Chairman Powell Speaks Publicly Prior to May FOMC Meeting

Federal Reserve Board Chair Jay Powell spoke publicly alongside European Central Bank President Christine Lagarde prior to the next month’s Federal Open Market Committee (FOMC) meeting scheduled for May 3-4.

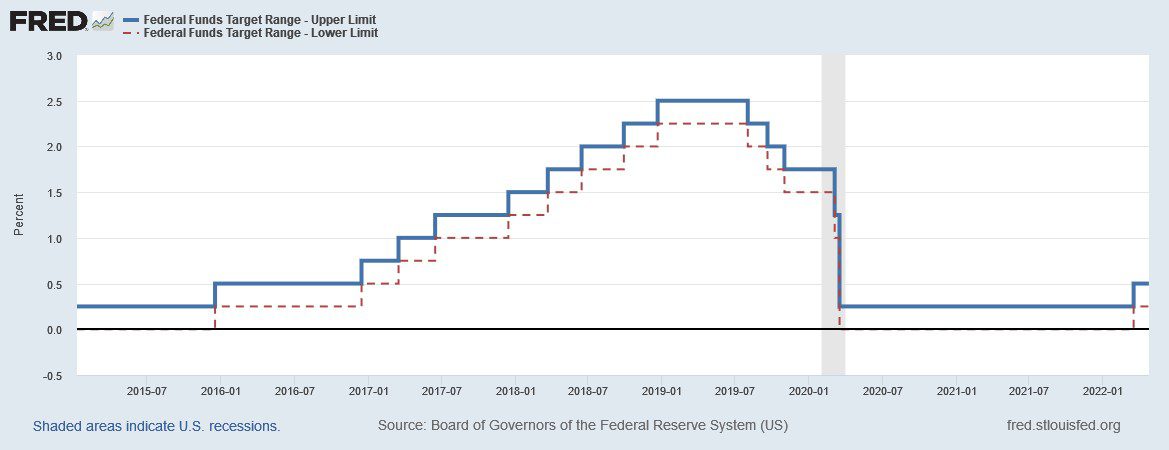

During a panel discussion hosted by the International Monetary Fund, Chair Powell addressed many points that largely suggested unanimity among FOMC members to take more aggressive measures to curb inflation. Some members have outright stated as much in public forums. The collective comments of these Fed officials strongly imply that a 50-basis point (1 basis point = 0.01%) increase in the target range for the federal funds rate will be announced at the conclusion of the next FOMC meeting. This would be the first half-point increase since 2000. Chair Powell’s comments were further interpreted to mean that additional half-point increases could continue into the summer meetings, leading to significant declines in major stock market indices last Friday. Markets have been very much reconsidering prior consensus around quarter-point rate increases over the seven remaining FOMC meetings in 2022. The last rate hike cycle (see below) was entirely comprised of 25-basis point increases. Decreases to the target range were varied, and far larger, given they occurred during periods of financial distress, most recently the global COVID pandemic.

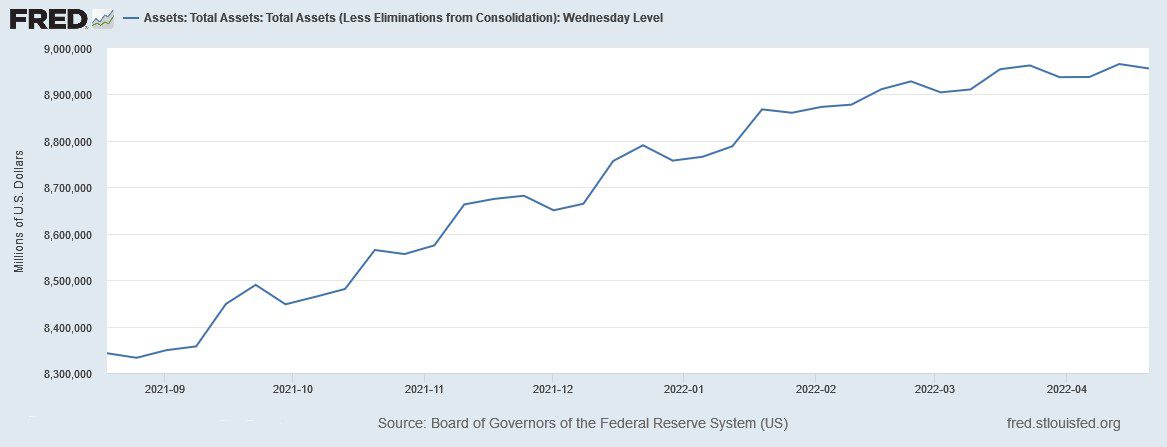

In addition, the Fed is continuing its quantitative tightening campaign, having eliminated asset purchases in March of this year and contemplating reductions in the asset portfolio. The current size of the asset portfolio is nearly $9 trillion, more than double its size as recently as the beginning of 2020. The markets are keenly focused on how the Fed will strike a balance of fed funds rate hikes and quantitative tightening in relation to economic growth and financial market conditions.

