The U.S. – China trade dispute continues to dominate headlines with little expectation for quick improvement. As global economic uncertainty persists, and the full impact of U.S. tariff hikes have yet to kick in, investors have fled to bonds driving yields down to multi-year lows.

The 10-year treasury yield has dropped to its lowest level since September 2017 reaching 2.16% Friday, May 31. Also, the yield spread between 3-month and 10-year treasuries, often monitored to determine the early signs of a pending recession, fell to as low as -16 basis points (1 basis point is .01%), the largest negative spread since 2007.

The Wall Street Journal (“WSJ”) reported last week that investors seeking higher yields have invested $8 billion into funds focused on high-yield muni bonds (often referred to as “junk“ munis) this year, the most through May since at least 1992. High-yield municipal bonds are non-investment grade securities, generally rated below Baa3/BBB-.

Muni bond funds overall have attracted $37 billion during this same period, reaching a level that is the highest in almost three decades. In addition to recent stock market turbulence, three primary reasons for the influx are noted:

- Continued decline in treasury, corporate bond, and other fixed-income yields;

- Increased expectations the Federal Reserve might cut the fed funds rate this year; and,

- Recent changes to the tax code gave a boost in demand to the muni bond market since federally tax-exempt muni bonds are one of the few remaining tax shelters.

The WSJ article cites the municipal default rate, tracked by Moody’s Investors Service, which has been about 0.1% since 1970 as compared to the 6.7% default rate for corporate bonds. The non-investment grade (bonds rated below Baa3/BBB-) municipal default rate is about 2.5% per Municipal Market Analytics. Investors seem to be making the judgment that low-rated munis offer one of the few opportunities to capture decent yields with an acceptable level of risk.

