The latest round of economic data revealed a mixed bag of news regarding the overall direction of the U.S. economy:

- Job growth stagnated in February with non-farm payrolls increasing by just 20,000, well short of economists’ expectations of 180,000. February was the worst month for job creation since September 2017. December and January job gains were revised upward, however.

- The unemployment rate of 3.8% was in line with expectations. A more all-encompassing measure used by economists (often referred to as the “real” unemployment rate) that incorporates discouraged workers, as well as those who hold part-time jobs for economic reasons, fell considerably to 7.3% from 8.1% in January.

- Average hourly earnings increased by 3.4% year over year (January 2018 – January 2019) compared to a 1.5% increase in the consumer price index during this same period.

- Finally, U.S. manufacturing output fell for a second straight month. Declining manufacturing output, weakening retail sales, and a sluggish start to the year with housing sales indicates the economy has lost some momentum in the first quarter.

Economists expect little growth in the first quarter. Goldman Sachs is forecasting gross domestic product will rise at a 0.6% annualized rate for the first three months of the year. Federal Reserve officials have commented they also see growth decelerating, citing weakness in China’s economy in addition to the U.S. – China trade war.

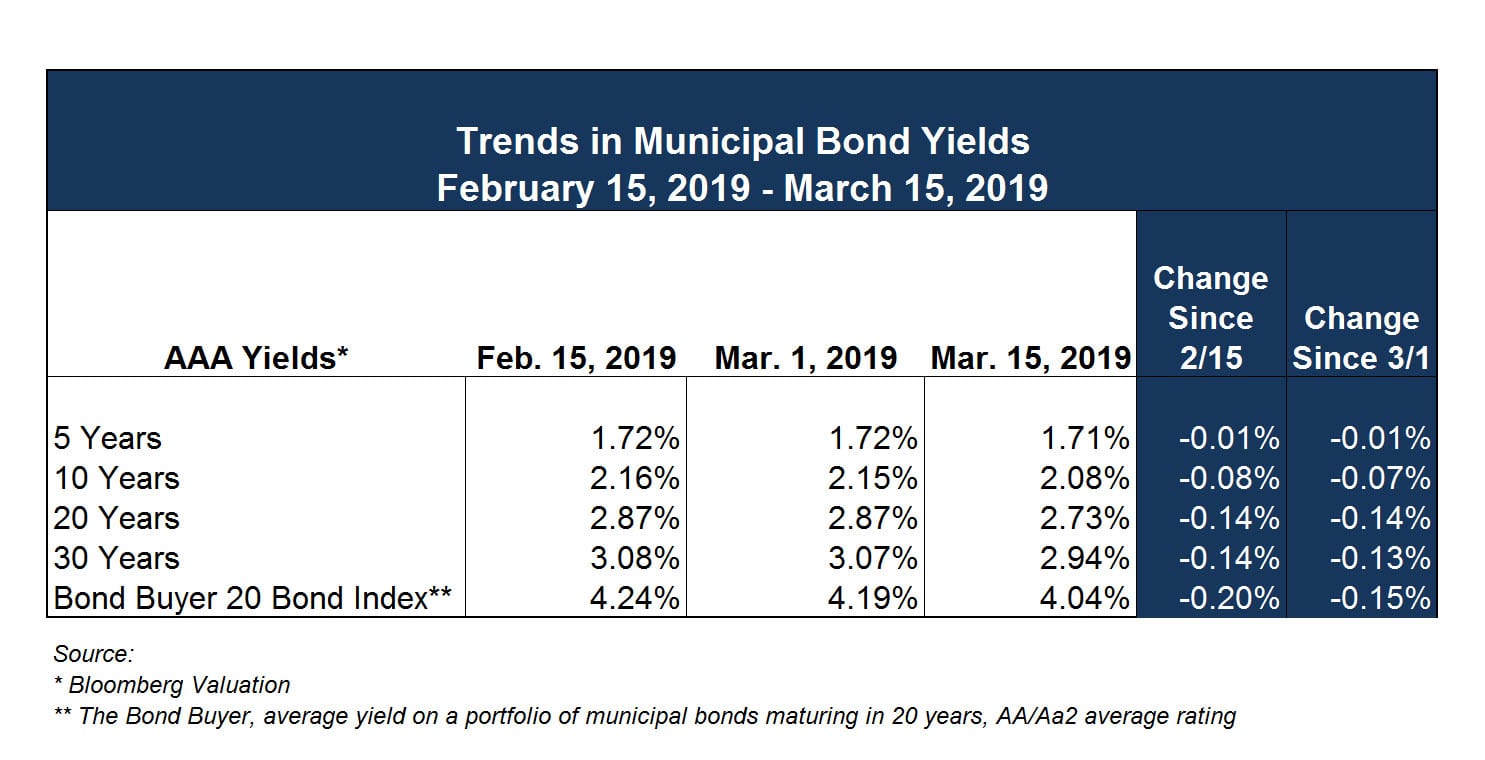

Municipal Bond Yields

In the municipal bond market both a dearth in new issue volume and yields continue to present a favorable backdrop for issuers. The Bond Buyer’s G.O. Index of 20-year general obligation yields ended the week of March 14th down five basis points to 4.04% from 4.09% the week prior. This index is at its lowest level since Sept. 6, 2018, when it was at 3.98%. The Bond Buyer’s Revenue Bond Index declined five basis points to 4.51% from 4.56% the week prior. Similarly, this index is also at its lowest level since Sept. 6, 2018, when it was at 4.49%.

