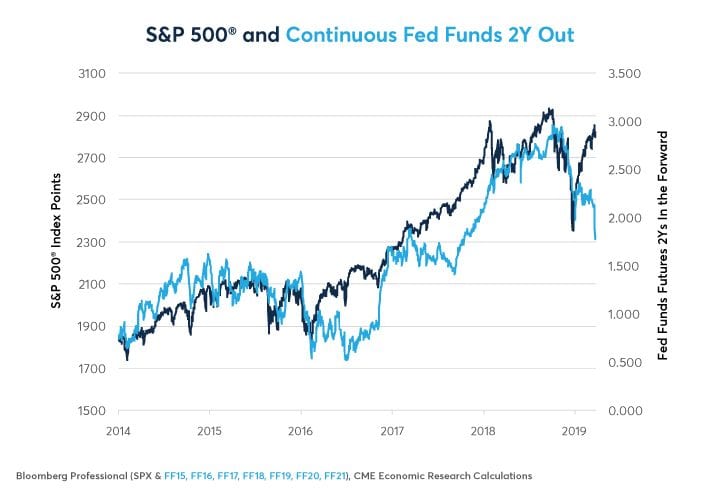

As we’ve highlighted in this Commentary previously, those who analyze the Federal Reserve (Fed) and its monetary policy-making body, the Federal Open Market Committee (FOMC), have indicated that no further rate hikes should be expected in 2019. The CME FedWatch tool currently lists the probability of any change at the next FOMC meeting on May 1st at 0.5%. Interestingly, that probability is on the rate-cutting side instead of the increase side. This is no surprise to those who have seen the 2018 rate hikes lead to ongoing criticism from politicians. Now, Fed-watchers are interested in a new phenomenon related to what has been an inverse relationship between the broader equity market (as measured by the S&P 500) and the expected future Fed Funds rate (as measured by the Continuous Fed Funds 2Y Out). This relationship has been strongly positively correlated since 2014 but has diverged in the first quarter of 2019.

Source: CME Group

This chart shows us that as the stock market has continued its bullish run in early 2019 the anticipation of a fed funds rate increase has declined.

According to CME Group, the only possible outcome given this environment would be for equities investors to adjust their strategy, causing stock prices to decline.

As long as the Fed is convinced that inflation is hitting its target at 2% and unemployment remains historically low it is unlikely the FOMC will shift their policy for the balance of the year. Stock market investors are looking elsewhere for economic signals, and in the past few weeks that has meant earnings reports, which are returning some positive news.

