It’s logical for any reasonable person to conclude that the more debt any person or entity has outstanding in relation to their “income” (revenues, etc.) the higher interest rates for said entity or person would be. More debt equates to more leverage (fixed cost), and, therefore, greater risk. These sorts of axioms hold no truth for the world’s largest sovereign debtors, and that includes the United States.

A report released Wednesday, September 1, by the Congressional Budget Office (CBO) stated that federal debt held by the public is projected to exceed 100% of U.S. gross domestic product (GDP) in the fiscal year that begins October 1, 2020. In fact, U.S. debt has now reached its highest level as a percent of GDP since the end of World War II (98%) and will exceed this benchmark in a few weeks. The U.S. will soon join other estimable debtors, such as Japan (235%), Italy (135%) and Greece (185%) in this rarified air. In just the second quarter of this year, total federal debt increased 16% from roughly $17.7 trillion to $20.5 trillion. Much of this recent increase is a result of expenditures associated with various initiatives to combat the economic impact of COVID-19. The country’s GDP has also shrunk during this period.

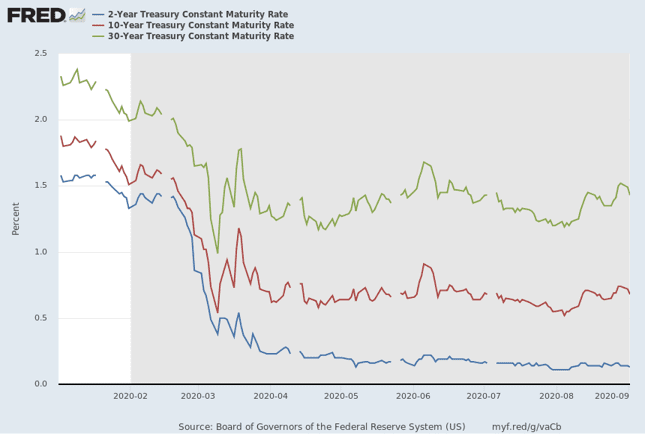

On the heels of the CBO announcement on Wednesday, the yield on the benchmark 10-Year U.S. Treasury Note declined from 0.67% to 0.64%. The CBO report also stated that net interest cost for the Treasury has actually declined 12% for the first 10 months of this fiscal year compared to the year prior due to significant declines in the federal government’s borrowing costs, even in the face of an increased debt load.

Speaking of Treasury yields, benchmark rates were generally higher across the curve from 2 – 30 years. The most pronounced increases were in longer-dated maturities with the 10-year up about 20 basis points on the month and the 30-year about 30 basis points. Yields inside of one-year are mixed up or down about five (5) basis points. Intermediate and long-term yields are actually down a bit from recent highs of 1.52% for the 30-year and 0.75% for the 10-year.

U.S. rates are still set against a backdrop of staggeringly low yields across the globe. At the 10-year maturity mark Germany’s “bund” yields -0.49%, the U.K.’s “gilt” yields 0.24% and Japan’s “JGB” yields 0.04%.

MUNICIPAL MARKET

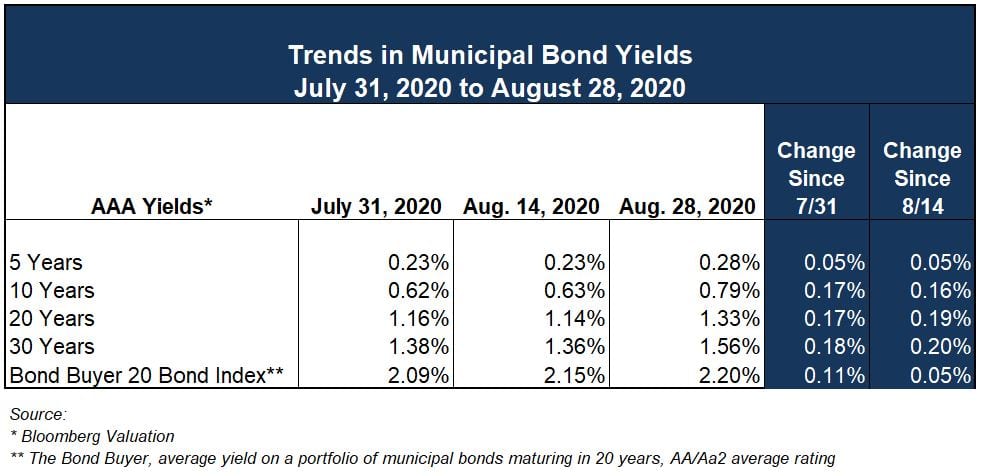

Munis have similarly increased in yield across nearly the entire maturity spectrum but have “outperformed” U.S. treasuries during this period, as they have not increased to the same extent. This is primarily because they had not fallen as much leading up to this point. Bloomberg Valuation reports the “AAA” 10-year tax-exempt yield at 0.80% at the end of August, approximately 110% of its taxable treasury equivalent. This should be taken with a grain of salt, as AAA yields still traded near record lows throughout the month of August.

