“As we express our gratitude, we must never forget that the highest appreciation is not to utter words, but to live by them.” — John F. Kennedy on Veteran’s Day

Election Day was over a week ago now and the outcomes are still unclear. The Associated Press projects Joseph Biden will be our 46th president, President Trump is contesting the election in several states, and Congress may be divided once again. At the time of writing, the Democratic Party has maintained control of the House of Representatives (albeit with a slimmer margin) and the Republican Party likely will maintain control of the Senate – runoff elections for both of Georgia’s US Senate seats are expected to solidify that outcome. As President of the Senate, the Vice President may play a far more pivotal role in the legislative process in the next Congress.

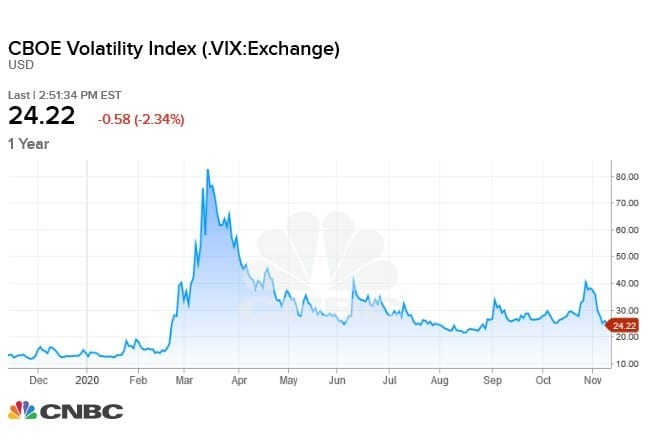

Like the election, 2020 has been a roller coaster for markets, presenting investors with tremendous uncertainty. The CBOE Volatility Index (VIX), which measures the 30-day expected volatility of the S&P 500 Index, has a historical five-year average right around 20, but has reached greater than 40 three times this year. The first was in March at the onset of the virus in the United states and the corresponding initial lockdowns, the second mid-June amidst heightened civil unrest and a new wave of COVID-19, and the third was in the lead-up to the election on November 3rd. Since then the VIX has dropped down to 25, an indication that markets have calmed post-election, which removed some of the uncertainty from the investment spectrum. According to Morgan Stanley’s Andrew Sheets, the pattern of market volatility increasing and reaching crescendo just before an election and then declining afterward is the same as what was experienced in 2016.

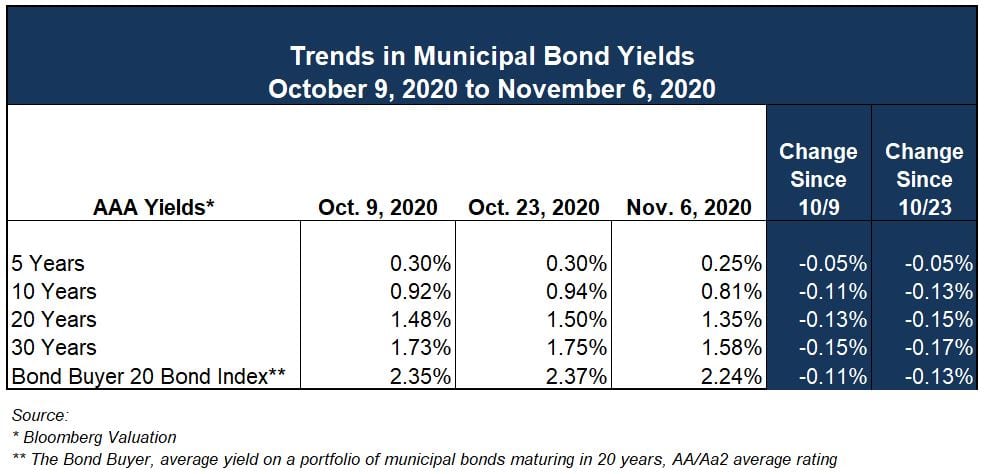

More recently, news of positive clinical results for a COVID-19 vaccine candidate from Pfizer were released on Monday, resulting in optimism we may be “returning to normal” somewhat soon. The S&P 500 closed that day at 3,550, its second-highest close in history. Many of the gains in equities earlier this week were seen in stocks of brick-and-mortar retailers, airlines and travel industry companies. In the muni market, AAA-rated yields were up 5 basis points (1 basis point = 0.01%) on the vaccine news.

Municipal Market Update

Markets were closed on Wednesday in observance of Veterans Day. Only $1 billion of issuance last week and under $2 billion during this holiday-shortened week meant dealer inventories were lighter, especially in the wake of major issuance volume the last few months leading up to the elections.

According to Bloomberg Valuation (BVAL), the 10-year AAA yield was up 5 basis points to 0.87% on Monday and stayed flat through Tuesday. Municipal yields outperformed treasuries due to the previously mentioned lower supply this week. Yields on the benchmark 10-year Treasury note increased by as much as 14 basis points up to 0.96% on Monday and the muni-to-Treasury ratio was calculated at 88.3%, significantly lower than the 120% we saw as recently as September.

Further Stimulus to Local Governments Looks in Doubt

In light of potential competing policy priorities at the federal level and the positive vaccine related news, the prospects of any additional Federal stimulus for local governments may have taken a hit these past two months. The CARES Act has since come and gone, and the many COVID-19 associated challenges still exist. Although there have been some efforts to negotiate another round of pandemic relief, each proposal has been thwarted at different times either by various Congressional leaders or President Trump, dimming prospects of additional aid.

Indeed, as 2021 budgets are finalized, cutting public services and/or raising taxes are prevalent discussions and hope of another Federal stimulus package seems dim. There are certainly arguments as to where we are at, as a country, in the economic cycle and whether prospects are improving, or will again be impaired by COVID restrictions. The Brookings Institute projects that local government revenues will decline by about 5% in 2020, 2021 and 2022, unless there is a drastic change in economic activity. Prognosticating beyond the next 6- 12 months might be an exercise in futility given the circumstances we are all faced with for the foreseeable future.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.