Source: CME Group

Municipal Bonds

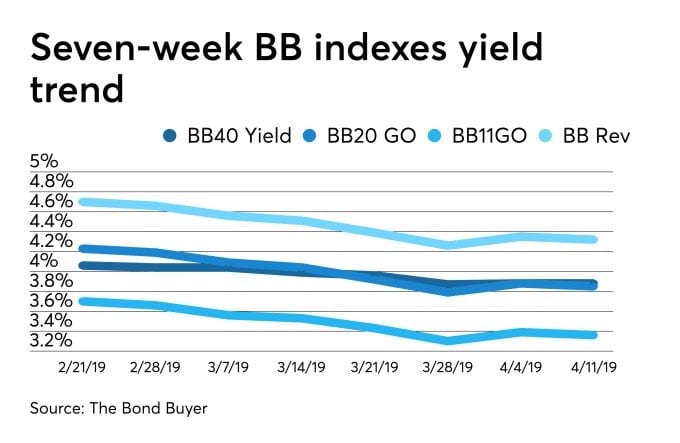

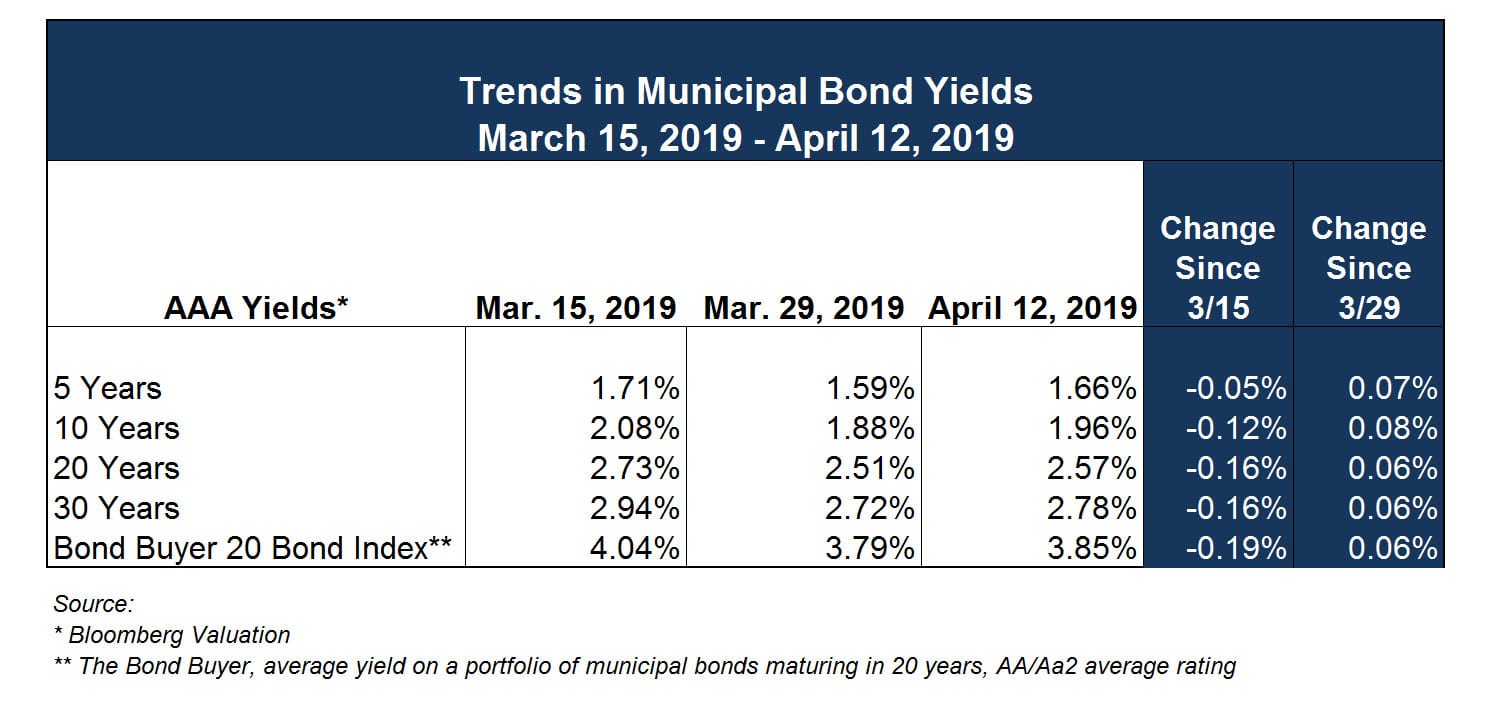

The market for municipal bonds continues to be robust and provide favorable rates for municipal issuers. The Bond Buyer reports that the seven-week trends for its indexes (20-year, 11-year, and revenue bond) were all down, while the 10-year Treasury remained flat and the 20-year Treasury notched up 2 basis points.

Source: The Bond Buyer

Municipal bonds have been trading better than Treasuries lately with Bloomberg reporting that the ratio of 10-year AAA yield to 10-year Treasury Notes is 76%. This ratio, known as the muni-Treasury ratio, compares the yield of a AAA-rated, tax-exempt municipal bond versus the yield of the taxable U.S. Treasury 10-year Note. Since April 1st, the yield on the 10-year Treasury Note has increased from 2.47% to 2.59%, while the AAA benchmark yield increased by 8 basis points from 1.88% to 1.96% during the same time.

