Second quarter data shows initial impact of COVID-19; Municipal bond yields continue to decline as volume surges

The U.S. Bureau of Economic Analysis (BEA) released the first estimate for Gross Domestic Product (GDP) for the second quarter late last week. GDP decreased at an annual rate of 32.9% in the second quarter. Economists surveyed predicted an even greater contraction of 34.7%. The BEA notes the decline in GDP reflected the response to COVID-19 as stay-at-home orders issued in March and April were partially lifted in May and June. This led to rapid shifts in activity, business operations, and spending.

While the headlines focused on this historic drop, it is important to note the 32.9% decline is based on an annualized rate. The BEA’s annualized rate projects the change from one quarter will continue for the next three quarters. Given the rapid and swift decline in the economy due to significant lockdowns and halted business operations, projecting that same outcome over the next 3 quarters paints an especially ugly picture. As most of the country has emerged from lockdowns, the conditions that existed for much of the second quarter have already changed from the depths of the lockdowns.

The year over year change in GDP as of the end of June results in a decline of 9.5%. This decline is still concerning, but it may be a more accurate gauge for the economy compared to annualizing a decline for a quarter that could be an outlier.

Over the past two quarters, output has decreased $2.1 trillion. Output in the second quarter of 2020 is the lowest since the 4th quarter of 2014. Inventory stocks dropped by nearly $380 billion during the first six months of 2020. As these inventories are replaced, this should boost future growth rates. In fact, some early estimates of third quarter GDP indicate an increase of 20% (annualized) may be in the cards.

The BEA also reported:

- Disposable personal income increased $1.53 trillion or 42.1% in the second quarter, which is largely attributable to “personal current transfer receipts,” meaning direct federal stimulus payments to individuals in the form of enhanced unemployment benefits.

- Personal saving was $4.69 trillion in the second quarter compared to $1.59 trillion in the first quarter. The personal savings rate as a percentage of disposable personal income was 25.7%. compared to 9.5% in the first quarter. These numbers would suggest that various COVID-19 relief efforts were boosting savings. In reality, this is more directly a result of increased personal income (see above) and declines in demand due to various restrictions associated with emergency orders in many states.

This week the Institute for Supply Management (ISM) manufacturing index rose to 54.2 in July from 52.6 in June, exceeding expectations. This index level indicated expansion in the manufacturing sector at the fastest rate since March of 2019 (any reading in excess of 50 equates to expansion). Negotiations also continue for the next round of COVID-19 relief packages. The enhanced $600 per week in unemployment benefits expired last Friday.

Municipal bond volume and yields

The Bond Buyer reports that municipal bond volume in July was its highest in 34 years, with $42.61 billion in municipal bonds sold. Taxable bond volume continues to increase. Year to date taxable volume is $68.98 billion compared to $70.49 billion for all of 2019. Through July, total volume for the year is $248.38 billion compared to $203.77 billion last year at this time. The increase in taxable volume is multifaceted, but largely a result of taxable advance refunding activity. Taxable yields have declined as much as, if not more than, tax-exempt. Additionally, the spread between taxable and tax-exempt yields for municipal issuers is about the tightest in history, given the absolute low levels of yields. Investors in the taxable market are keen to diversify their portfolios and taxable municipals are a good fit from a credit quality perspective. Data released by Refinitiv Lipper showed the week ended July 29th was the 11th consecutive week of positive inflows into municipal bond funds.

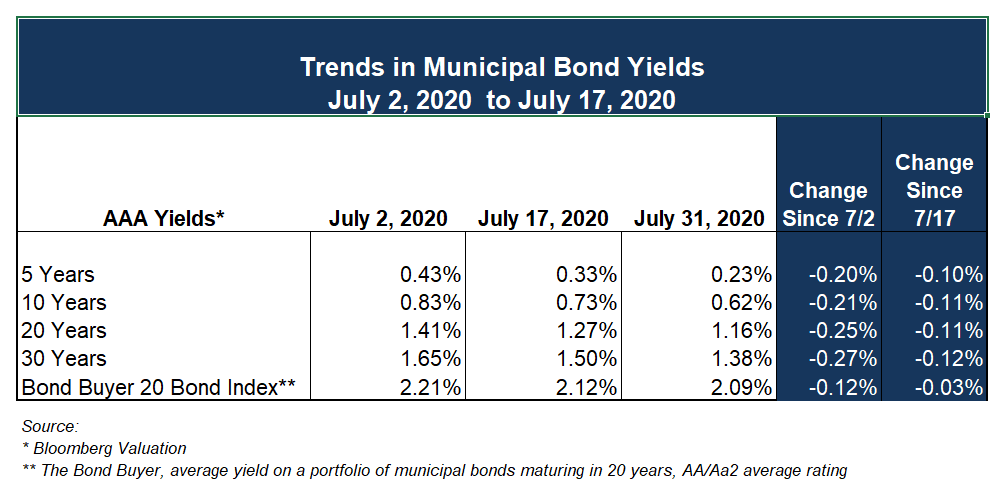

Municipal bond yields continued to decline across the curve the past two weeks. Investor demand remains strong for rated and non-rated debt, with credit spreads extremely tight in relation to historical norms. This is a big contrast to the period from March to June, when many market participants referred to a “bifurcated market,” with large spreads in yields between highly-rated and lower-rated issuers/issues. We expect refunding activity to remain strong for the rest of the calendar year at these yield levels. New issue volume will likely remain on this trend unless volatility reemerges in the coming months.

Bidding a Fond Farewell

It is with mixed emotions that we say a professional goodbye to our friend and colleague, Joel Sutter. Joel will officially retire at the end of August. We are both excited for this opportunity for Joel to spend more time with family and grandchildren and somber, knowing, at the same time, that we will be seeing less of him.

Joel’s career at Ehlers spanned nearly 24 years, most of which he spent as head of our K-12 Public Education Team, serving many different states. During his time at Ehlers he collaborated with clients and colleagues on tens of billions of dollars of school financing projects and literally hundreds of debt issues. Joel’s dedication to public education didn’t just start when he arrived at Ehlers. His tenure in the industry include serving as Business Services Manager at one of the largest school districts in Minnesota, a Legislative Analyst with the Minnesota Senate, and a Research Analyst with the Minnesota Department of Education.

Importantly to readers of our Market Commentary, Joel is one the original authors and editors. His last edition as author preceded this publication. We are forever grateful for his contributions to these pages and for what he’s done to build a lasting legacy and culture of client service at Ehlers.

In closing and as is customary at Ehlers, we wish Joel Bond Voyage!

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.