The machinations of elected officials and monetary stewards in the nation’s capital are the primary focus of the news cycle and financial market participants.

The Federal Reserve’s Federal Open Market Committee (FOMC) concluded its meeting last week. As the monetary policy-setting body of the Fed, market participants have been keenly interested in the FOMC statement published at the conclusion of each recent meeting, as well as the comments from Fed Chair Jerome Powell that accompany those policy prerogatives. As expected, the FOMC left the target range for the fed funds rate unchanged at 0.00% to 0.25%. In its statement, the Committee acknowledged the improvement to the U.S. economy and overall employment. On one of the key topics of inflation, the statement’s language in this regard was unchanged from the prior meeting: “[i]nflation has risen, largely reflecting transitory factors.” On the other key topic of the Fed’s asset purchase program (often referred to as quantitative easing, or “QE”), the FOMC recognized the U.S. economy’s progress towards achieving the goals deemed necessary to taper asset purchases. However, the current purchase amount of $120 billion per month of U.S. Treasury and agency mortgage-backed securities purchases will continue unchanged. The Fed has remained steadfast that it will provide clear signals to the market on any intent to reduce its asset purchase program.

Chair Powell’s prepared remarks clearly held out the spread of the Delta COVID-19 variant and the lingering effects of the pandemic as presenting risks to the “substantial further progress” the Fed and FOMC need to see in order to induce any shifts in monetary policy. Additionally, Chair Powell largely reiterated the FOMC statement regarding the transitory nature of inflation pressures, while admitting that inflation could be higher than the Fed’s near-term target of 2.0%.

