The monthly employment report that was released on Friday, July 2 showed that the U.S. added 850,000 jobs in June. This exceeded expectations, which were anticipated at around 720,000. Good news from the June jobs report is that factors which may have been seen as inhibitors to job growth, such as additional unemployment benefits, fears of the virus, and unavailability of childcare are easing, allowing more employees to return to work. However, the unemployment rate (5.9%) ticked up from the previous month (5.8%), which is higher than the consensus estimate of 5.6%. The unemployment rate prior to the pandemic hovered around 3.5%.

As the new data are teased apart, a few themes are noteworthy. First, average hourly earnings grew just 0.3%. This is lower than the previous month and may ease perceived tension of wage inflation. Growth in hourly earnings for April and May were 0.7% and 0.4%, respectively. The year-over-year increase in wages is 3.5%.

Second, the largest gains this month are in the leisure and hospitality sector, which added 343,000 jobs. By comparison, manufacturing added just 15,000. And though this is a big boost to the economy as re-opening unfolds across the country and consumer’s fears subside, the increase in jobs in this sector may result in moderation of growth in average hourly earnings, compared to previous months. The leisure and hospitality wages are among the lowest across all sectors. Finally, the labor force participation rate among workers aged 25 – 54 years, considered to be the prime working cohort, rose to its highest level since the pandemic began.

In terms of the Federal Reserve’s somewhat nebulous ‘substantial further progress’ threshold for jobs, the report was an indicator that the Fed is looking to a return to something close to a pre-COVID jobs level prior to taking major actions on monetary policy changes.

Federal Open Market Committee Meeting Minutes

Commentary following the June meeting of the Federal Open Market Committee was reported in our last publication. Since that time, the official meeting minutes were released, but not much new information was gleaned. The meeting minutes also didn’t reflect the announcement of the latest jobs report. The takeaway from the minutes seems to only be that the Committee began discussing the fact that they should soon talk about scaling back on asset purchases, though a consensus on the magnitude and timeline was not clearly stated. The bond market had an initial reaction of increases in yields, which quickly retreated to prior levels just before the announcement.

Muni Bond Supply & Trends in Yields

As the potential for a tax increase looms over investors, the demand for municipal bonds remains strong. For seventeen straight weeks, municipal bond funds have posted net positive inflows. The demand is so strong that some municipal bond funds have announced they would close to new investors.[1] High demand by institutional and retail investors is compounded by the lack of supply as municipal issuers await news on infrastructure spending or other infrastructure spending/programs from the federal government. Topping off the imbalance of supply and demand is the seasonality of the municipal market, generally. By summer, most of the bonds financing construction projects have been sold, limiting the number and amount of new issuance. In addition, the months of June through August have a relatively high dollar amount of maturities and optional redemptions (bond calls) than the rest of the year, leaving investors with plenty of cash to reinvest.

The Bond Buyer reports that total potential estimated volume for the shortened July 5 holiday week is $4.709 billion, while the 30-day supply is currently at $11.5 billion[2].

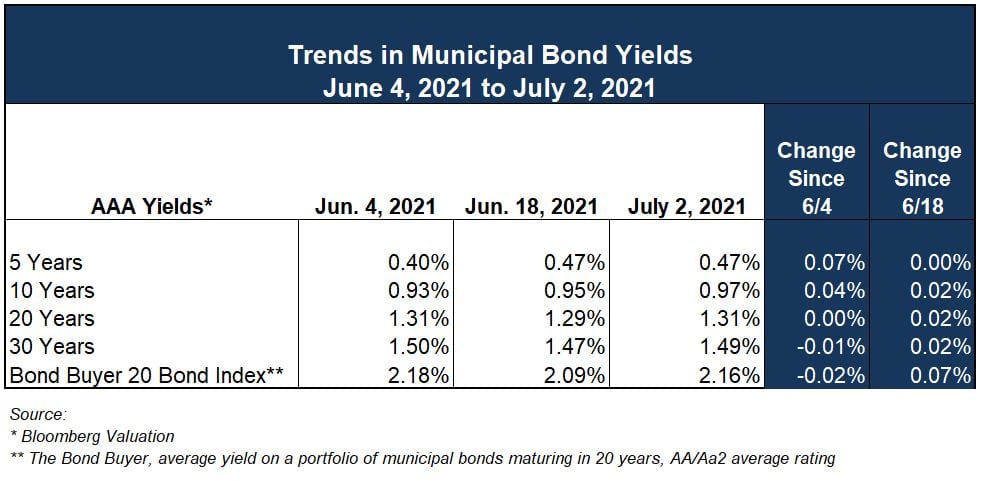

There’s little new to report in terms of municipal bond yield trends. Rates are continuing at historic lows, with little movement as a result of the release of economic data, FOMC meetings, or federal government action or inaction, for that matter. There remains some variation over the last month across the spectrum, as “AAA” yields reported by Bloomberg Valuation at the five-year maturity mark are up 7 basis points compared to a reduction of 1 basis point at 30 years. The increase on the low end of the maturity spectrum and a decrease at the longer end represent a movement toward a flattening of the yield curve.

