The Federal Open Market Committee (FOMC) last reduced the federal funds target rate over 10 years ago, in December of 2008, and has raised the rate nine times since then, beginning in December of 2015. But that is likely to change when the Committee meets next week. Based on Fed Chair Powell‘s testimony to Congress on July 10 and 11 (discussing the uncertainties stemming from U.S. trade policy and slowing global growth), a rate cut is very likely to happen when the Committee meets next week (July 30 and 31).¹

Since then, comments by other members of the FOMC and other regional Federal Reserve Bank presidents have prompted speculation about whether the rate cut will be 0.25% or a more aggressive 0.50%. As of July 23, the CME FedWatch Tool shows a 100% probability of at least a quarter-point rate cut at the July meeting, and a 76.5% probability of a half-point cut. Despite this strong consensus, in recent days, three separate regional bank presidents –Thomas Barkin of Richmond, Raphael Bostic of Atlanta, and Eric Rosengren of Boston – have questioned the need for any rate cut! As an aside – of these three, only Rosengren is presently a voting member of the FOMC. That said, if the FOMC surprises the market and maintains its current rate policy, some market turmoil is likely to occur.

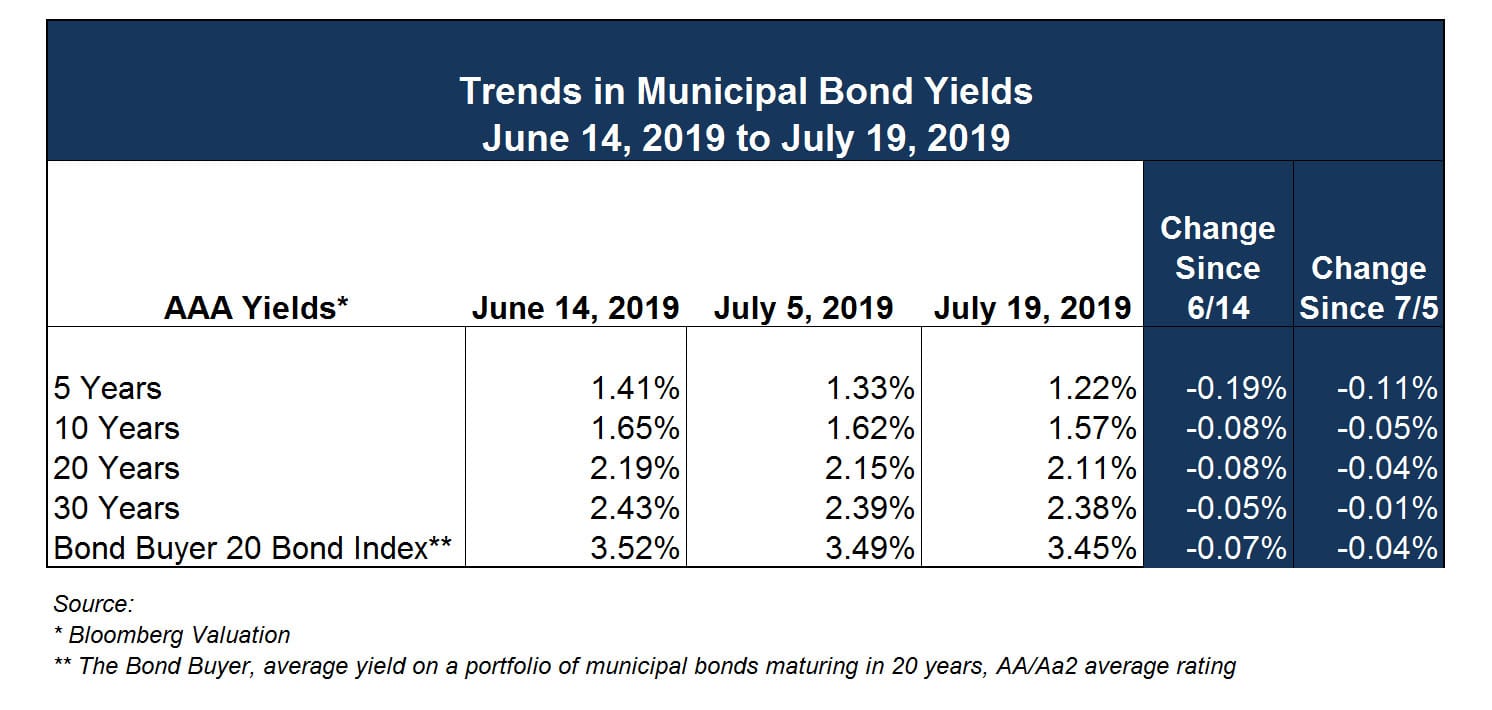

Muni Yields Continue to Decline

The table below shows that yields on municipal bonds, as reported by Bloomberg Valuation (BVAL), have continued to decline over the past two weeks, especially at the short end of the yield curve. It is likely the muni market has already priced in a 0.25% cut in the federal funds rate.