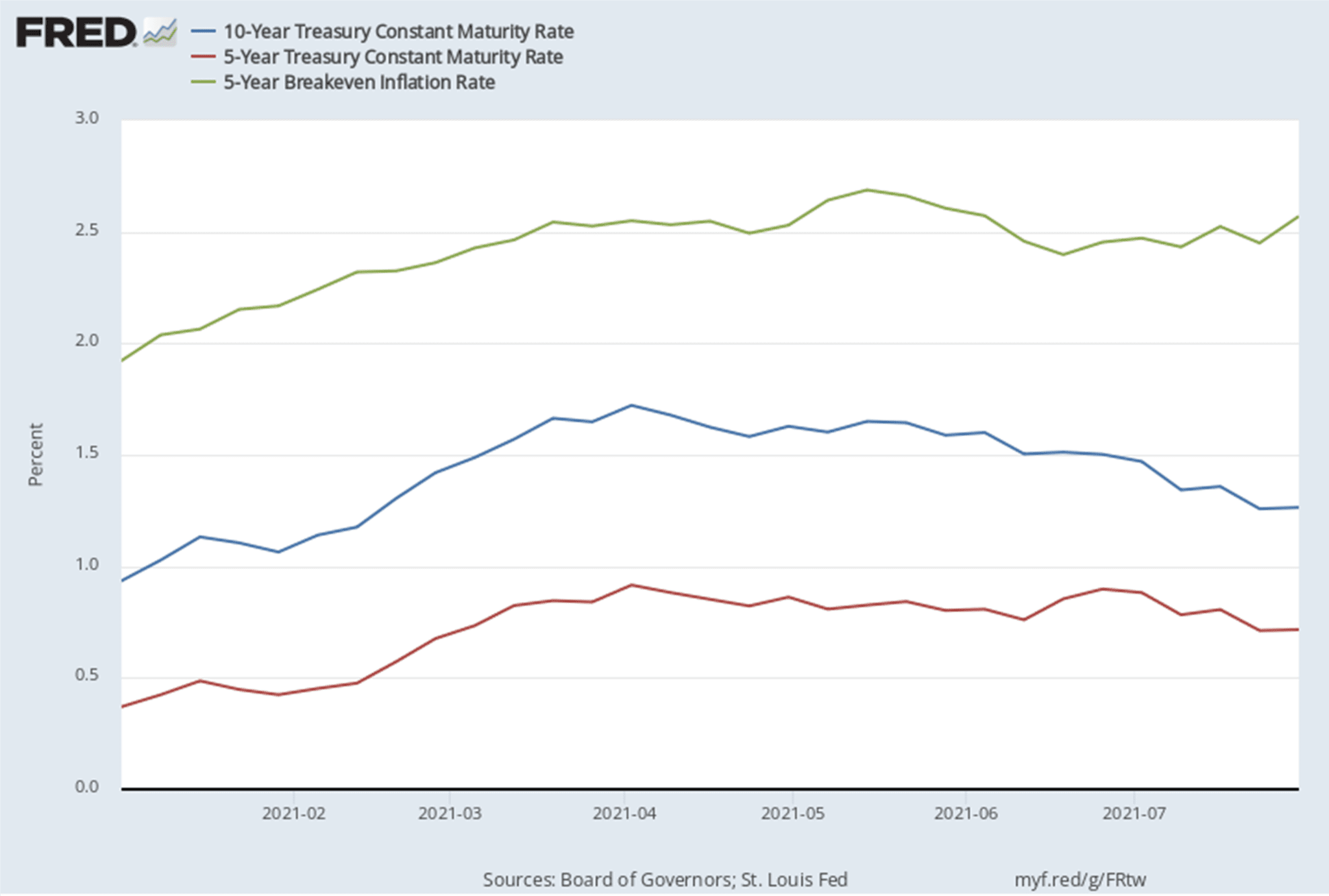

It seems the market tends to agree with Chair Powell’s assessment – at least over a longer forecast period. The 5-year breakeven inflation implied by comparing the yield on a 5-year U.S. Treasury Inflation Protected Security (TIPS) and the nominal coupon 5-year Treasury has hovered around 2.50% for the last few months, after reaching as high as about 2.75% in the early summer. This means that an investor would be indifferent between the return on an inflation-adjusted Treasury and its nominal counterpart if inflation averaged 2.50% over a five-year period. The current 10-year breakeven provides for a similar outlook. Inflation expectations are certainly higher now than they were at the beginning of the year but have recently abated.

Nominal Treasury yields have also declined meaningfully the last few weeks, including yields on the shorter-end of the interest rate curve through five years, which were rather sticky in comparison to falling yields at the ten- and thirty-year mark. The 10-year U.S. Treasury closed trading on Tuesday, August 3 at 1.18%, down from a recent range of 1.25% – 1.35%. The 5-year has declined to about 0.65% – below its recent high range of about 0.80% – 0.90%.

The chart below shows data from the Federal Reserve Bank of St. Louis’ “FRED” repository back to January 1 of 2021.

The Fed will undoubtedly be paying close attention to economic, employment and inflation data over the coming quarters as it divines its monetary course over the intermediate term. Tapering of asset purchases would likely come well in advance of any movement on the target range for the fed funds rate based on comments from Federal Reserve officials. It’s anyone’s guess as to the timing and magnitude, however. Inflation is expected to calm from recent highs, which were perceived as alarmingly high in comparison to the year-over-year comparisons to pandemic-induced lows for broad price measures. Employment remains a great unknown. Recent employment data has been lackluster, or at least below expectations and uneven, at best. The expiration of enhanced federal (and some state) unemployment benefits in September may reduce the amount of “noise” in various employment and labor data. That expiration itself is subject to the prevailing whims of Congress and the Presidential Administration.

Speaking of which, the political machine has been working overtime in the halls of the Capitol building. There has been much banter about various infrastructure, spending and tax packages, although the details have been few and far between. One important item that is a result of inaction relates to the federal debt limit. The Bipartisan Budget Act of 2019 suspended the federal debt limit until July 31, 2021. July 31 has come and gone, so the debt limit was “set” to $22 trillion as of August 1 and will not change without Congressional action. This state of affairs has caused the U.S. Treasury to invoke “extraordinary measures,” including suspension of the issuance of State and Local Government Series Securities (SLGS) Treasury obligations. SLGS are used by tax-exempt issuers and borrowers as investments for refunding and defeasance escrows, as they provide a means of targeting specific maturity dates. The interruption of SLGS availability means that issuers and borrowers will need to use open market securities when investing bond proceeds to advance (and sometimes current) refund and defease prior tax-exempt obligations. This is an inconvenience for those that had such transactions in progress and should similarly be a consideration for those contemplating a refinancing of tax-exempt bonds. Our municipal and investment advisors at Ehlers can assist you in crafting a calendar that allows for the use of open markets, as well as structuring and bidding refunding escrow investments. The earliest that Congress might address this issue is likely the first week in October after Senators and Representatives return from recess.

While both bodies of Congress deliberate over the debt ceiling, they will likely be preoccupied with what have been deemed differing pieces of “infrastructure” legislation with vastly different potential outcomes. The Senate is debating a bipartisan “package” that is currently priced in the range of $550 billion to $1 trillion, depending on how one measures such things. While broad brushstrokes have been agreed-upon, the devil will be in the details of what has been described as an almost 2,700-page bill that has yet to come out of any committee. Uncertainty on any legislation abounds, as key members of the House Democrat caucus have adamantly stated the Senate bill will not be heard unless accompanied by a larger piece of legislation with a stated dollar figure of $3.5 – $5.0 trillion. The Senate version is “paid for” in the context of repurposing available dollars and using other measures that don’t require additional federal revenues. House Democrats “pay” for their much larger legislation through some of those same measures, but also via tax increases. Only time and the prevailing political winds will tell how this all unfolds. For the time being, financial markets seem largely unaffected by the circus around them.