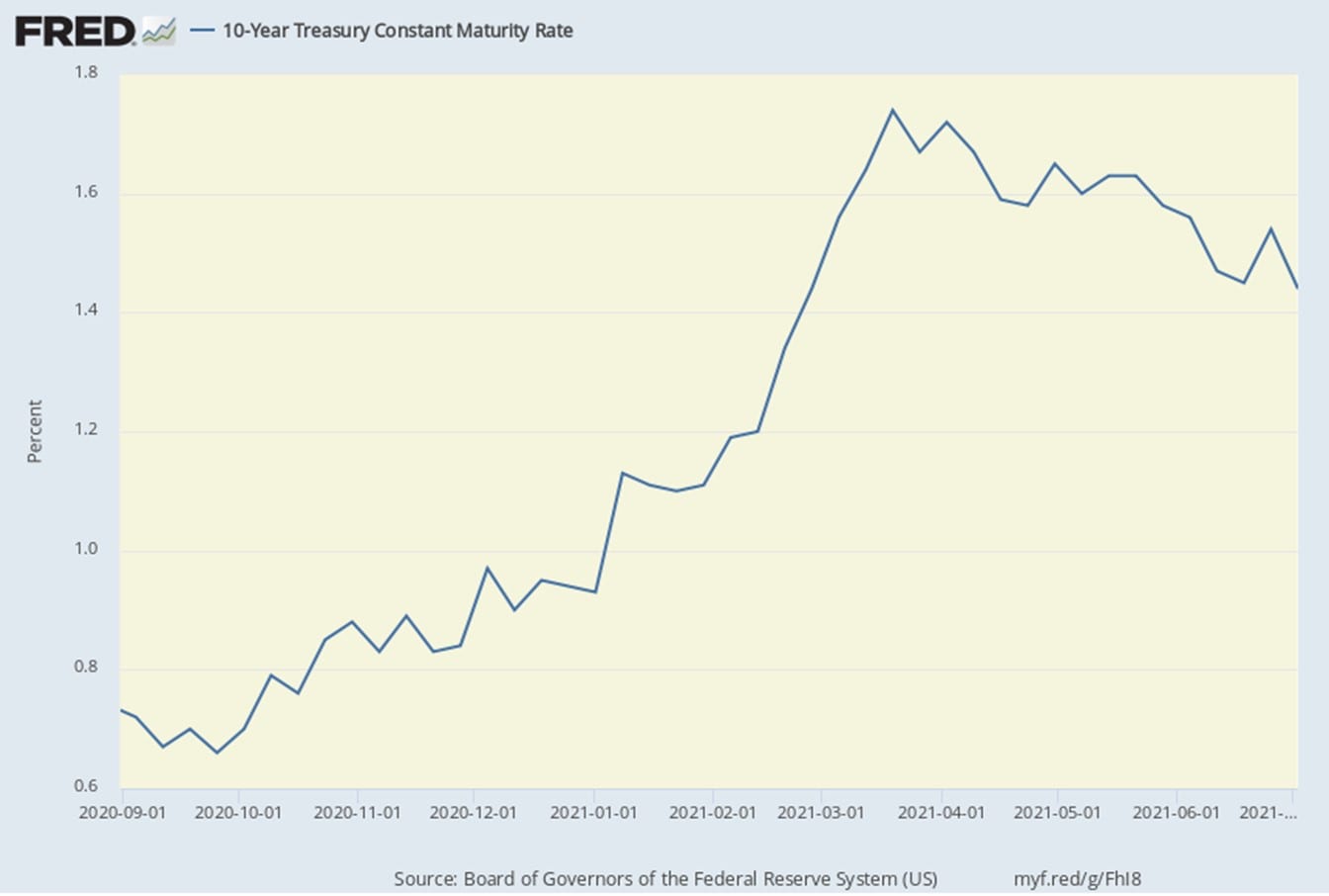

Comparatively the 10-year Treasury is down considerably from the high of 1.74% in March. Following this week’s release of economic data and possible concerns surrounding the delta variant, the yield has fallen to as low as 1.25%, then stabilizing around 1.30%. The last time it was this low was in February 2021.

As mentioned, the summer months may present refunding opportunities. Your Ehlers’ advisory team is regularly monitoring your outstanding debt for refunding opportunities, but don’t hesitate to reach out to discuss your refunding questions or anything else you might need to assist you with your financing needs.

[1] https://www.sec.gov/Archives/edgar/data/909466/000119312521154358/d359286d497.htm

[2] https://www.bondbuyer.com/news/muni-yields-grind-lower-on-day-2-ust-rally-as-fomc-minutes-offer-little-new

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.