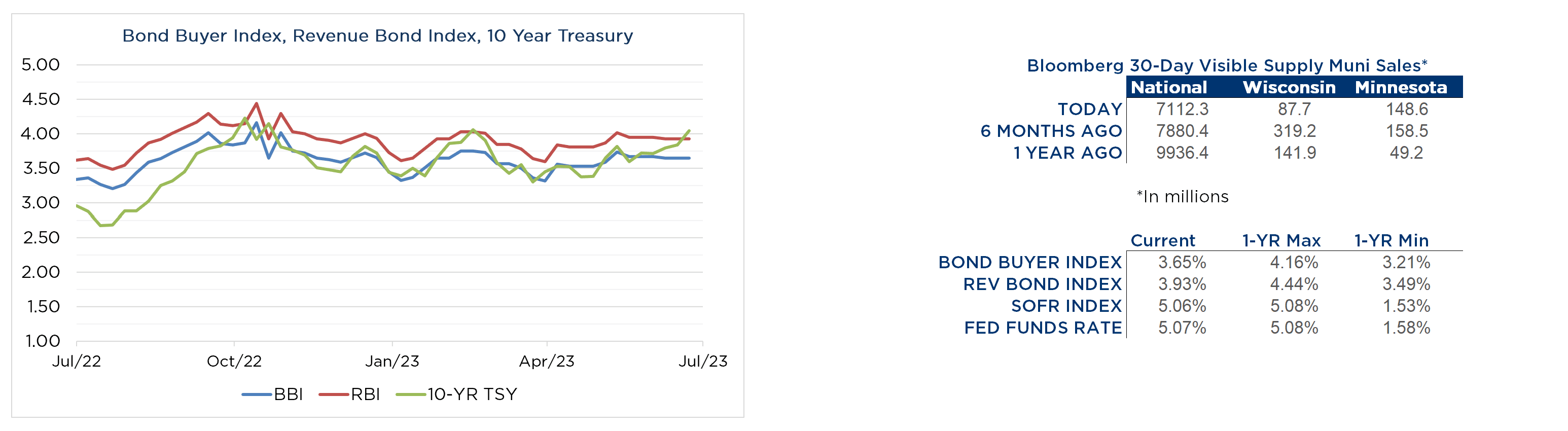

- Municipal-bond issuance nationally started to recover in June, marking the first month in 2023 where new issue sales rose year-over-year. Municipalities were likely waiting to see if rates would come down but eventually needed to tap the market for impending project needs.

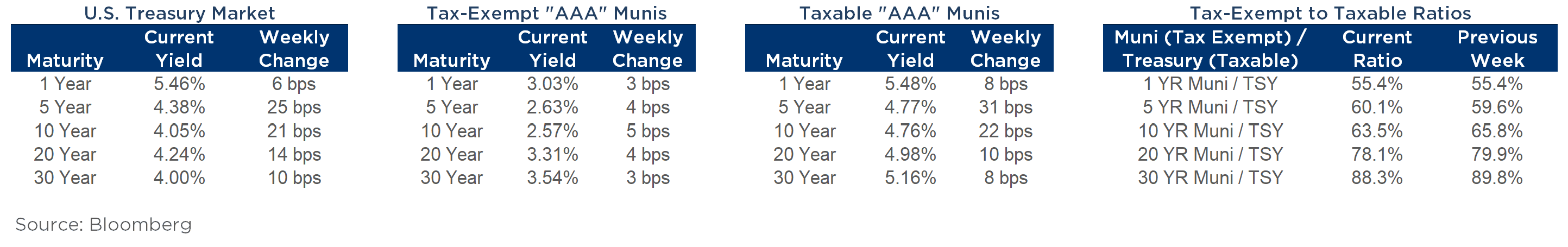

Rate Indices:

Definitions:

- BVAL AAA Curve = Bloomberg Valuation Service’s real-time and contributed sources tracking movement in the Municipal market.

- BBI = Bond Buyer Index; a daily index of municipal bond prices created by the Chicago Board of Trade and published by The Bond Buyer.

- RBI = Revenue Bond Index; a weekly index of interest rates on revenue bonds.

- 10-Year TSY = 10-Year Treasury index tracking the yield of U.S. Treasury Securities. It is closely watched as an indicator of broader investor confidence.

- SOFR Index = An extension of the Secured Overnight Financing Rate (SOFR), it measures the cumulative impact of compounding the SOFR on a unit of investment over time (i.e. One Year).

- Fed Funds Rate = Set by the Federal Open Markets Committee, it guides overnight lending between U.S. banks.

*30 Day Visible Supply based on Bloomberg Fixed Rate municipal calendars. Excludes accreted value of capital appreciation bonds and short-term notes. Prior to March 7, 2005, values calculated using full calendar history.

Source: Bloomberg – Rates as of 7/6/2023

Resources:

EMMA New Issue Calendar

FRED Economic Calendar

Ehlers’ Upcoming Bond Sales & Recent Sale Results

Important Disclosures:

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.