The bond market is heavily influenced by economic data and recently, by the major central banks around the globe. In the past 2 weeks, the European Central Bank, People’s Bank of China, and Bank of Japan have each announced their intention to keep short term interest rates low in the hopes of stimulating growth. Similarly, U.S. Treasury yields declined across all maturities last week after the release of first quarter gross domestic product (GDP). Although GDP exceeded estimates, the underlying data indicates lukewarm consumer spending, business investment trends, and core inflation.

Coupled with a yield-curve inversion and declining inflation expectations, most pundits expect the Federal Reserve to pause on any further increases in the fed funds rate, which explains much of the recent decline in interest rates. The Fed’s views on inflation (which has been below its 2% target for the 11th straight year) was a key focus of the market in relation to this week’s Federal Open Market Committee (FOMC) meeting. In the words of the Fed Chairman Powell, the current rate of inflation is “transient“ and the Fed is “comfortable with our current policy stance.” However, some pundits believe the FOMC’s next move will be to raise the fed funds rate then hold off for a while. Other pundits believe the lack of inflation may prompt the FOMC to have conversations on cutting its benchmark rate. For example, the Fed Funds Futures Probability Index is suggesting that there is a better than 50% chance the FOMC will cut the fed funds rate in September.

Positively, market fears over trade tensions appear to be easing as the U.S. and China inch toward a trade deal. However, those fears are unlikely to be immediately resolved. Trade talks between the U.S. and European Union are set to start again, after the two parties had paused negotiations in July 2018. EU leaders have made it very clear that should President Trump attempt to apply his Chinese tariffs negotiation playbook to the EU, they would retaliate very swiftly with neither side appearing likely to back down in a rush. Heated trade tensions between the two would undoubtedly have negative global effects.

Taxes Are In

Following the passage of the Tax Cuts and Jobs Act (TCJA) in December 2017, the debate on tax reform shifted from Washington, D.C. to all fifty states. As many of our readers are aware, states incorporate provisions of the federal tax code into their own tax codes in varying degrees – meaning, because income tax rates were cut and several deductions were eliminated, Adjusted Gross Income levels have generally increased, boosting state revenues for fiscal years 2018 and 2019. Now in its second year, several states have again seen tax revenue increases due to TCJA; though, to be fair, the increases also come with less federal funding for education, infrastructure, and other programs. The question going forward will be if states will alter their tax laws to conform with federal tax code. For example, last spring, Minnesota state lawmakers failed to agree on a rewrite of the state’s tax laws to match TCJA. Lawmakers have agreed in principle that tax conformity is important and have pledged to work out an agreement, but with a month left in the legislative season, it is unclear what compromise can be accomplished – meaning, next year’s tax filing season may be just as complicated given the variance between the two tax codes.

