State Government Budget Preview

2020 has been quite a year for state and local governments. With the budget woes and revenue volatility municipalities have had to weather, one thing did go their way-2020 will be a record year for municipal bond issuance, with new issue volume likely to exceed $450 billion. In a typical year about 90% of new issues in the municipal market are issued as tax-exempt. However, this year is different in many ways with taxable municipal debt comprising a much larger proportion of the overall market.¹ Taxable volume is estimated to exceed $135 billion, a 123% increase over the prior year. This dynamic helped local governments in two ways. First, it kept the supply of tax-exempt debt lower in the face of demand for tax-exempt bonds, pushing rates low for new tax-exempt bonds. Second, the huge number of taxable refundings provided relief to many municipal budgets that were absorbing spending on COVID-19 related measures in addition to their regular budget pressures.

As many state governments continue to wait for a federal relief package, legislatures have begun passing their own relief bills, and many states now have updated budget forecasts to inform their decisions. With mostly better than expected news than states were seeing amid pandemic shutdowns this spring, states with robust rainy-day funds will still fare better going into 2021 budget discussions.

Minnesota’s budget forecast arrived the first week in December with better than expected revenues, a tremendous improvement over what the mid-year pandemic update posted. The current forecast projects a surplus of $636 million for the FY 2020-21 biennium, ending June 30, 2021. But for FY 2022-23, the state is projecting a $1.273 billion budgetary shortfall. The state’s rainy-day fund is currently at a statutory maximum, totaling $2.377 billion. In the near term, this means that local governments may be spared, as no extraordinary budget measures are required to close a gap in the current biennium. However, budget adjustments will need to be made in order to balance the FY 2022-23 biennium during the upcoming legislative session. With Minnesota having the only politically divided legislature in the country, we can be assured that discussions will be heated, all ideas will be on the table and a conclusion is unlikely to be swift.

Colorado, with Democrats in the legislative majority and the governor’s office, passed a relief package late last month in a three-day session prior to their full regular 2021 session. The relief package, totaling over $200 million, included assistance for small businesses, food pantries, childcare providers, renters and landlords. The governor is hopeful that future budget forecasts would show improvement as a result of earlier budget cuts and higher than expected revenue gains.² Colorado’s budget forecast that will inform the 2021 session will be released next week.

In Wisconsin, where modest revenue growth is projected over the course of the biennium beginning July 1, the state is on course to close out the current fiscal year with a $1.2 billion general fund balance, a portion of which would be deposited into its budget reserve. The reserve fund hit a peak of $762 million at the end of fiscal 2020 on June 30 after a $105 million deposit. A revenue forecast early this year (before the pandemic) had the rainy-day fund on course to hit the $1 billion mark at the close of the current biennium June 30.³ Nonetheless, at this level, the rainy-day fund will provide a cushion for any potential budget cuts and may mitigate any trickle down effects.

Not all states are positioned so well. Illinois, plagued by unfunded pension liabilities and a $4 billion budget gap, also must deal with a potential rating downgrade to below investment grade –a historical first for any U.S. state. Fitch Ratings, Moody’s Investors Service and S&P Global Ratings assigned negative outlooks to their ratings that presently one notch above junk bond status (junk bonds are generally considered those rated below Baa3/BBB-). Although Illinois was able to access funds through the Municipal Lending Facility, a program that is scheduled to expire at the end of the calendar year, allowing it to borrow at a cheaper rate than the municipal bond market would have allowed, most pundits consider this a temporary reprieve from its financial challenges.