Municipal Market

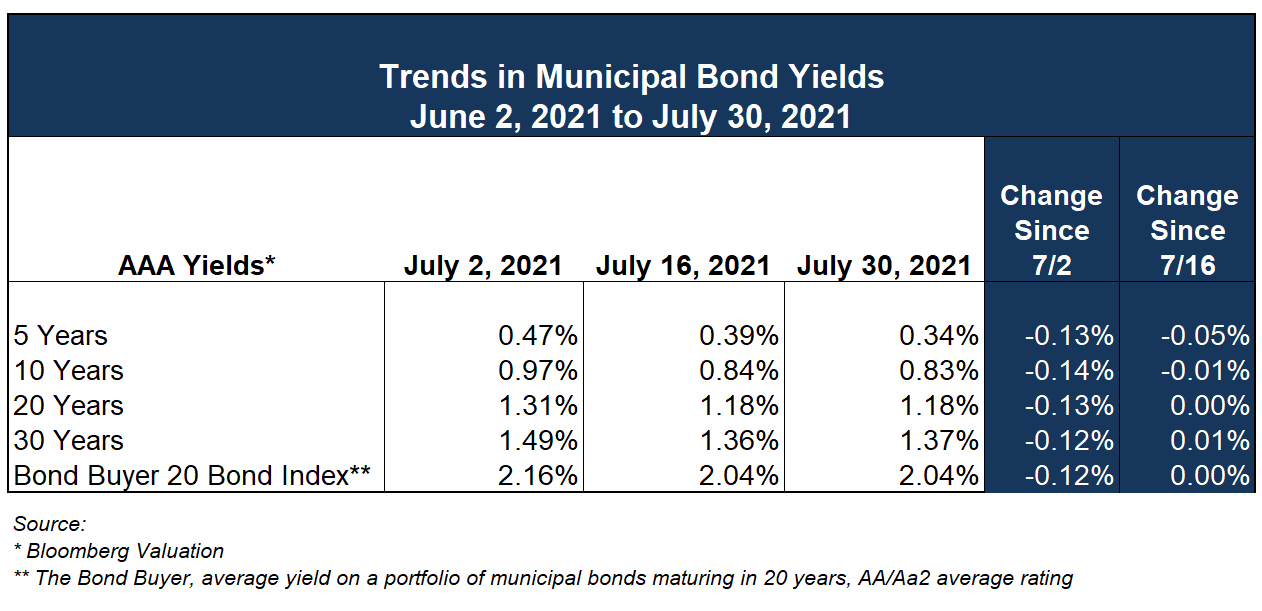

Municipal yields have been fairly stable the last two weeks in the face of slight declines in U.S. Treasuries, as alluded to above. AAA yields, as reported by Bloomberg Valuation, are down 10 – 15 basis points (one basis point = 0.01%) since the beginning of July.

With Treasuries outperforming (i.e., yields declining/prices rising more) comparable tax-exempt bonds, ratios of tax-exempt to Treasury yields have risen slightly. The current ratio at ten years is approximately 71%. This is actually low when viewed in a historical context but did reach lows in the 60% range in the last 18 months.

What we have consistently referred to as a “supply/demand” imbalance has persisted, although some strategists predict net new supply of over $140 billion through the remainder of the calendar year, as maturities and redemptions abate in the last two quarters against a backdrop of new money issuance. However, the recent decline in yields may lead to an increase in refinancings, which could further drive reinvesting activity.

This dynamic is set against uncertainty at the federal level with respect to the aforementioned infrastructure legislation, some of which would have dramatic impacts on corporate and individual income taxes. The dials could ostensibly move in both directions with increases in marginal rates, but also expansion of deductions, specifically repeal of the cap on State and Local Taxes (SALT). While absent from current legislation, there has been a consistent drumbeat of changes to the tax code to reinstate tax-exempt advance refundings and the potential for new varieties of direct-pay bonds issued as taxable obligations.

While we wait for more clarity from our friends in D.C., the Team at Ehlers stands ready to partner with you as you prepare for project financing and refunding of existing debt. We look forward to working with you.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.