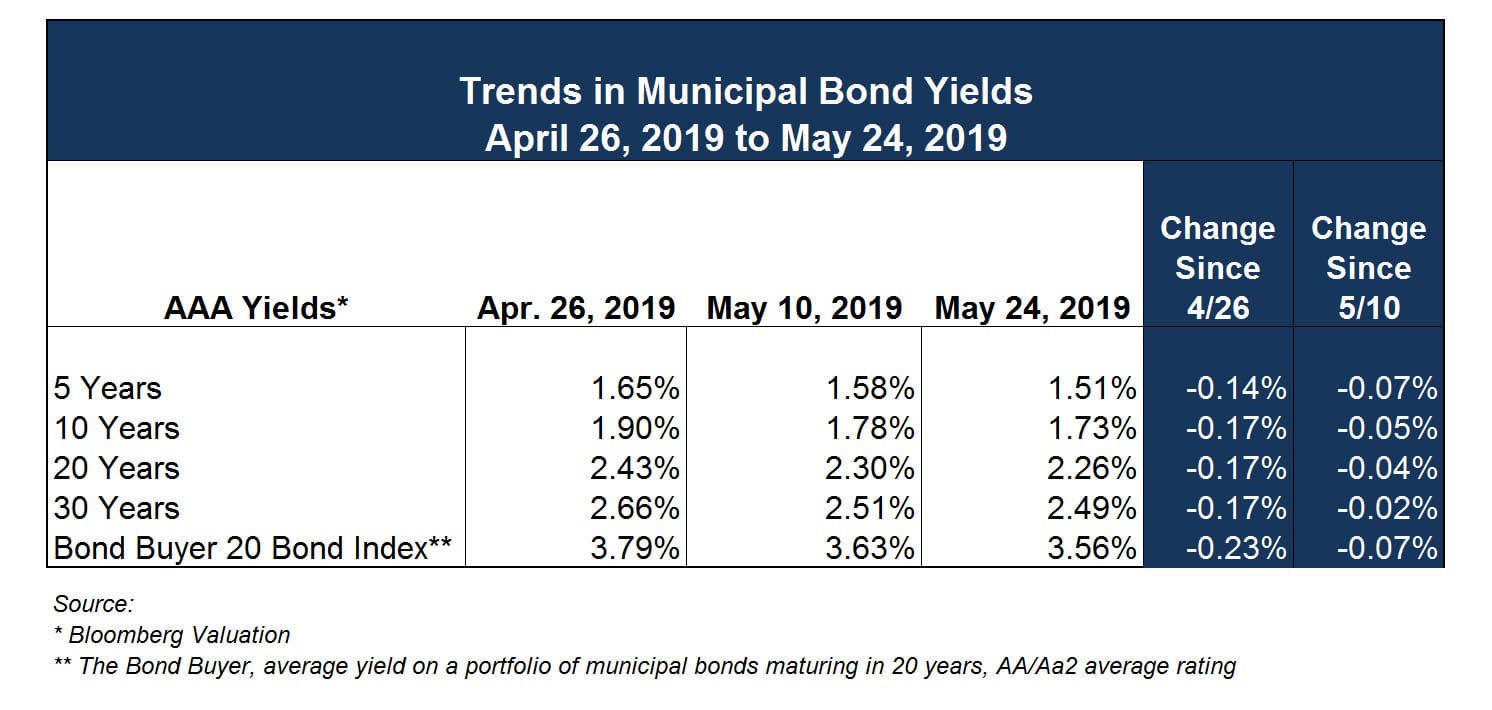

In short, municipal bond yield trends remain favorable for issuers, continuing a trend which began in March, with declining yields across nearly the entire yield curve.

Update on Advance Refunding Legislation

Tax-exempt advance refundings were eliminated as part of the 2017 Tax Cuts and Jobs Act. Advance refundings occur when issuers refund bonds more than 90 days before the bonds to be refunded are first callable. The tax code had previously allowed an original issue of tax-exempt bonds to be advance refunded once on a tax-exempt basis.

The Bond Buyer reports that bipartisan legislation introduced recently by ten House lawmakers to reinstate tax-exempt advance refundings faces opposition in the Senate despite support from 26 national associations including the Government Finance Officers Association, The National League of Cities, and National Counties Association. The Public Finance Network estimates that in the 5-year period from 2013 – 2017, advance refundings saved state and local municipal taxpayers at least $12 billion. However, the Joint Tax Committee estimates the federal income tax revenue loss due to reinstatement of advance refundings would be $16.8 billion over ten years. The general consensus is that future infrastructure spending bills offer the best opportunity to attach legislation that reinstates tax-exempt advance refundings.

Given the potential for cost savings, Ehlers encourages issuers to re-engage their representatives on the value of these types of transactions and the potential benefits of restoring this option.

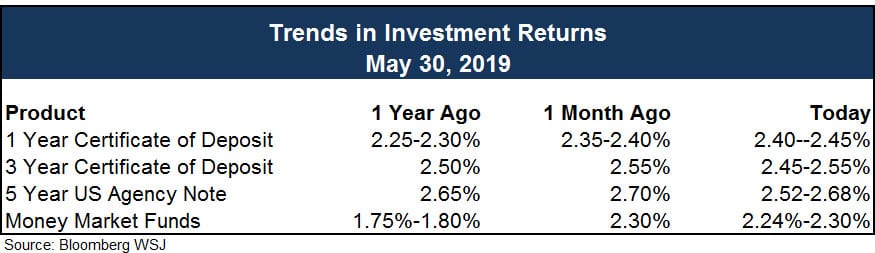

Investment Trends

The release of the minutes from the April 30 – May 1 Federal Open Market Committee (“FOMC“) meeting has not caused much of a stir, which is understandable given their dated nature. But one could find some reason to interpret them as being dovish for two reasons: The Fed makes it clear that its members are not in a hurry to raise interest rates. They note that “a number of participants” felt some of the risks and uncertainties surrounding their outlooks for the year had moderated, including trade negotiations (which have deteriorated noticeably since said meeting). The key takeaway right now is that the stock market has a reasonable assurance to think policy rates are going to remain quite low on a real and nominal basis. Fed members observed that a patient approach in determining future adjustments to the target range for the federal funds rate would likely remain appropriate for some time, especially in an environment of moderate economic growth and muted inflation pressures, despite global economic uncertainty.

The Ehlers Investment team, with a combined five decades of experience, remains vigilant in monitoring current market conditions and in the development and implementation of investment strategies. Contact an Ehlers Investment Advisor today for assistance in evaluating your current investment portfolio and developing a strategy for consistent and predicable revenue.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.