Reaction to December FOMC Meeting

At his press conference following the conclusion of this month’s meeting of the Federal Reserve’s Federal Open Market Committee (FOMC), Fed Chair Jerome Powell stated that “evolutions” and “changes” in the economy have pushed the FOMC to more quickly rein in monetary policy accommodations that have been deployed since the beginning of the Covid-19 pandemic. Specifically, and most immediately, the Fed will double the rate at which it tapers its asset purchases beginning in mid-January, with a goal to have the asset purchases completely stopped by the end of March. The Fed stated as recently as November that it would reduce its monthly net asset purchases by $15 billion per month, which will now be $30 billion – $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities. Previously, July was the timeframe the Fed had generally set to end asset purchases. The decision to wind down the asset purchase program more rapidly was unanimous on the part of voting members. FOMC participants continue to see “rapid growth” going forward despite some of the recent headlines about inflation and fears about the spread of the Omicron variant of Covid-19.

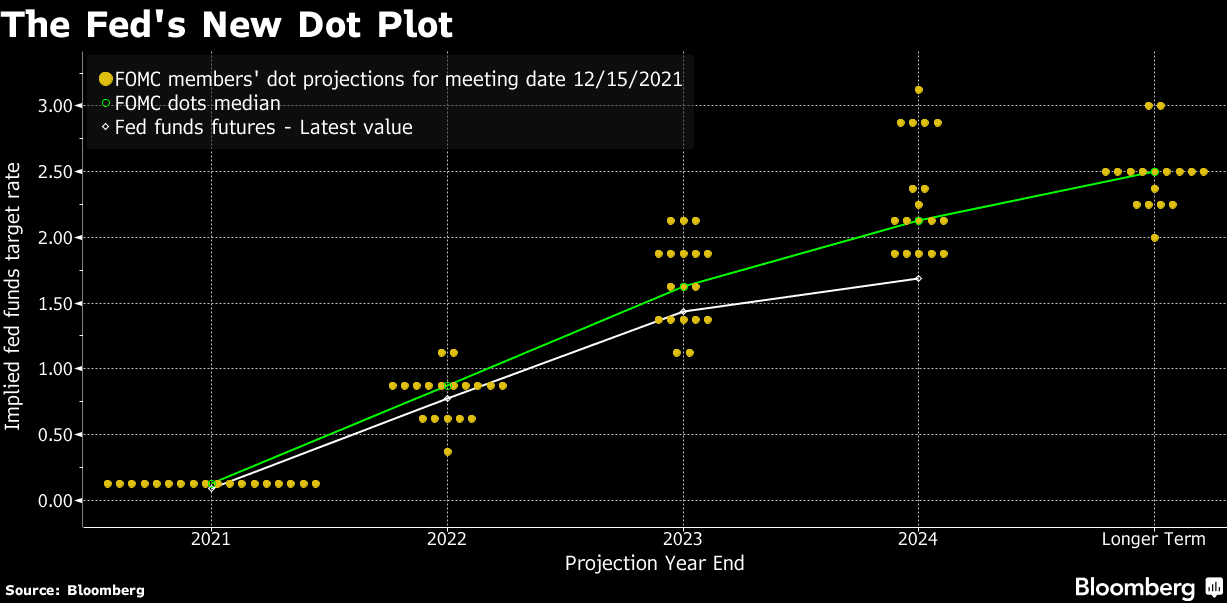

Finally, all 18 FOMC members projected at least one fed funds rate hike in 2022, with the median projection among that group now being three increases to the target range for the federal funds rate next calendar year, a significant change from earlier this year when forecasts indicated no increase(s) until 2023. This change, as well as the accelerated pace of tapering asset purchases, comes as the Fed shifts its messaging about inflation using terms such as “transitory” to what is now more clearly stated as structural in nature. There is almost no doubt Fed members have received the “markets” feedback that they are behind the curve on tempering inflationary concerns. Projections of FOMC members still show a consensus that inflation will return something approximating the Fed’s target level of 2.00% towards the end of 2022, perhaps having been stymied by the aforementioned interest rate increases. In any event, the Fed’s own projections of inflation and GDP growth have been less than stellar over time.

The latest dot plot, which is a compilation of FOMC member’s expectations for the fed funds over a multi-year period, indicates a greater consensus that the target range for the fed funds rate will be over 1.50% by the end of 2022. This is a considerable departure from as recently as September’s FOMC meeting. Other central banks seem to be singing from the same hymnal, with the Bank of England announcing on Thursday a quarter-point increase (to 0.25%) to its overnight rate and the European Central Bank stating it will also reduce its bond purchases only a short time later.

According to Bob Michele, chief investment officer at JP Morgan Asset Management “[what] we’re seeing from the Fed is that they’re beginning the process of re-establishing their credibility”. Portfolio managers and economists alike, sent a similar message, confident in the fact that the Fed was beginning to take the necessary steps and use the proper messaging to validate concerns over inflation, which it did.

US Treasuries were largely unchanged in reaction to the FOMC pronouncement and Chair Powell’s comment with mixed movement – the yield on the 10-year note jumped up 3 basis points (1 basis point = 0.01%) on Wednesday but remained mostly flat in the earlier part of the yield curve. Yields are generally unchanged through the close of trading on Thursday.

Trends in Municipal Bond Yields

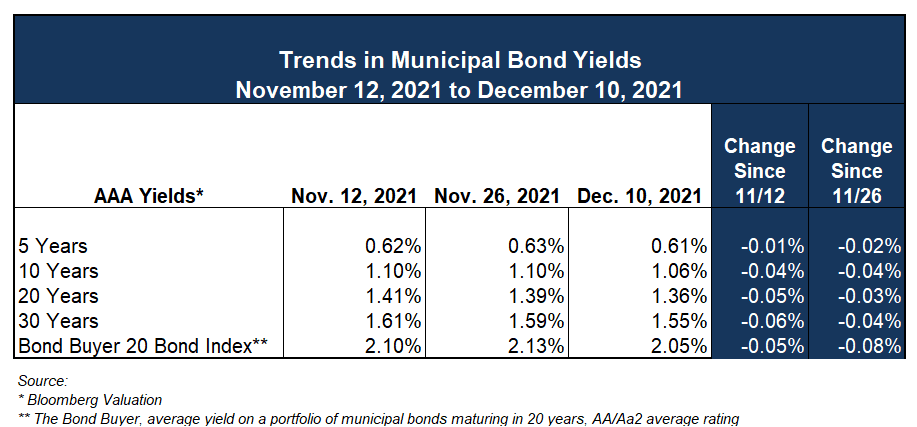

Municipal bond yields were largely flat following the conclusion of the FOMC meeting. According to Bloomberg Valuation (BVAL), AAA municipal bond yields dropped between 2 and 4 basis points over the past 2 weeks. This nominal decline comes after yields had remained mostly flat throughout November.

Muni-to-Treasury ratios came down slightly at nearly all benchmarks with the movement in yields. According to Refinitive, ratios were 47%, 71%, and 80% at the 5-, 10-, and 30-year marks, respectively, on Wednesday afternoon. These ratios are lower than when we last reported them in our Market Commentary (Dec. 3rd), indicating a continued trend of tax-exempt munis trading “rich” to taxable equivalents.

As always, we look forward to providing our clients with the best possible strategy to meet your capital needs and make the best use of your cash and bond proceeds throughout the evolving economic cycle. This will be the last Market Commentary of 2021, and on behalf of the authors and all of us at Ehlers we want to wish you all happy holidays and thank you for taking the time to read our Commentary this year.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.