U.S. Labor Department Reports Record Job Quits

A report released Friday, November 12, by the U.S. Department of Labor noted a record 4.4 million Americans quit their job in September. The total number of jobs available is 10.4 million, well above the 7.68 million people looking for work. The quits rate (number of quits in the month as a percent of total employment) increased to 3% in September, which is also a record dating back to 2000. Quits increased across multiple sectors, most notably in arts/entertainment and education. Leisure, hospitality, manufacturing, and health care sector quits rose to record highs in September. The total hires were 6.4 million in September, generally unchanged from the month prior.

The Atlanta Fed’s Wage Growth Tracker, a measure of the nominal wage growth of individuals, indicates workers in the 16 – 24 age group are seeing wage growth accelerating much faster than the rest of American workers, with the median age growth increasing by 9.6% in September. Those in the 24 – 54 age range saw wages grow by 3.7%, comparatively. It is estimated nearly 70% of the workers that have exited the workforce compared to pre-pandemic levels are Baby Boomers, causing a shift towards hiring younger workers to fill the gaps.

The labor market is still in flux and workers have remained mobile, forcing businesses to offer higher pay, bonuses, and other incentives to create more friendly employment conditions. Generally, many workers are less motivated to keep jobs they no longer want. Average hourly earnings are up more than 5% for the year, although when adjusted for inflation, earnings have decreased 1.1% on the year.

Meanwhile, Consumer Confidence Takes a Hit

Consumer confidence has plummeted to its lowest levels in 10 years, according to the University of Michigan’s Consumer Sentiment Index. The index generally measures how American consumers view prospects for their personal finances and the general economy. The index fell to 66.8 in November compared to 71.7 the previous month.

The economists that worked on the study stated the low consumer sentiment was due to escalating inflation and a growing belief amongst consumers that effective policies have not been put in place to reverse that trend. One in four consumers said inflation has reduced their standard of living. Half of American families anticipated bringing home smaller incomes next year after adjusting for inflation.

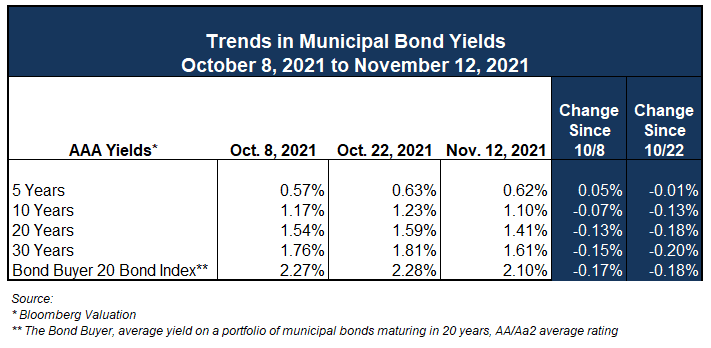

Trends in Municipal Bond Yields

Positive news generally continues regarding tax-exempt municipal bond yields. Over the past few weeks, bond yields have continued to decline across the interest rate curve. Monthly new issue municipal bond volume rose during October by 5.6% from the previous month. New issue volume had been declining the previous three months. Municipal bond mutual fund inflows have increased for 36 consecutive weeks, with last week’s inflows being the largest since July.

Update on Advance Refundings

Lobbyists working to advance municipal market interests continue to push for the reintroduction of financing tools that could benefit municipal issuers and borrowers, some of which are presently in the Senate version of the Build Back Better legislation, as reported by The Bond Buyer.

When discussions began on broader infrastructure legislation earlier this year, it was anticipated it could include several provisions such as reinstatement of tax-exempt advance refundings, increasing the annual limit for bank qualified debt from $10 million to $30 million, and restoration of certain forms of direct pay bonds. All three of these tools were eventually eliminated from recently passed legislation on traditional infrastructure.

These current efforts are primarily focused on the restoration of tax-exempt advance refundings. Legislative support appears strongest with the Senate Finance Committee, but the House needs to approve a reconciliation bill before the legislation returns to the Senate.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.