The declines in muni yields this year have been larger than almost anyone predicted, and larger than the declines in other interest rates. For example, from last December 31 to July 22, the 10–year AAA muni yield (BVAL) has declined by 77 basis points, from 2.32% to 1.55%, while the 10–year treasury yield has declined by 65 basis points, from 2.69% to 2.04%. The 10-year muni–to–treasury ratio (ratio of the yield on a 10–year AAA-rated muni bond to the 10–year treasury note), was at 75.8% as of July 22, and has hovered in the mid-70s for much of the past three to four months. That ratio was often above 90% in 2016 and 2017. In general, the higher the muni-treasury ratio, the more attractive municipal bonds are relative to treasuries for investors.

So why have muni yields declined so much? A recent article by muni veteran George Friedlander² offers some insights, many related to the federal tax reform legislation approved in December 2017 (effective for calendar year 2018).

- The amount of municipal debt outstanding declined by almost $50 billion in 2018. Friedlander attributes this primarily to the elimination of tax-exempt advance refundings in the 2108 tax reform legislation. With a decline in supply of bonds and continued strong demand, yields have been pushed downward.

- The tax reform legislation also significantly limited the federal tax deduction for state and local taxes. For high-income individuals, particularly in high tax states like California and New York, this has increased their federally taxable income considerably, making tax-exempt muni bonds a more attractive investment.

Friedlander also notes some trends in ownership of bonds that may be affecting yields. First, municipal bond mutual funds have seen net inflows every week of 2019, so their share of ownership of munis has increased. Second, bank ownership of tax-exempt munis has declined dramatically, likely because the decline in the top corporate tax rate (from 35% to 21%) has decreased the value of tax-exempt bonds for banks. In fact, bank ownership of municipal bonds decreased in 2018 for the first time in over fifteen years³. From other sources of data, we also have observed that insurance companies have reduced their holdings and purchases of municipal bonds, presumably also because of the reduction in corporate tax rates.

¹ Bloomberg, July 21, 2019

² The Municipal Perspective, Court Street Group Research LLC, July 1, 2019

³ https://www.sifma.org/resources/research/us-municipal-securities-holders/

The Importance of Accurate Disclosure

At Ehlers, we frequently remind our clients of the importance of accurate disclosure of financial and operating information – both when preparing Official Statements for issuance of new debt and in the “continuing disclosure” of information required by continuing disclosure agreements and SEC rules. Since audited financial statements are included in both Official Statements and in required continuing disclosure reports, it is especially important that those financial statements are complete and accurate.

Sometimes it takes an extreme example to illustrate the consequences of providing misleading information. Chicago-based law firm Chapman and Cutler recently reported on an interesting SEC enforcement case. ^ The SEC charged the former controller of a New York not-for-profit college with violating the antifraud provisions of federal security law, specifically in relation to revenue bonds issued on behalf of the college in 1999. On the same day, the United States Attorney’s Office of the Southern District of New York announced criminal charges against the same individual.

In the complaint against the former controller, the SEC claims that, by 2013, the college was under considerable financial stress, and that to address cash flow needs, the controller withdrew funds from the college’s endowment fund without the approval of the Board of Trustees. The SEC also alleges that controller took several steps (concealing the misappropriation of funds and withholding required payroll tax payments) that caused a significant overstatement of the college’s net assets in the audited financial statements.

The former controller has agreed to a partial settlement with the SEC and pleaded guilty to two counts, with potential monetary sanctions and prison sentence to be determined later.

This case serves as an important reminder that federal officials will not hesitate to use the antifraud provisions of federal securities law to prosecute state and local governmental officials who have withheld or manipulated important information. So, while it may be challenging to admit that the organization you work for is experiencing financial difficulties, it is always best to disclose key information completely, accurately, and in a timely manner. Failing to do so could result in costly legal proceedings, monetary penalties to both the organization and individuals, and even prison time.

^ Chapman Client Alert, Chapman and Cutler LLP, April 5, 2019

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.