As shown in the table below, from March 1 to March 15, yields on AAA-Rated muni bonds (as quoted by Bloomberg Valuation) changed very little at 5 years, but declined by 0.13% to 0.14% at 20 and 30 years.

Hope for Advance Refundings?

Democratic Rep. Dutch Ruppersberger of Maryland and Republican Rep. Steve Stivers of Ohio, co-chairs of the congressional Municipal Finance Caucus, are leading an effort to restore tax-exempt advance refundings. Tax-exempt advance refundings were eliminated as part of the 2017 Tax Cuts and Jobs Act. Advance refundings occur when issuers refund bonds more than 90 days before the refunded bonds are first callable. Previously the tax code had allowed an original issue of tax-exempt bonds to be advance refunded once on a tax-exempt basis.

Representatives Ruppersberger and Stivers could offer legislation as an amendment to broader infrastructure legislation before the House Ways and Means Committee. According to The Bond Buyer (March 13, 2019) Ruppersberger, a former Baltimore County executive who served in local government for 17 years, said tax-exempt advance refundings “take advantage of lower interest rates and saves not only our government, but our taxpayers, money.” Stivers and Ruppersberger stated that more than 70 of their colleagues have signed a letter in support of municipal bonds as a financing tool for infrastructure.

The Government Finance Officers Association (GFOA) and many other professional associations affiliated with state and local governments established positions and talking points to educate Congress on the value of tax-exempt advance refundings. Some of GFOA’s talking points include:

- Advance refundings previously allowed state and local governments to take advantage of lower interest rates by reducing debt service expense on outstanding debt. GFOA argues the prohibition of tax-exempt advance refundings forces issuers to essentially accept market conditions within the 90-day current refunding window and, unlike with home mortgages, takes away the ability of municipal issuers to refinance for debt service savings when interest rates are most favorable.

- By reducing their debt service expenses through tax-exempt advance refundings, states and localities are able to free up borrowing capacity for new investment in infrastructure and other important facilities.

- Limiting governments to a single tax-exempt advance refunding was a compromise that recognizes how important advance refundings are for states and localities, while respecting the interests of the federal government by minimizing the number of tax-exempt bonds outstanding.

Ehlers will continue to monitor these legislative efforts. The municipal bond market was not provided with much warning that the 2017 Tax Cuts and Jobs Act would eliminate tax-exempt advance refundings. If this proposed legislation gets traction, it provides an opportunity for issuers to re-engage their representatives on the value of these types of transactions and the potential benefits of restoring this option.

Investment Update

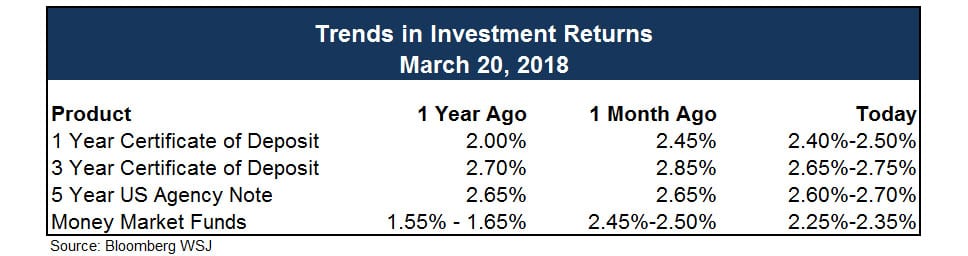

This week’s Federal Open Market Committee (FOMC) meeting has market watchers anticipating no change in the target range for the fed funds rate of 2.25 percent to 2.50 percent and a heightened focus on Fed Chair Powell’s recent semi-annual monetary policy testimony to Congress. Summaries of that testimony highlighted his view that the Fed will take a patient approach with monetary policy and that the Fed is close to agreeing on a plan to end the balance sheet runoff. Fed officials will submit new rate and economic forecasts, and those projections could offer clues about whether they still anticipate raising rates later this year.

Less than three months ago the 2018 December FOMC “Dot Plot” revealed a median expectation of two rate increases for 2019 and one in 2020 – a reduction from earlier projections of three rate hikes for 2019. The dot plot shows how each member of the FOMC projects the fed funds rate at certain intervals over the next few years, with one dot for each member. The chart suggests the Fed is still more inclined at this juncture to raise the target range for the fed funds rate sometime this year than it is to lower the target range.

The fed funds futures market remains confident that the FOMC will not be hiking rates in 2019, as the implied likelihood of a rate cut in January 2020 has increased to 39.9% from 26.0% just one week ago.

Source: Briefing.com

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.