The U.S. stock markets have been relatively stable over the past two weeks. From July 7 to July 21, all three of the major U.S. stock indices increased between 3% and 4%. Remarkably, the S&P 500 is within 3.6% of its all-time high (February 19).

Despite the strong stock market, it seems like new negative economic news and forecasts are released every day. The Federal Pandemic Unemployment Assistance, which provides up to $600 per week in additional unemployment compensation, will expire at the end of July. There are concerns that this could worsen financial distress for many Americans, resulting in missed mortgage and rent payments and ultimately growing evictions and foreclosures. Additionally, both United Airlines and American Airlines recently warned employees of the potential for tens of thousands of furloughs. Many retail companies have announced store closings, along with a litany of restaurants, bars and other hospitality-related businesses that have shuttered across the country. As state and local governments cut budgets in response to a loss in tax revenues, some are beginning to announce potential layoffs.

With new unemployment claims continuing to exceed one million per week, the enduring effects of the coronavirus are still top of mind for many. Federal policymakers have for weeks been discussing a new stimulus package, possibly including an extension of federal unemployment assistance, payroll tax cuts, and direct assistance to local governments and schools. The House passed a $3 trillion stimulus package in May, but the Senate has yet to reach consensus on their version. On July 22nd, Senate Republican leadership and White House staff reportedly agreed to key components of a stimulus package, increasing the chances that a new bill will be approved within the next two weeks.

Muni Yields Decline

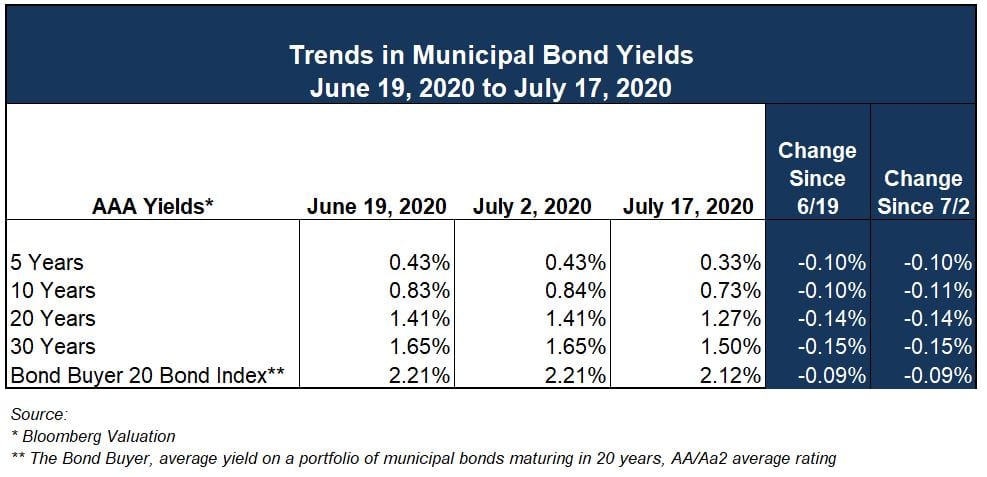

As shown in the table below, yields on municipal bonds (as measured by Bloomberg Valuation) declined by 10 to 15 basis points (0.10% to 0.15%) from July 2 to July 17. Over the preceding two-week period, from June 19 to July 2, yields had been steady.

These yields are very low by historical standards. For example, the 10-year yield was at 2.44% on July 17, 2018 and 1.57% on July 17, 2019.

Market participants continue to report strong demand for munis. For the week ending July 15, tax-exempt mutual funds reporting to Refinitiv Lipper saw $857 million of net inflows – the 10th consecutive week of net inflows.

Another closely watched measure in the muni market is the “muni-to-treasury” ratio, measured by the ratio of the MMD 10-year AAA tax-exempt yield to the 10-year U.S. Treasury yield. This ratio had been in the range of 70% to 75% for most of the last two years. (Muni yields are historically lower than treasury yields because interest earned on munis is exempt from federal income taxes.) In March, when COVID-related shutdowns first took effect, treasury yields plummeted, and the 10-year muni-to-treasury ratio increased to over 200%, presumably because investors perceived much greater risk with munis than with treasuries, along with the fact that U.S. Treasuries trade in a global market, while municipals are largely a national market. The ratio has been declining gradually since March, and, as of July 21, was at 119.9%.[1] When and if economic conditions improve significantly, the ratio could decline further – either due to increasing treasury yields, declining muni yields, or both.

MSRB Report on Competitive Bidding for Municipal Securities

The Municipal Securities Rulemaking Board (MSRB) is a self-regulatory organization which plays an active role in regulating and supervising the market for municipal securities. The MSRB regularly publishes “white papers” and other reports regarding the municipal securities market. They recently released a report that reviewed the relationship between the number of bids on a competitively-sold municipal securities primary offerings and the resulting cost of capital (yield) for the issuer.[2]

The report notes that there are three primary methods by which municipal securities are issued:

- Competitive bidding, in which issuers request underwriters to submit a firm bid to purchase a new issue of securities.

- A negotiated offering, in which the issuer works directly with a specific underwriter or underwriter syndicate to negotiate interest rates, call features, purchase price, and other terms.

- A private placement offering, in which an issuer or a placement agent sells a new issue directly to an investor or a limited group of investors.

In all three methods, the issuer is often assisted by a municipal advisor.

The MSRB study examined trends in competitive municipal offerings from January 2009 through June 2019. Some of the primary conclusions of the study are summarized below.

- The percentage of sales for which the competitive bidding method was used increased from under 40% in 2009 and 2010 to over 46% in 2018 and 2019.

- The average number of bids received per issuance gradually increased over the period studied, from an average of 4.4 bids in 2009 to an average of 5.7 bids in the first half of 2019.

- The “bid spread” (i.e., the difference in yield between the winning bid and other bids) declined over the study period.

- There was a “negative association” between the number of bids received and the bid spread. In other words, the average bid spread was smaller for sales with larger numbers of bids received.

The full MSRB report is available here: http://www.msrb.org/Market-Topics/Reports.aspx

It’s important that issuers consult with their municipal advisor prior to determining the method of sale for their financing, which is consistent with GFOA best practices. When issuing securities is deemed advisable, there may be merits to either a competitive or negotiated offering. Similarly, there may be occasions where a private placement is warranted as the preferred solution to achieving the issuer’s financing objectives. Your municipal advisor has an obligation to recommend the method of sale that is in your best interest. If you are considering accessing the capital markets in the near future, our team of advisors at Ehlers would welcome an opportunity to speak with you.

[1] The Bond Buyer, July 21, 2020.

[2] Municipal Securities Rulemaking Board, Competitive Bidding for Primary Offerings of Municipal Securities: More Bids, Better Pricing for Issuers?, July 2020.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.