Federal Budget Proposal

Last month the President published his 2020 Federal Budget proposal. It is worth discussing a few key components as they relate to capital budget priorities for municipal issuers. The President’s proposal is a window into the priorities that the President will set forth during the budget process; however, it is only a suggestion as the job of crafting the budget lies primarily with Congress, though the President still must sign it at the end.

In the proposal, the overall impact for Transportation would be a reduction by 19% which includes funds for direct grant programs (i.e. transit initiatives), as well as pass-through programs that help fund road maintenance projects. The proposal also would eliminate the Community Development Block Grant (CDBG) program, which has a current annual appropriation of $3 billion. The CDBG program helps fund economic development initiatives for local and state governments.

The proposal includes $200 billion for infrastructure improvements, which is the same as past proposals. Half of the infrastructure funds would be in the form of competitive grants to state and local governments, $20 billion would go toward financing low-cost loans for municipalities and expanded use of private activity bonds. $50 billion would go toward rural infrastructure, and the remainder would fund seed projects, as well as the Federal government’s own infrastructure.

This infrastructure plan has been talked about before, and as the budget process rolls along, it will be important to see how policy-makers address it. If it were to come to fruition in any form, that could mean major shifts in capital planning, as grant monies become available. Additionally, there would be new ways to finance projects. Issuers, therefore, would be expected to shift their strategy to accommodate the new programs (much like when the American Recovery and Reinvestment Act (ARRA) became law in 2009). Ehlers works with our clients to analyze all options for funding capital, including any Federal loan and grant programs that may be available. Your Ehlers team will stay on top of developments within the Federal and State budgets to ensure you are informed when making important financing decisions.

Investment Trends

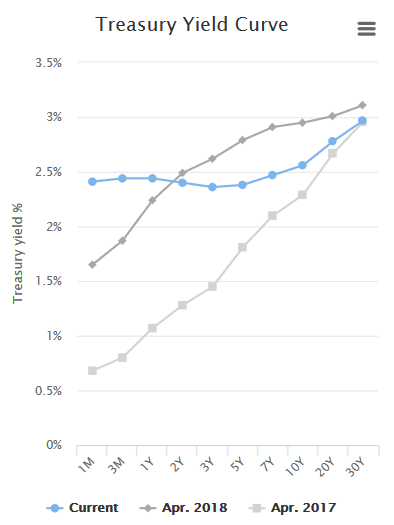

The short end of the US Treasury yield curve has remained relatively unchanged as compared to last month with 6mo, 12mo, and 2yr Treasury rates declining slightly by an additional 4-8bps.

US Treasuries and other public fund investments remain flat to inverted at certain points along investment curve, rewarding short term investors with higher returns. The historical relationship between yield curve inversions and the economy is well-known. When shorter-term rates are below longer-term rates (a normal curve), banks can lend profitably, as they earn the spread by borrowing at the short end and lending at the long end. But once the curve inverts, the absence of profitability leads to a reduction in lending, with the resultant tightening in credit conditions contributing to a potential recession. What remains unclear is whether the current yield curve inversion is a temporary, one-off situation, with the curve destined to flatten/steepen again, or the beginning of a more protracted inversion. But there is hope, with liquidity still ample amid tight credit spreads. The average return on invested capital (ROIC) for U.S. companies remains above both short- and long-term rates, while lower, longer-term rates are increasingly supportive of the housing part of the U.S. economy.

The Ehlers Investment team recommends investing in these current economic conditions with a strategy utilizing a comprehensive cash flow forecast to build a laddered portfolio, with an average weighted maturity of approximately 3 years, depending on circumstances. A laddered structure will allow for taking advantage of rising interest rates as maturing investments can be reinvested at higher rates and protect a portfolio if rates should continue to fall or remain inverted, thereby reducing the impact on overall portfolio performance.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.