Municipal issuers have clearly taken advantage of the low-rate backdrop with three straight months of new issue volume exceeding $40 billion. The Bond Buyer reported August volume was down slightly from the prior two months, but still more than 4% higher year-over-year. Taxable issuance has been the driver of increased volume over this period, reaching 30% of total muni issuance in the month of August at over $12.5 billion, up 60% over last year. The Bond Buyer similarly reported that new-money issuance was up 9% to just over $25 billion, while refunding volume was actually down 14% year-over-year. As rates moved backed up in the middle of August some issuers may have paused on refinancing plans and sought to bide time until rates settled.

Investors have exhibited extremely strong demand during the latter months of summer. Refinitiv Lipper reported six consecutive weeks of muni bond mutual fund inflows in excess of $1 billion, dating back to July 22, with a number of weeks exceeding $2 billion. The most recent period exhibited a drop to just over $140 million. A recent example indicative of this demand phenomenon, especially in the taxable muni space, is the Florida State Board of Administration Finance Corporation (state agency that administers its Hurricane Catastrophe Fund) tapping the market on September 2 to raise capital at favorable rates with a $2.25 billion deal that was upsized by $1 billion due to investor demand. There have also been a number of recent accounts where transactions have been repriced with lower yields as a result of over-subscription in many maturities.

It should be noted that the recent strong primary market activity is set against a weakening credit environment in the municipal sector. To some degree this is sector-specific, but it cannot be denied that the ramifications of COVID have been felt at nearly all levels of government. A tremendous salve of federal aid has been laid against pandemic-induced wounds at the state and local level, which includes CARES Act funding to support extraordinary costs associated with COVID-19. However, these various forms of aid to institutions, governments and individuals are finite. Much of the economic damage remains to be seen once the salve wears off. Many media outlets have reported on the significant budget gaps being faced in many states and some of the country’s largest cities, let alone airports, convention centers, health care, hospitality and leisure, and transit. Only time will tell how long it will truly take for these wounds to heal and what impacts will be felt on municipal credit.

INVESTMENT TRENDS

Yields across all fixed income sectors inched higher during the month of August as the interest rate curve continues to steepen, albeit incrementally. The 30-year U.S treasury yield rose from 1.19% to 1.48%. The 3-year treasury rose from 0.12% to 0.15%. Remember that government pools, money market funds and other cash-like products have not been immune to declines in yields, as many of these products have begun to approach yields of 0.00% – 0.05%, depending on their respective underlying credit quality, average maturity and withdrawal requirements. Declines in stated returns on these vehicles generally come with a lag as underlying investments mature and reinvestments occur.

At the Federal Reserve’s Federal Open Market Committee (FOMC) meeting in August, the FOMC unanimously approved a shift in the central bank’s inflation goal, likely leading to a longer era of low rates in the U.S. The Fed signaled its intent to allow inflation to rise modestly above its 2% target under a new regime of “average inflation targeting”. This means the Fed will be inclined to allow inflation to rise above the 2% target for a longer period before considering increases to the fed funds rate.

Given the steepening yield curve, there is incremental return to be gained by moving out in term to maturity on the curve. For instance, the 3-year Treasury yields 16 basis points, representing a 33% yield pickup when compared to the 1-year Treasury at 12 basis points. Extending the weighted average maturity of a portfolio can be accomplished in a number of ways, all of which should be built on the foundation of a confident liquidity profile provided by cash forecasting.

Additionally, purchasing alternatives to traditional investments like U.S. treasuries, agencies and FDIC-insured brokered CDs can prove valuable, although it may require a modest orientation on such products and amending your investment policy. Ehlers is happy to assist in this regard, if warranted.

We continue to focus on safety of your principal, liquidity needs through asset allocation strategies and an eye towards a competitive rate of return.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.