Municipal Bond Yields Decline

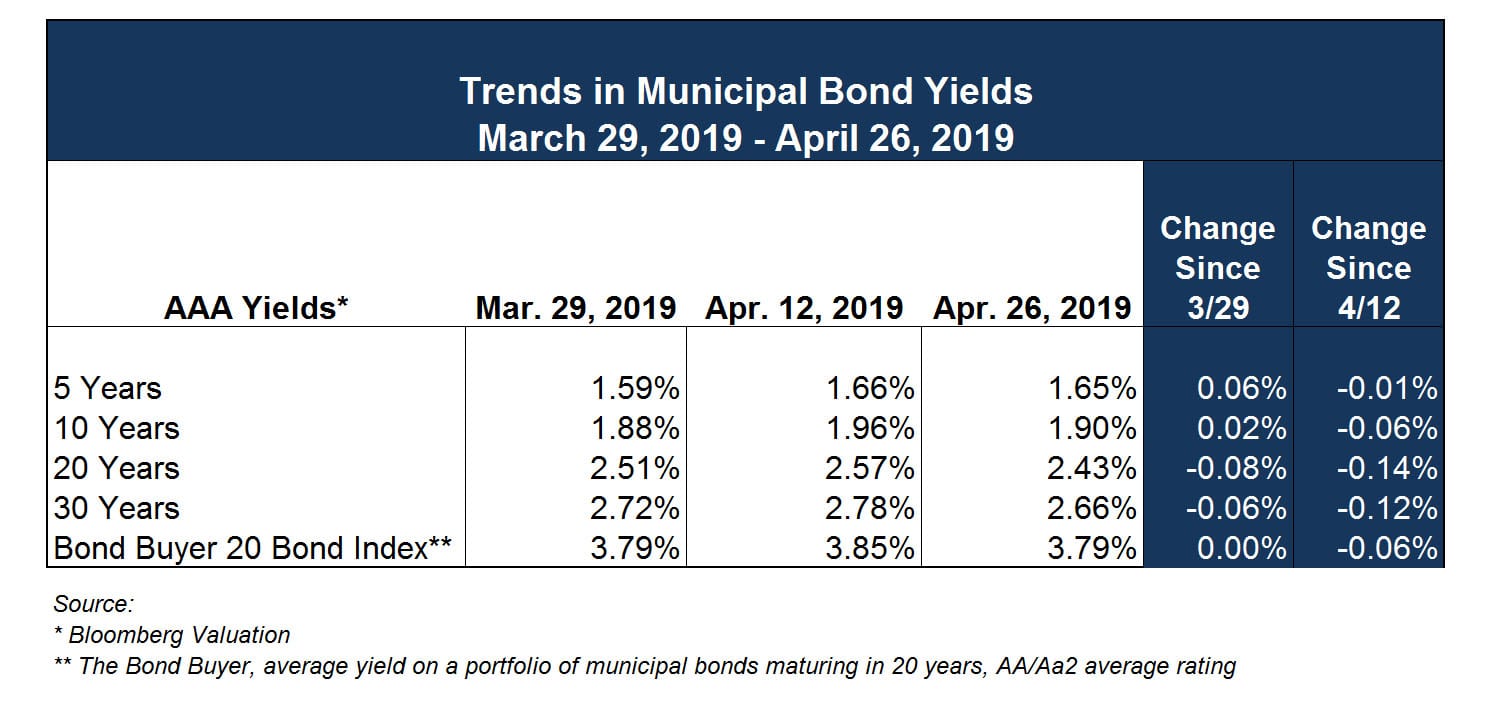

According to the Bond Buyer, in the week ended April 25, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index (based on 40 long-term bond prices), fell to 3.87% from the previous week’s 3.89%. From the Bond Buyer:

- The Bond Buyer’s 20-Bond GO Index of 20-year general obligation yields dropped seven basis point to 3.79% from 3.86% the week before. It is at its lowest level since March 28, when it was at 3.79%.

- The 11-bond GO Index of higher-grade 11-year GOs fell five basis points to 3.31% from 3.36% the previous week. It is at its lowest level since March 28, when it was at 3.30%.

- The Bond Buyer’s Revenue Bond Index declined six basis points to 4.27% from 4.33% the week before. It is at its lowest level since four weeks ago, when it was at 4.26%.

- The yield on the U.S. Treasury’s 10-year note was lower to 2.53% from 2.56%, while the yield on the 30-year Treasury dipped to 2.95% from 2.96%.”1

Some experts believe municipal bond yields are too low relative to Treasuries; the ratios of muni yields to treasury yields have been low by historical standards for many weeks. But the supply of new munis remains low, while investor demand for munis is strong. Indeed, municipal bonds remain one of the only tools left to reduce an individual’s overall tax burden. Also, given some of the economic uncertainty, munis may be somewhat of a safe haven for investors.

Investment Trends and Recap of the FOMC Meeting

The Treasury yield curve and other allowable public fund investment options along the investment spectrum remained relatively unchanged this past month over month. Investors seem to be pausing to digest which way the Fed is projecting interest rates this coming year. The Fed left rates unchanged in their most recent FOMC meeting but decided to tweak a key lever of its control over interest rates: interest on excess reserves.

As a method of controlling the money supply, the Fed incentivizes banks to place money at the central bank by paying interest on those reserves. The interest rate is within the bounds of the target set in its FOMC meetings and sets a standard for the interest rate that financial institutions ultimately use to lend out to consumers and businesses in the economy.

When the Fed raises the interest it pays on reserves, it incentivizes banks to leave more money in reserves at the Fed, thus contracting the money supply and notching up the effective interest rates in the market. Likewise, when the Fed lowers the interest it pays on reserves, it incentivizes banks to leave less money at the Fed, thus expanding the money supply and lowering the effective interest rates in the market. The Fed lowered this key rate from 2.40% to 2.35%, marking the first time this rate was reduced since 2008.

The Ehlers Investment team does not believe in timing the market especially when the Fed is unclear on which way interest rates are headed. We instead recommend investing in these current economic conditions with a strategy utilizing a comprehensive cash flow forecast to build a laddered portfolio, with an average weighted maturity of approximately 3 years, depending on circumstances. A laddered structure will allow for taking advantage of rising interest rates as maturing investments can be reinvested at higher rates and protect a portfolio if rates should continue to fall or remain inverted, thereby reducing the impact on overall portfolio performance.

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.