Municipal Bond Yields

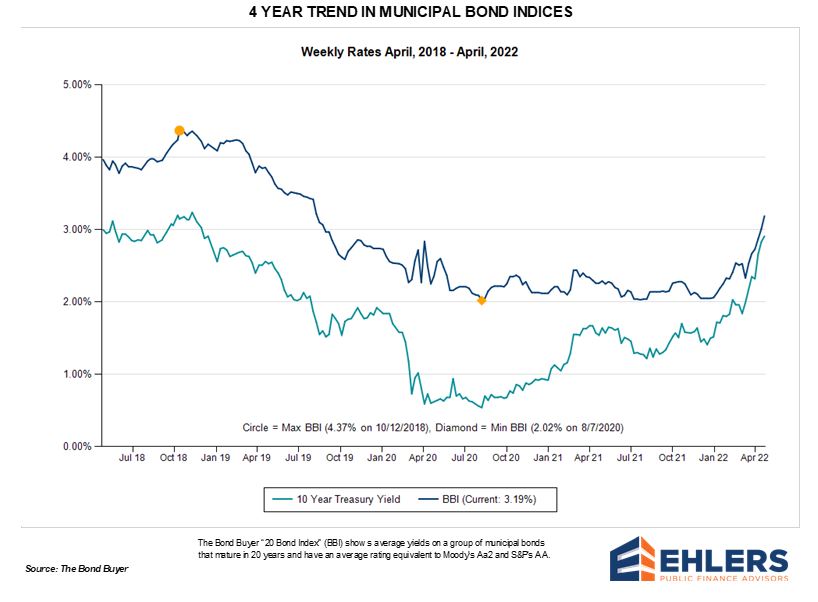

Fixed income investors are intently focused on the efforts the Fed is making toward combating inflation. As rates have materially increased from their absolute lows, redemptions from municipal bond funds have forced portfolio managers to sell holdings. The pace of outflows has been steady since the beginning of the year. Refinitiv Lipper reported $4.3 billion in outflows in the previous week. This dollar figure accounts for roughly 4% of total assets under management. It’s always helpful to put numbers into context. The outflows the market is currently experiencing are less than what occurred during the “taper tantrum” of 2013 and more measured than the scale and speed at which outflows occurred in 2020, following the onset of the COVID-19 pandemic, with $24 billion of outflows occurring over a two-week period.

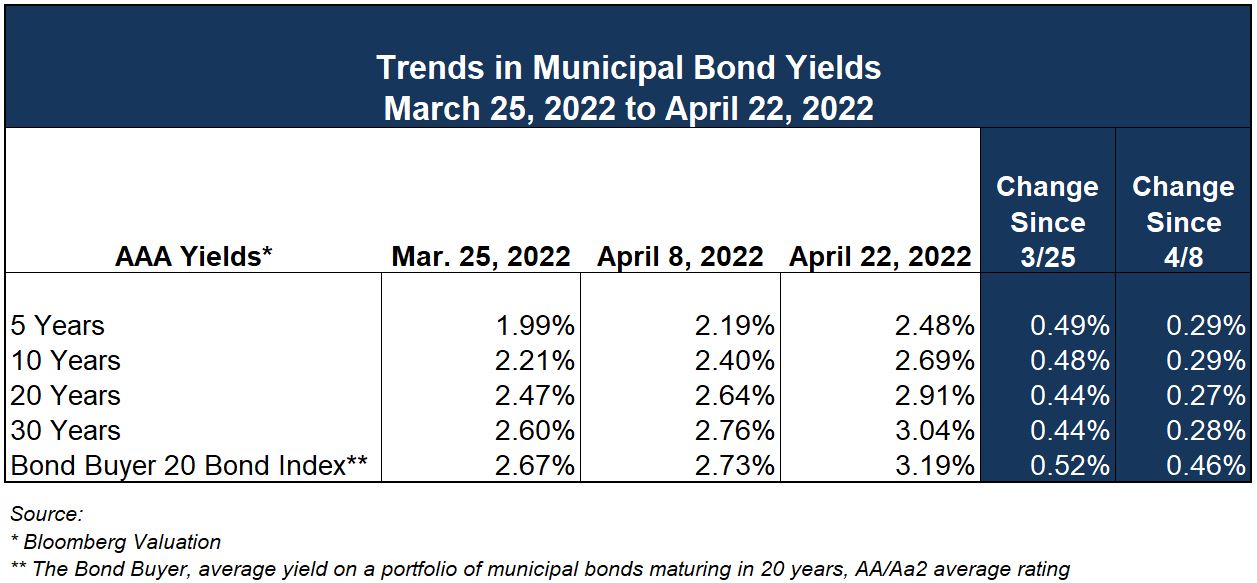

Week-over-week changes in AAA, tax-exempt yields were fairly uniform across the maturity spectrum. Month-over-month, yield increases were more heavily felt on the short end of the interest rate curve. The 30-year “AAA” benchmark reached the 3.00% mark for the first time since March of 2019.

Muni-U.S. Treasury ratios have been relatively stable and are presently around 80%, 91% and 103% at 5-, 10- and 30-years, respectively, according to Refinitiv MMD. Municipal bond yields have recently tracked rather tightly with U.S Treasury equivalents.

Volatile times call for a measured approach to your long-term capital planning needs. A comprehensive perspective that takes your unique circumstances into consideration is what is needed during times like this. Don’t hesitate to reach out to your Ehlers Municipal Advisor to help your community navigate your goals and objectives.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.