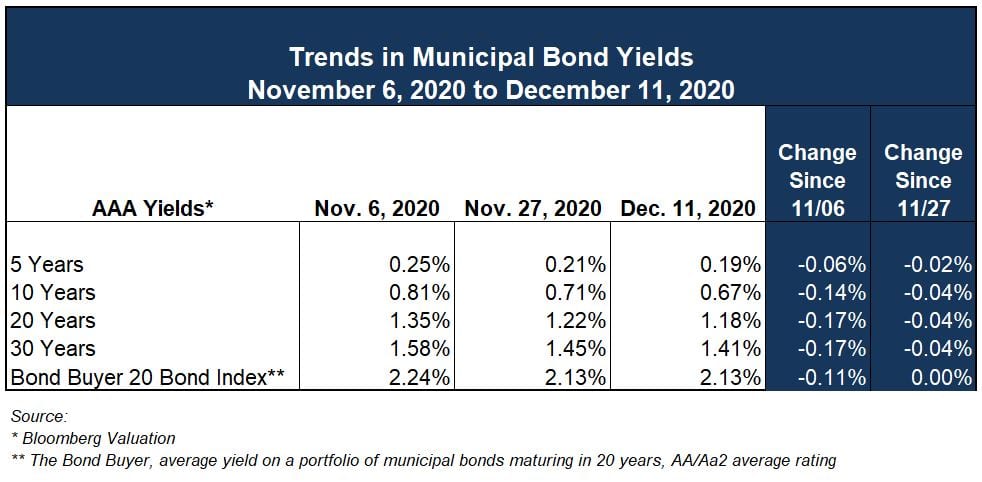

Municipal Bond Yields

On Monday, the Electoral College cast their votes for President, a ceremonial process that wrapped up without hindrance. The votes will be counted by a joint session of the House and Senate on January 6. The COVID-19 vaccine also rolled out to front-line health care workers, and the U.S. federal government doubled orders for the vaccine. Meaning, there are indications that we are making progress toward a return to normal, and, in light of the news, markets remain steady so far this week: short term rates remain near zero with little movement. Yields on the longer end were down slightly since the beginning of November. U.S. Treasury yields on the long and short ends have followed in sync with municipal bond yields.

Consumer and Economist Expectations for the New Year

The Federal Reserve Bank of New York’s Center for Microeconomic Data released the November 2020 Survey of Consumer Expectations (SCE). The SCE contains information on how consumers expect overall inflation to behave and provides insight into how Americans view job prospects and earnings growth. Most notably, the survey reports spending expectations rose to the highest level recorded in more than 4 years. However, the SCE also examines many other measures that resulted in a mixed report overall: median expected household income growth stayed flat at 2.1%, well below the 2019 average of 2.8%, the mean perceived probability of losing one’s job in the next 12 months decreased, and median year-ahead home price change expectations decreased. Note this is the first monthly decline in this measure since April 2020. With this hint at how American households view the economic outlook, at the end of the week, we’ll turn to the experts for their expectations for the new year.

The Federal Reserve Federal Open Market Committee (FOMC) is meeting for a two-day policy meeting wrapping up Wednesday. In a Bloomberg survey of nearly 50 economists, the majority of respondents expect the meeting to result in new guidance from the Fed’s monetary policy body, possibly linking the Federal Reserve’s bond buying program to economic conditions. The remaining respondents expect this change to occur, but not quite as soon as this December meeting. The new guidance would give analysts some additional insight into the Federal Reserve’s bond buying program, which when kicked into high gear in March of this year, also accompanied the Fed’s decision to push interest rates to zero.â´ If the December meeting results in new guidance, these “qualitative outcome-based guidance” measures would likely focus on both inflation and employment, respondents said.

Finally, the survey also suggests that, under the Biden administration, there will be increased coordination between the Treasury and the Fed, which the respondents agreed would be good for the economy. Expectations of Gross Domestic Product (GDP) by the Fed may also adjust in response to the increase in COVID-19 cases and the recent shutdowns by many state’s Governors.

¹ https://www.bondbuyer.com/news/led-by-taxables-a-resilient-muni-market-to-break-issuance-records

² Colorado Sun: https://coloradosun.com/2020/11/30/colorado-economic-stimulus-impact-special-session/

³ Bond Buyer: https://www.bondbuyer.com/news/coronavirus-drives-cautious-wisconsin-budget-forecast

â´ https://www.bloomberg.com/news/articles/2020-12-14/fed-expected-to-offer-new-guidance-not-action-on-bond-buying

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.